Chris Curl,

Editor

March 15, 2023

Ordinals, in the context of Bitcoin, refer to a specific type of non-fungible token (NFT) that is used to represent unique digital assets on the blockchain.

Unlike fungible tokens such as Bitcoin or Ethereum, which are interchangeable and have equal value, NFTs like ordinals represent one-of-a-kind assets that cannot be replicated. This uniqueness makes them valuable to collectors and enthusiasts who are willing to pay high prices to own them.

In the case of ordinals, each token represents a specific integer or number in a sequence, such as 1st, 2nd, 3rd, and so on. This sequence can represent anything, from a series of artworks to a collection of trading cards, and each ordinal token is tied to a particular asset in that sequence.

Check out our latest free research reports for in depth analysis on specific market trends.

View ReportsThe creation of an ordinal NFT involves a process called minting, where the unique asset is assigned a digital identity on the blockchain. This digital identity is recorded in a smart contract, which is a self-executing code that runs on the blockchain and defines the rules and conditions of the NFT.

Once minted, the ordinal NFT can be bought and sold on various NFT marketplaces, with the price determined by supply and demand. As with any collectible, the value of an ordinal NFT can fluctuate based on factors such as rarity, popularity, and historical significance.

These ordinal inscriptions aren’t limited to JPEGs either. They can be just about anything that fits within a Bitcoin block such as PDFs, video and audio files, or even programs.

Each individual satoshi can be inscribed with an ordinal. Satoshis are units of measure with each Bitcoin containing 100,000,000 satoshis. As Bitcoin becomes more valuable it’s increasingly necessary to use these smaller units to transact.

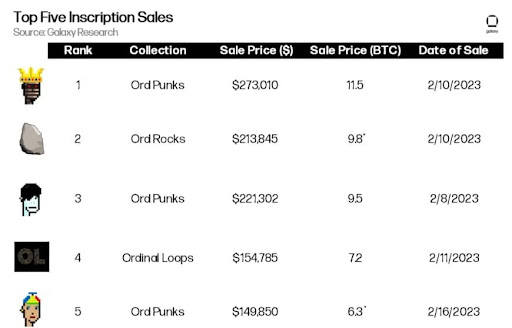

A recent report by Galaxy Digital suggests that the market for Bitcoin NFTs built on ordinals could reach a staggering $4.5 billion by 2025. This projection is based on the growing popularity of NFTs and the unique value proposition of ordinals in the digital art and collectibles market.

Remember EtherRocks? Well, they’re back as OrdRocks and trading for hundreds of thousands of dollars.

The report also predicts that the adoption of Bitcoin NFTs built on ordinals will grow significantly over the next few years, driven by the increasing interest in cryptocurrency and blockchain technology. This growth is expected to be fueled by the expanding market for digital art and collectibles, which is currently valued at over $2 billion.

Check out our premium publications for more trading recommendations and exclusive coverage on the markets.

View PublicationsA major criticism is that ordinals are clogging up the Bitcoin network making the blockchain bigger and more difficult to download. While this is true, I don’t think there’s any stopping new crypto trends especially when there’s money to be made.

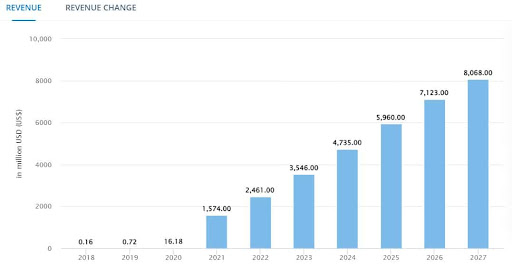

By 2027, almost 65 million users are anticipated to enter the NFT market. Here’s hoping the zoomers get some money to spend.

In addition to their unique value proposition, ordinals also offer several advantages over traditional NFTs. For example, they can be used to create dynamic sequences that evolve over time. This makes them more versatile and engaging for collectors and enthusiasts.

NFTs are always controversial, but it’s impossible to deny their profit potential.

In Crypto Cycle, I’m researching Bitcoin ordinals and looking out for ways to profit going into the next crypto bull market.

Chris Curl

Editor, Daily Profit Cycle