Nick Hodge,

Publisher

Nov. 16, 2022

See how beat the bear market.

Plus: get three new stock recommendations as we head into 2023.

I don't do this often, so I want you to pay attention.

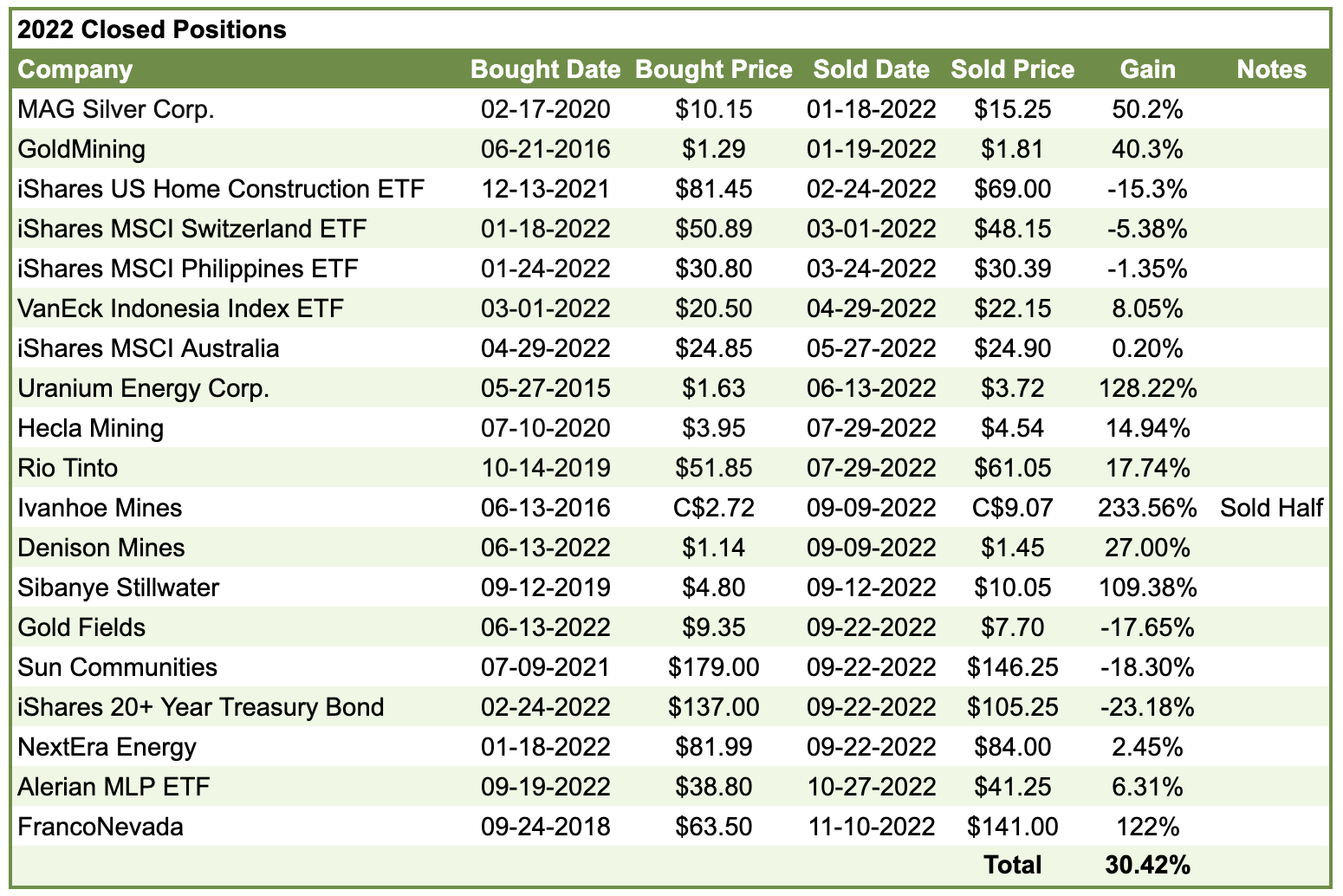

What you're looking at is the closed portfolio from Foundational Profits for 2022, a year where the S&P went down more than 20%, where the NASDAQ went down more than 30%, and where former darlings of the market like Facebook and Meta, Amazon, Apple, Microsoft, and Google lost trillions of dollars in market cap.

Many people lost one in $5 or more in their retirement and brokerage accounts.

And yet, look what we were able to do. We closed four triple-digit winners. Our portfolio is up more than 30% for the year.

We did it not by trading, not with risky companies, not with options, not with crypto. We did it with large- and mega-cap companies, sector ETFs, and industry ETFs.

And we're not done yet. There's a lot more to go despite us heading into the end of the year.

So what I wanted to tell you today is that the November issue is out for Foundational Profits. It's $99 a year for performance like you see above.

And that's not an oddity or a rarity. This is something we've been able to do for six out of the past seven years — beat the market no matter if the market's going up or down.

And we do it with a simple once-a-month newsletter that you can follow along with at home.

This month, there's a lot to go through in the issue.

I give an entire macro update on what's going on in the world of economics and in the market as it relates to the Fed and the interest hiking cycle, the dollar and its recent strength and weakness going back and forth — what that means for precious metals — and how I'm personally responding to it in my portfolio.

That's what this letter is all about. It mirrors what I'm doing with my retirement funds in my IRA — the money that I keep for my children's future.

This issue goes through exactly what my allocations are towards various sectors and individual stocks of the market.

And it also has a couple of new recommendations.

We have a recommendation in the healthcare sector. We have a recommendation in the uranium sector. And we have a recommendation in the cannabis sector.

I also go through a recent lithium recommendation that I think is going to be a big winner for us. This is a company that just got a permit to construct its mine and is courting several large automakers and industrial players to sign strategic partnerships and funding agreements with.

Because, as you should know, lithium is at all-time record highs and the world is scrambling to get enough of it.

All of that is in this issue, including an interview with the president of that lithium company who is a star in the industry that sold his last lithium company for over $6 billion. The company he's currently heading, which I think will be worth much more than it currently is, is only trading with a half-a-billion-dollar market cap.

So a lot of room to run, especially as it constructs a new lithium mine.

Plus, we have a letter to the editor asking about hydrogen and asking about gold and how inflation affects gold.

There is plenty to dig into in this issue, including, like I said, a peek over my shoulder at the allocations I have heading into the end of 2022 and into early 2023 as a recession develops and continues for the next couple of months. And as the markets continue to be choppy and volatile.

So if you're looking for guidance, if you're looking for individual recommendations, if you're looking to see which way markets are headed, then I encourage you to subscribe to Foundational Profits.

It’s only a $99 upfront investment to get started for the performance like you see in the portfolio above.

If you're not already a premium subscriber, it's well worth the small investment to get the monthly issues and the special reports that allow you to peek over my shoulder as I manage my personal retirement wealth for myself and my family, as you should be doing for yours.

Just click here to become a member today.

You’ll get access for a one-time investment of $99. That'll get you 12 monthly issues where I cover the market from soup to nuts every month, including what I'm doing with my personal capital to navigate these troubled times, to insulate myself and my family from them, to prosper in spite of them — as well as how to get into position for what I see coming after the turbulence we're seeing now.

If you'd like to see the strategies that we're using to do all that, which are beating the market this year despite the S&P continuing to be in negative territory, click here to become a member of Foundational Profits — and join the thousands of people who now see a better way.

Nick Hodge

Publisher, Daily Profit Cycle