Hydrogen Stocks:

Hot Air or Must-Have Shares?

If you want to invest in hydrogen, an ETF is probably a good place to start poking around. If nothing else, looking at a few funds can give you a clear picture of how Wall Street is defining and investing in hydrogen.

We’ll set aside for now the fundamental investment thesis for investing in hydrogen, and return to it later.

The three main hydrogen ETFs are:

- Global X Hydrogen ETF (NASDAQ: HYDR)

- Defiance Next Gen H2 ETF (NYSE: HDRO)

- Direxion Hydrogen ETF (NYSE: HJEN)

A look at the top holdings of each will give you a good lay of the land as far as how Wall Street thinks about hydrogen investing. Here are those top three hydrogen ETFs along with the top five holdings of each as of spring 2024:

From this we quickly learn that there aren’t many “pure play” hydrogen companies. The Global X fund comes closest to being a true hydrogen ETF. The Defiance fund has a bit more industrial gas mixed in. And the Direxion fund is a bit of both with some oil and gas for good measure.

All three will give you some exposure to what the street considers the top three pure play hydrogen stocks:

- Bloom Energy (NYSE: BE)

- Ballard Power Systems (NASDAQ: BLDP)

- Plug Power (NASDAQ: PLUG)

But you’ll also get lots of exposure to large industrial companies and conglomerates that only generate a tiny fraction of their revenue from hydrogen. Companies like Cummins, Shell, Toyota, and BP all make an appearance in one or more of those supposed hydrogen ETFs.

How have they performed as investments? In a word, terrible. All are deeply negative over the past year and have significantly underperformed the S&P 500 (SPX).

The Case for Green Hydrogen

The world is racing to reduce its carbon emissions.

It is primarily attempting to do that by replacing fossil fuel sources of electricity generation with renewable sources while simultaneously electrifying internal combustion engines for transport.

Hydrogen proponents say we could instead use renewable energy to split water molecules, thereby generating “green hydrogen” via electrolysis that can be burned for steelmaking or transport. Currently, so-called “gray hydrogen” is produced from fossil fuels via a carbon-intensive process.

The problem with green hydrogen, at least so far, is that it is both expensive and inefficient. According to the Financial Times:

Hydrogen is abysmally inefficient. Consider EVs, for example. Even when factoring in the 5 per cent lost in transport and 10 per cent as batteries charge and discharge, EVs can be up to 80 per cent efficient. In hydrogen vehicles, between 30 and 40 per cent of the starting renewable electricity is lost in making the fuel and a further 40 per cent in the fuel cell.

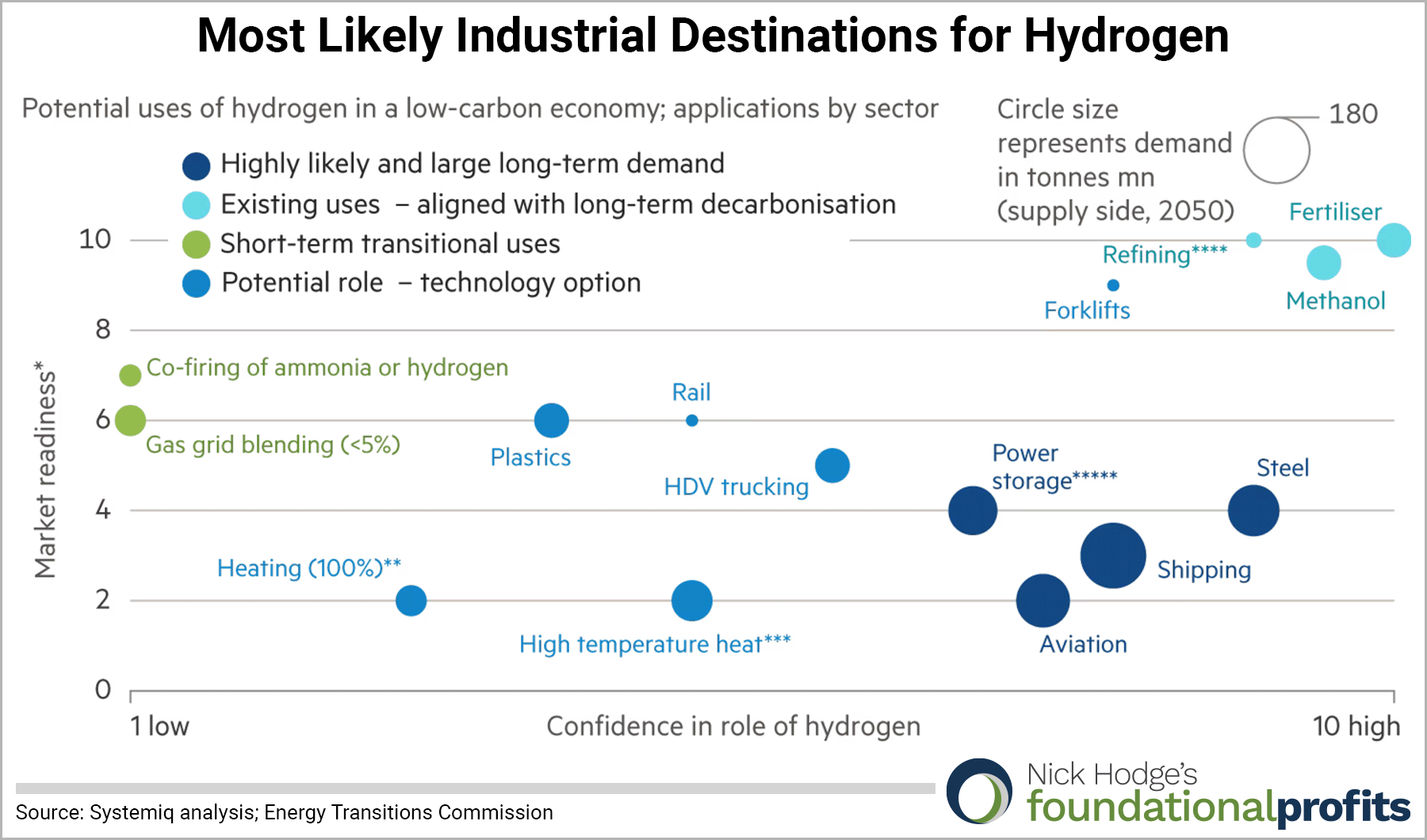

“Hydrogen’s poor efficiency means that it holds a compelling case as a decarbonisation solution only where direct electrification is not feasible — in industrial processes that require a chemical reaction, for instance,” says Mark Meldrum, of climate consultancy Systemiq.

That doesn’t mean hydrogen won’t find a place in the world’s new energy mix. It makes total sense to use green hydrogen in industries that already use gray hydrogen, like fertilizers. It makes sense for planes, ships, trucks and buses that need to carry large amounts of fuel on board. That is, applications for which the weight and storage limits of batteries make electrification unfeasible or economic. It also makes sense for some energy storage applications where excess renewable energy that would otherwise go unstored is used to make hydrogen to be burned later.

Lex, the investment column of the Financial Times, estimates these uses could require 500 million tonnes (MT) of hydrogen annually by 2050 in a net zero energy scenario and account for 10% of the global energy mix. That would require an investment of $20 trillion.

Currently, the world produces 75 million tonnes of pure hydrogen annually. Another 45 million tonnes is produced as a mix of gasses. Only 1% of it is green.

To date, only 0.15% of that $20 trillion has been invested. And projects that have been announced have been woefully underfunded. In 2021, for example, the Hydrogen Council said it expected at least $300 billion to be invested in hydrogen over the next decade yet so far only $80 billion has been committed. That means the bulk of hydrogen investment won’t be made until the 2030s or 2040s — if at all.

At present, hydrogen isn’t price competitive with natural gas, even when a price is applied to carbon. So that puts hydrogen where renewables were in the early 2000s: reliant on government policy and subsidies for adoption.

The US is throwing money at it, with a $3 per kilogram of green hydrogen subsidy included in the recent Inflation Reduction Act. Europe is seeking to mandate production into existence, with a target of 42% of the hydrogen used in industry coming from renewable energy by 2030.

And yes, there have been a significant amount of hydrogen headlines. But announcing projects does not mean they’ve been funded or greenlighted. Existing green hydrogen production projects represent less than 1% of the total hydrogen produced over the past three years globally.

Should You Invest in Hydrogen?

I’m not investing directly in hydrogen until there is further policy and subsidy clarity.

As you saw at the outset of this report, even the ETFs dedicated to the sector only contain a handful of pure plays. And, with the exception of a few brief spikes, those investments have been terrible for two decades. Here's a chart of Ballard Power Systems and Plug Power since 1999.

They’ve both found support at the volume bars. They both make hydrogen fuel cells. But have fallen victim to hydrogen’s scale issue. Namely, that it hasn’t really found a wide audience outside of forklifts and buses.

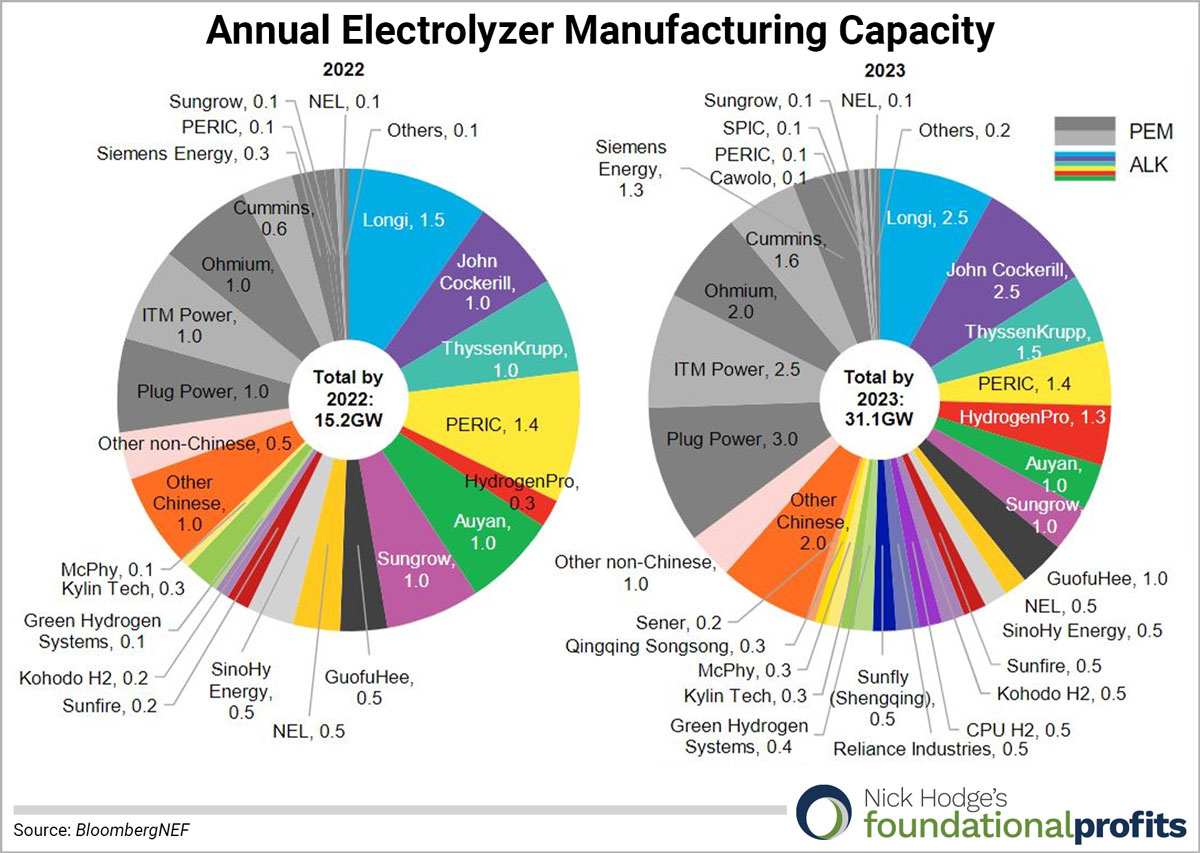

Other ways to invest in hydrogen include companies making the electrolyzers. Installations of electrolyzers are set to grow from two gigawatts currently to 242 gigawatts over the next eight years, with companies like Longi Green Technology, John Cockerill, Plug Power, ITM Power, and ThyssenKrupp leading the manufacturing, according to BloombergNEF.

German industrial company Thyssenkrupp spun off its electrolysis unit, called Nucera (XETRA: NCH2). It IPO’d with a US$3 billion market cap, making it the largest German IPO of 2023. Those shares have lost half their value since the IPO.

You could also invest in potential hydrogen storage companies. Given the quantities needed, traditional tanks aren’t going to cut it for hydrogen storage. The capacity needs to be vast. Traditionally, large gas reserves and even the US Strategic Petroleum Reserve are stored in giant underground salt domes or caverns. Companies like Atlas Salt (TSX-V: SALT) are exploring for and developing such salt domes in areas that also have strong renewable energy credentials. It has more than quadrupled in value in the three years since it began actively trading but is down sharply from its 2022 highs.

There is also the potential to invest in certain kinds of iron deposits that are more amenable to steel production via a green hydrogen process. Promoters have realized this and are starting to list and talk about “green iron” projects. Your editor is intrigued and will further educate himself.

For now, I’ve done one private placement in a hydrogen-tangential company but am not yet ready to make it a holding in my less speculative portfolio. I consider lithium a much safer way to invest in the ongoing energy transition. You can see my latest research on that here.

Call it like you see it,

Nick Hodge

Publisher, Daily Profit Cycle