Bizarro World Podcast,

with Nick and Gerardo

April 18, 2022

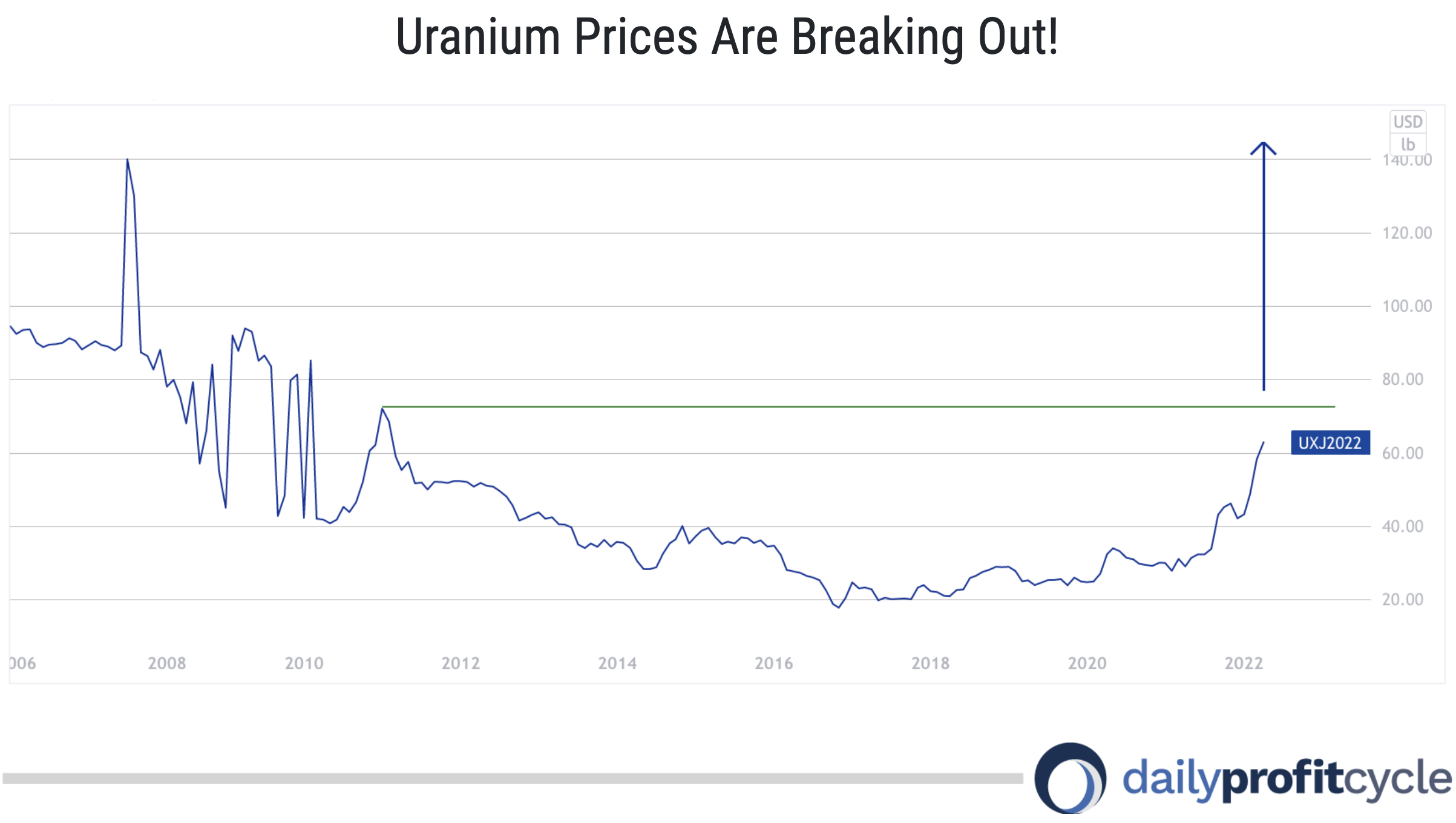

Uranium prices are the highest they've been in a decade. We discuss where there is still value.

Gold is back near $2,000 per ounce. We go over why, and why it could go much higher.

Elon is still the best billionaire troll.

Police still have a chip on their shoulder and aren't being held accountable.

This Bizarro World keeps turning in episode 165.

Table of Contents

1:04 Interest Rates, Falling Stocks, and Rising Gold

8:16 Uranium at Decade Highs

12:50 Talking Shop: Resource Speculations

19:53 Billionaire Chess: Musk Trolls Twitter & SEC

23:30 Buffalo Police Not Charged for Shoving 75-Year Old Man, Fracturing Skull

31:22 Positioning Inflation, War, Recession

Gerardo Del Real: Elon and Twitter sitting in a tree. Billionaire chess. That's what's going on out there, folks. We'll talk Elon's latest bid. We'll talk the bid to get gold above $2,000 again. That's looking more and more realistic by the day. Uranium hitting 11-year highs. Crypto is playing peekaboo. Buffalo police officers not charged for the beating of the 75 year old elderly man whose skull was fractured. A whole lot of the same everybody. I'm Gerardo Del Real along with Mr. Nick Hodge. This is episode 165 of Bizarro World, our weekly therapy session. Mr. Hodge, how are you sir?

Nick Hodge: Doing well Gerardo, trying to get to Easter. Watching the stock market continue to falter and generally just executing with what I'm given. How are you?

Interest Rates, Falling Stocks, and Rising Gold

Gerardo Del Real: I'm fighting the good fight. I'm fighting the good fight. We're hanging in there, up and at it. A lot as usual going on, right? I mean, I know that the broader indices continue to kind of pull back and rates continue to rise. And we have mortgage rates above five, and we have a ten-year that's flirting with the 3% level. And possibly a 50 basis point rate hike at the next Fed meeting. This within the backdrop of a slowing economy, volatility increasing, plus the war against the Ukrainian people. It's going to be an interesting summer this year. I don't know where to start. There's a lot going on. I'd love your take on the broader indices and rates because I know that you watch as I do, not just US rates, but international rates. And it's been pretty interesting the last couple of months.

Nick Hodge: Let's start with stock markets, I guess, because the last time we had this podcast, we were talking about how stocks were coming off their best week in two years, right? And I told you that that wasn't going to continue to be the case. And that turned around quite abruptly. You've got earnings slowing, a couple of banks reporting slowing growth, which is just really a kickoff to earning season. But expect more of that with negative comps that we mentioned in previous issues, right? This first quarter earnings are being compared against first quarter 2021, which was coming out of lockdown.

So gosh, what did I see already? Banks like Goldman Sachs and JP Morgan, year over year earnings down 40%. And so you have that headwind for stocks. You also have the headwind of slowing growth. And we'll learn later this month how GDP is going to fare for the same reason as earnings are slowing. And then you've got inflation really slowing down the consumer. So the print that came out this week was 1981 levels. I mean, that's before I was born, so I literally haven't lived through the market that we're experiencing right now.

Gerardo Del Real: Neither have most traders by the way.

Nick Hodge: I was just going to say, neither have most traders and most investors. And so it's very interesting from that, it's going to be one hot summer like you said. Interest rates continue to get away from us, certainly from me who felt they were going to back off by now. So what do I want to say there? One, let me cover my ass first. It's been better than the stock market, right? I mean, losing a couple percentage points in bonds is better than losing eight to 10 percentage points in the S&P, but it's still not good investing because the first rule is don't lose money.

Gerardo Del Real: The longer you lose money, the poorer you get. Is that how that works?

Nick Hodge: Absolutely. So it's time to reevaluate that rate trade. Except every time I look at it, it wants to sort of pull back to resistance, right? It doesn't want to go all the way higher to 3% like you just mentioned, though certainly it's popped above 2.7 a couple of times.

Gerardo Del Real: Yeah.

Nick Hodge: And that leads me to the Fed, which you sort of ended with as well. How dumb/aggressive are they going to be, right? And you have former Fed people saying that they're going to be really dumb. They're going to raise the rates and they're going to break something. So interested to see what it is that's going to break. Perhaps it's the record gold price.

Gerardo Del Real: I think several things will break, and I think they'll happen alongside each other, right? I was listening to an interview, a Hedgeye interview with Danielle DiMartino Booth, who's a former Fed insider and someone whose opinion I value when I listen to her speak, especially about the Fed. And she was saying it won't be corporate credit, and it won't be the stock market, no Fed wants to let that fail on its watch. But she could see potentially the junk bond market being allowed to kind of wither away. And that would provide the Fed cover to kind of do that about face. And I think both you and I, me certainly, the about face that I expect the Fed to do after the next hike, I do believe it hikes other 50 basis points during the next meeting.

But I think after that, that sounds like the most educated and plausible way forward. If I'm doing the math and I know there's $31 trillion in US debt, and I know what global debt looks like, and I know that there's already riots and chaos in the street that's inflation related, exported directly by the Fed. If I'm looking at that entire picture and connecting those dots, I could see the Fed saying something has to be sacrificed for me to have... You mentioned covering your ass. For me to be able to cover my ass when I do the about face and start easing again, not increasing rates. And I could absolutely see the junk bond market being allowed to break as you mentioned it. And if that happens, forget gold to $2,000, you're going to see new all time highs in gold quickly. And the gold equities that still present some of the most compelling value in the entire space are going to go absolutely bonkers. The way that uranium stocks have for the past 12 to 18 months. That's my Ted talk.

Nick Hodge: Gold wants to break out now. It's knocking on the door, and it's a perfect actually training opportunity, right? Take some off on the 5% up days, and then pick some back up on the 5% down days. And what do I want to say? Getting to be almost a stock picker's market, and getting tougher to get your spots, right? Christ, I had a little bit order in for a Revival Gold (TSX-V: RVG)(OTC: RVLGF) for a week. I moved it up a penny, and then another penny. And it's like, no, fuck you... we're not selling any shares at this price. Whereas two weeks ago, you could have got not all you wanted, but you could have got at least a little bit.

So I guess the takeaway there is buying gold pullbacks is the takeaway. And I've told you about GDX at $46. I've certainly told our paying subscribers about GDX... Excuse me GDXJ at 46. And that's even gotten away from see, it's over $50 in the past two days. It was $47 a week ago. And so that's what I mean, that GDXj comes back significantly below $50, GDXJ you want to be picking that up. And I can't tell you, I don't think you can either, when gold is going to break new time highs, but I can tell you that gold is definitely in bullish trend while many other things are not. And a lot of investors still need a haven or are going to want that haven as all the market dynamics that we just talked about continue to play out.

Uranium at Decade Highs

Gerardo Del Real: You mentioned Revival Gold, let's switch sectors a little bit. Let's talk the uranium space. Let's switch commodities, I should say. What opportunities are you seeing out there? There were a lot of companies this week. I'm looking at my little app here and green, green, green, Uranium Energy Corp (NYSE: UEC) at $6.40. That touched the brand new high this week. UEC trolls, how's that feeling right now? Don't care if you troll, it's just math, right? It is what it is. You either made money or you didn't. But what do you see as far as the uranium space? Where is their value right now?

You mentioned Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF) last week. I've mentioned Labrador Uranium (CSE: LUR)(OTC: LURAF). And if I'm going to answer my own question, which I am now, I think that right now for me is one of the most compelling values for an exploration uranium play with topnotch management and a really clean share structure. They announced a C$7 million financing, an hour later it was upsized to C$8 million, at C$1.40 flow through. And I think for Labrador, look, summer's coming. And that's where we're really going to see the exploration upside kind of tapped into by the company when the drill start turning. So I like Labrador, I like some of the names in the uranium space. But we talked about it before, it's two steps forward, one step back. Hell of a week for a lot of those uranium equities.

Nick Hodge: I saw Fission Uranium (TSX-V: FCU)(OTC: FCUUF) up near a C$1.10, and it hasn't been there in a bit. The one that we watch here in the United States had a good run, reported some new mineralization. And then I go back to Skyharbour. So I was writing about it today actually. And I'm starting to get the questions like, "should I sell a little bit?" And I tried to address that question and that's the opposite of where do you see value, right?

Gerardo Del Real: I thought you did that beautifully by the way. I read that. It was very well written. You should post that up and post the link because I thought it was a great explanation on when and how it's really your choice at the end of the day. But let me allow you to provide the context.

Nick Hodge: That's what I was going to do, is I was going to recite it, and I was going to recite it in the context of Skyharbour, which I mentioned a couple of times on this podcast. We bought first below C$0.40 cents, and then again at C$0.45 cents, and I've just watched it run to sitting in the C$0.70 cent range right now. And my context was this, look, if I own 100% of Skyharbour, I bought 98% of that via private placements, and then 2% of that trading around my position in another account. Well, both those positions are significantly up. And not that I'm itching or looking to sell uranium stocks, but the way I presented it was your car breaks down, you got to buy a new car, the tuition bill comes due for your kids, your house needs painted or you need new outdoor furniture, whatever it is, right?

If you got a bill that you got to pay, today's tax pay for example. Not that you should be selling stocks to pay your taxes because you're just got to pay taxes on that again next year. But anyway, the point was if I need that little 2% jingle to take my family on a trip or whatever, I can sell that, hold my 98% position at Skyharbor, and still be a lot of things, right? Still be bullish on uranium, and still have a significant holding and not have to worry about watching two accounts. I don't know how many accounts you have, I have a lot. I mean, I look all around, right?

Gerardo Del Real: There's a lot. Yeah. Yeah.

Nick Hodge: And so if I can eliminate a little bit of a headache, make enough coins to take my wife on a nice trip for a weekend and still have a very significant position relative to my speculative portfolio in Skyharbour, then that's a win, win, win. But how I followed that up was I don't know what your situation is, right? I don't know how many shares you have and what price you bought them, or what you need money for. So typically, the selling decision is yours. And then where I really ended it was by saying that I don't see a catalyst to call sell on uranium industry-wide, right? And likely won't for a while. So I'm not going to be making sell calls. So to answer your original question, where you see value, it's in pullbacks. But my horses are in the race. I'm not out there looking for a lot of new horses, especially in uranium.

Gerardo Del Real: We have some pretty horses.

Nick Hodge: Right. And I know when they're coming in for a pitstop. Or when they're slowing down a little bit, and they're ready to be ridden hard again to beat the analogy a little bit more. So I see value in pullbacks is the answer to the question.

Talking Shop: Resource Speculations

Gerardo Del Real: Great answer. Have to mention that the Dollar Index broke 100 while gold is flirting with $2,000, right?

Nick Hodge: And rates are up as well.

Gerardo Del Real: And rates are up as well. That's very, very bullish gold price action. Again, this on the back of a record quarterly high in the price of gold. So now it's going to get interesting here. I think the summer's going to be fun. I think the rest of 2022 is going to be fun. If you're looking for value in the gold space, you mentioned Revival Gold. I said Labrador in the uranium space. Everybody knows how I feel about Patriot Battery Metals (CSE: PMET)(OTC: PMETF) in the lithium space. Ethos Gold, now Prospector Metals (TSX-V: PPP)(OTC: ETHOD). There was a six to nine month period for Prospector Metals where the company seemingly every other month, and I could be off by a month, in either direction it was doing a financing. And they were allowing very strategic investors, long term strong hand investors to come in and write checks. And what ended up happening is frankly, they blew the share structure out for an exploration company, right? Too many shares.

They just did the right thing, which is consolidate on a three to one basis. But I interviewed the CEO, Alex Heath earlier today, and I believe 2022 for Ethos is going to be an absolute barn burner. I think they have two potentially company making projects, the Toogood project in Newfoundland.

Nick Hodge: Great name.

Gerardo Del Real: Yeah. And then they have a second project that's a nickel-copper-palladium-platinum-gold project that Rob Carpenter is absolutely in love with from what Alex shared with me. And so geologists excite easy, but Rob Carpenter isn't one to lend his name to just any project. And the way it was described to me during that interview, which we'll publish next week was that this is Rob Carpenter's baby. And so when I start hearing someone as accomplished as Rob Carpenter describe a project in that kind of light, I get excited because as you know, I am very attracted to exploration stories. There's nothing like a new discovery for me, right? I love buying a thing at 10 cents, 20 cents, 50 cents and seeing it go to $1.50... $2.00... $5.00 on the back of a drill bit. So I think Ethos is going to have itself a hell of a year. Free podcast, free advice, get your money's worth. Let's see how it plays out.

Nick Hodge: I got thoughts on Ethos.

Gerardo Del Real: Prospector.

Nick Hodge: Yeah. I got thoughts. PPP is a good ticker too. But I have thoughts, and they're not all flattering because of the financings. So I covered it in the letter for a while, sold because of the financing. So it's in certain ways, it embodies everything that's wrong and everything that's right with the junior running sector. Multiple financings to let in the people, diluting the share structure, diluting the people who came in ahead of those strategic financings, rampant delays, misses on the first early drill campaign, shedding of projects. Which isn't necessarily a negative to spend a little of money, drill a hole, right? Drill to kill, right? And that, I guess, was sort of the strategy.

But to say that this was a company that you were putting together to honor Gary, and then to do that for a couple of years, it left a bad taste in my mouth. And then here we are, posst-rollack starting to do things better. We always knew the potential of the rocks and the people that were involved, and now looking like a good exploration story once again. We didn't mention that one of those assets is in Newfoundland. And I think that's important. Newfoundland has come on strong in the past couple of years. And there's been a lot of me too stories.

Gerardo Del Real: The good me too, everybody. As if you made a discovery, and we're also drilling there. Not me too as in the other me too, although not so good.

Nick Hodge: Not that one. No. So I agree. When I was writing about it to people who financed it privately with me, I was saying sort of what I just said now. It's been frustrating, it's been dilutive, and now rolled back. But it's worth holding onto for the upside potential of these drill campaigns that hopefully we finally see here in 2022. And one more, since this is therapy session, I feel that Ethos kind of got cast aside in the Discovery Group a little bit as well over the past year or so as they focused on other projects and companies within the group. So it's good to see Prospector come back into focus again.

Gerardo Del Real: Whitton Lake is the name of that second project. Whitton Lake. There's also a third that they're drilling, which is called the Savant Lake, a property, which also looks very prospective. But that one to me is less of a potential company maker than the other two. I mean, if they hit on one, it's off to the races. If they hit on both, then it's going to get real fun. And I think we're already set up really well for an exciting second half. I've shared my enthusiasm around Hannan Metals (TSX-V: HAN)(OTC: HANNF), I've shared it around Patriot Battery Metals. Both companies that will have drills turning here the remainder of the year handing in the third quarter. Prospector here starting in May, looks like they'll be drilling throughout the year. A lot to like.

Nick Hodge: Before we pivot, next week I'll be financing a company that's drilling in Newfoundland. They actually made a discovery last year, silver, gold, copper, lead, zinc discovery. And I don't think the market understood. It's got some good people involved, including people involved in some of the uranium companies you just discussed. If you haven't seen it, I'll show it to you after we're done recording.

Gerardo Del Real: C'mon, Nick. Quit holding out on me, man.

Nick Hodge: This very tight share structure, and also has money in the bank that they have to spend because it was flow through funds. So they'll be going back into the system that they know is mineralized and drilling this summer. And it's got a $9 million valuation and $3 million in cash in a tight share structure. Good people involved, so I'm going to write a check and give it a shot.

Gerardo Del Real: I like that. Got to mention Kutcho Copper (TSX-V: KC)(OTC KCCFF) hit a 52 week high of C$1.10 a few months ago. You had a Wheaton Preciouse (NYSE: WPM) come in and exercise shares at C$0.90, and they were happy to do so. And it's trading at C$0.59, was as low as C$0.53 earlier this week. There's a lot of value in Kutcho Copper. So a lot of names for you all to pick from.

Billionaire Chess: Musk Trolls Twitter & SEC

Have to pivot and talk billionaire chess. Is there anybody that trolls better than Elon Musk? I've said this over and over on this podcast, top level trolling.

Nick Hodge: And dumping.

Gerardo Del Real: And dumping. I don't know. I mean, if everything is to believed, Elon Musk bought quietly a 9.9% stake in Twitter (NYSE: TWTR) while trolling it on Twitter. Which again, that's something billionaires can do, right? He then comes out this week and says that he wants to make an offer for Twitter. He wants to buy the entire company. That sends Twitter people in a panic, right? Because Elon, you either love the guy or you hate the guy. For some reason, there can be no middle ground. He can't be a genius and an asshole at the same time. Or he can't be an angel and a dumbass at the same time. Apparently in this universe here, those two things with Elon Musk can't happen. You either feel one way, he's the dumbest scum of the earth idiot that never did anything, never invented a thing. Or he's just like the second coming of DaVinci, right? There's no middle ground for some reason.

So he then says he's going to buy Twitter. And then today he was giving a Ted talk, I believe in Vancouver if I'm not mistaken. And he says, "well, I don't know if I actually have enough right now liquidity to buy Twitter, but if my offer is rejected, I have a plan B." And so again, it's fun to watch. It's above my salary to speculate what the end game is, but just judging from Elon's history, and in his business dealings, you can say a lot of things about that guy. He hasn't lost a lot of people money, and there's always a vision, and there's always a plan. And if this is just to troll Twitter, just to say, look, I can. I think it's hilarious. I think there may be more to it. And we'll see.

Nick Hodge: I think he's truly keen on protecting free speech. I think this is part of a broader Fourth Turning. Part of the changing of institutions that we often talk about. And I mentioned this last week, but you brought it up. I mean, obviously there's a capitalistic tick to it. He's a billionaire capitalist, and he likes making money. But I do think that he didn't like the shadow banning and the censorship and wants to change that, given that Twitter is the world's public space or public town hall. And I would say that I'm one of those people who are sort of nuanced about Musk. Maybe I'm the only one because I do see him as a sort of a pumper as well. You remember?

Gerardo Del Real: Sure.

Nick Hodge: $420 funding secured, and the Dogecoin, or maybe it was Shiba. But anyway-

Gerardo Del Real: Probably both.

Nick Hodge: Probably. And he knows how to do it. He understands, obviously, his power on social media and his following. So I'm interested to see if the SEC has anything to say about the way he's approached Twitter over the pat couple of weeks. I know they certainly have questions about his tweets about taking Tesla private and things like that. And then I guess the last thing I'd say is maybe I'd become Elon Musk convert if I can get my Starlink because I'm still struggling with home internet. But it's supposed to be late 2022.

Gerardo Del Real: Come on, Nick. They got internet in the Ukraine, in the war zone right now, Elon made that happen.

Nick Hodge: Not in Eastern Washington. Maybe that's why mine is delayed.

Buffalo Police Not Charged for Shoving 75-Year Old Man, Fracturing Skull

Gerardo Del Real: Oh man, that's tough. I tell you what else is tough. It's tough to live in a country where we've been so blessed with opportunities. I come from immigrant parents, you come from immigrant grandparents, I believe.

Nick Hodge: And my mother.

Gerardo Del Real: There you go. And there's few places on the planet where a story like Nick's or a story like mine could be realistic, right? Where we have family that comes from another part of the world, and then slowly but surely we are able to launch and build companies, and hopefully do some good in the world. But it's tough to know that that is true, while simultaneously knowing that two Buffalo police officers can throw a 75 year old elderly man to a sidewalk, push him straight back, have him bleeding out on the pavement with a fractured skull. And while they were suspended by the department while there was an investigation, they are now going to be allowed to start working again after an arbitrator found that "the two used absolutely legitimate force" is how the arbitrator worded it, and did not violate department policies.

Let me read to you the crooked shit that the arbitrator wrote. They said, "Well, Mr. Gugino might well have believed that he was engaged in some type of civil disobedience or perhaps acting out a role in some type of political theater, he was definitely not an innocent bystander. He was in the square past 8:00 PM, and did not comply with the officer's order to move back." Now, let me give this dumbass arbitrator the benefit of the doubt and say well, legally, nothing was wrong. Legally, he was out past curfew, and legally he was out protesting, albeit peacefully.

So maybe legally the force was justified. I think it's bullshit, but let me give the arbitrator the benefit of the doubt. Maybe it was legal. But if there is a 75 year old man or woman peacefully protesting, who gets shoved on his back, has his skull cracked open, is laying out bleeding... to see the line of officers that walked by that old elderly man and didn't pick him up, that may be legal. But fuck it's sad. And is sure in the hell isn't right. Not the way that I was brought up. And I'll commend, I believe it was a gentleman that was there. I believe there was a National Guard group that was there. And it was the national guard that actually walked over and picked the gentleman up as he lay there motionless, bleeding out while a line of police officers just walked right past this guy.

And so as amazing as America is, as great as this country can be, again, there's a lot of systems and structures and institutions that need some revamping because if this is legal, if this is within the policy, I don't want to give Buffalo, New York a dollar. I won't travel there. Who cares? They probably don't want me, but I have a hard time reading that, and reading that those officers did nothing wrong. And then listening or watching as the arbitrator scolds a peaceful protestor, adds insult to literal injury by saying maybe he felt like he was acting out a role in some type of political theater. Out there peacefully protesting in America.

Nick Hodge: But we saw the video, we talked about it when it happened. It was callous, and it was uncalled for. And I'd debate that with anyone outside of the legality like you said. Not a lawyer, obviously. But I would also assume that police are mandated or required to provide care. Even if you shoot somebody, you got to try to resuscitate them or try to provide care. We saw them push him down and not provide any care at all. And so this is one of our pillar topics, let's say, the accountability of police and the militarization of police and how they're trained and recruited and do their jobs. And it continues to be a very tough issue. There was another shooting this week, or maybe it was last week in Grand Rapids, Michigan when the body cam footage just came out.

Gerardo Del Real: That was next. Yeah.

Nick Hodge: It's tough. The white cop ends up shooting the black guy in the back of the head. But after what? After what I would classify as a struggle where the guy was, I mean, fighting the police officer.

Gerardo Del Real: Sure

Nick Hodge: The last frames were far away and hard to see exactly what happened. But in much of that video, you can see him trying to fight the officer, to grab the taser, et cetera. And so all of these continue to be case by case, and continue to be parsed out in the most granular detail. And that's fine, I guess. That's part of the American judiciary/justice system. But on the grander whole, outside of the granular detail of all these individual cases, I think we can all, and if we can't, certainly I can admit that there's a larger problem here outside of that granular detail of 'was it legal or inside the parameters'. To watch that video of the police force who's paid to serve and protect the citizenry, push that gentleman down when he's guaranteed by the constitution. I don't want to hear about curfews and I don't want to hear about stuff like that.

Gerardo Del Real: Get the fuck out of here with that.

Nick Hodge: It's freedom of speech. Don't tell me it's 8:01, I can't be out of here exercising my constitutional rights. That's you as a government institution trying to squash my constitutional rights to validate your actions against me. And so anyway, what I was saying was anybody who watches that video can see that the cops were in the wrong and didn't need to use the force that they used with that individual. And that to me is the bigger problem. Obviously it's a problem that they're not going to be held accountable, but it's a larger problem that they are willing to act that way. And second, they know that they have the protection of whatever, thin blue line, thin blue shield, all the prosecutors and all the arbitrators, right?

Gerardo Del Real: Whatever happened to just respect for your elders? Just bringing it back to... Forget legal, forget just force, forget curfew, just fucking human being. He's a 75 year old elderly man. I mean, I could understand if he is a 300 pound jacked up guy, and you feel like, okay this guy's being a little threatening... let me push him back and make sure that he doesn't rush me. It's a 75 year old elderly man, have some respect.

Nick Hodge: He was showing no aggressiveness. I mean, he was-

Positioning for Inflation, War, Recession

Gerardo Del Real: Literally had his hands up, but just wanted to be out there and exercise his constitutional right to protest. We're sending another $800 million in weapons to the Ukraine, that tells me this war ain't slowing down anytime soon.

Nick Hodge: I wrote that last week, the market says that the war's not slowing down. What's the new cute thing we do? Now we send diplomats over for a photo op, that's what we do now to show our support. Meanwhile, citizens are perishing by the tens of thousands. But the counts getting high. And gosh, I don't really have anything great to say about that. I'm sort of a non-interventionist kind of person, but I'm also not a half measure kind of person either. And it seems like we're doing half measures, right? Good service and not real support. And that to me is almost worse than doing nothing.

Gerardo Del Real: I wish they would track how many dollars in weapons they're sending to Mexico. Nobody talks about that.

It's a bizarre world, Nick. There's a lot. There's a lot. Here in Austin, there's a rail package project, and it was packaged as project connect, right? And it's meant to ease and alleviate the struggles that come and the traffic that comes with a booming economy and a boom town here in Austin and all of central Texas, and it's meant to alleviate traffic. And so we find out today, here a year after the proposition passes for $2.5 billion that now the two light rail lines and the underground tunnel are going to double in cost from $5.8 billion to $10.3 billion.

Nick Hodge: Is that inflation?

Gerardo Del Real: That's a little bit. That's a little bit. And so the mayor explained that the rise is due to "real estate in Austin, inflation, and supply chain issues." This will not be a one off you all. I know used car prices dipped back down for a month, I know inflation has likely peaked in a lot of sectors. A lot of it isn't transitory, a lot of it's never making the u-turn. And I think this is a perfect example of very real consequences to, again, Fed enabled policy that has made it to where even when there's a fear of recession, let's be honest Nick. I'll sound like an asshole for a little bit. Are you really worried about a recession? You individually, you personally, with the investments that you've made and the way you've allocated and positioned yourself through your real estate holdings and your stock holdings and the two companies that we co-own together. Are you really worried and cowering about this coming recession?

Nick Hodge: Let me parse it out. No, I'm not worried about the coming recession or slowing growth or a 20 or 40% haircut in the stock market. I get concerned about a black swan event that I can't predict or some new monetary system that I can't forecast or understand or get ahead of, but I don't worry about slowing growth for two quarters. I don't worry about that. But when you read about how inflation is going to affect you, at least in this fiscal year, a five to 10% increase in cost is bearable for me.

Gerardo Del Real: Again, there is two types of recessions. There's sessions where I hope the price of that Austin condo downtown goes down, right? I hope I can buy stock cheaper. I hope I can position for the Fed pivot when it happens because it's going to happen. And then there's a type of recession where if my rent doubles, and this is most of America, right? Where something like 50 or 60% of America doesn't have $1,000 in savings, that's the part that pisses me off. Because for that America, for that side of it, and I've been there, I was there for a long time. It's not going to be easy to come back from.

And we need again, I hate to keep beating a dead horse, right? But this Fourth Turning, we need to revamp everything. The way we teach our students, what we teach them, the way we pay our teachers, the way we hire in this country, the benefits that we provide, both public entities and private entities. I like to think with Digest Publishing that we consider ourselves as responsible stewards of the lives of our employees. And the way that we do that is by compensating well and making sure that we provide top-notch medical packages for our employees. That has to be the new model for everybody because it's getting tough out there for a lot of people. And again, we have $800 million in weapons that we can send to the Ukraine, we can't come up with a comprehensive mental health package to address the way that this country deals with mental health. I'm not blaming this on mental health, but some asshole in Brooklyn just injured 32 people and shot something like 16 of them.

All of these things are connected in one way or the other. And so if we're not going to fundamentally address the things in this country that needs to be addressed, then why are we sending $800 million in weapons abroad? And again, my heart goes out to the Ukrainian people. I'm actually all for arming the Ukrainian people and allowing them, giving them the opportunity to defend themselves. But man, I'm also all for taking care of us here in this country and providing better resources, both as private entities and the public entities. I'm not putting this all on government, but it's a tricky time. It's a tricky time.

Nick Hodge: Well, you're seeing corporations starting to step up and lead. And that's part of the transition is institutions take responsibility when others won't or are failing. And you mentioned us. I mean, that's part of that. That's part of the corporation stepping up to provide what the government can't or won't. And I think it migrates in that direction until critical mass is hit, and the government says, "Hey, this is the new rule. Or we're going to do it this way." But clearly a lot has to change. And we were all the way to the poles on political beliefs and wealth inequality, right? I mean, it's pushed all the way to the edges. And the erasure of the middle class has been a theme for a long time, but it's very pointed now that the stimulus money has dried up and that costs are rising and that wages aren't rising as fast.

And now those rising costs are hitting not just rents, which is obviously important for people to afford, but also mortgages, which is important for people to get out of that rent cycle to the ownership cycle is increasingly out of reach. If you were looking for a quarter million dollar home a month ago at 3%, now you're looking at a $200,000 home at 5%. And so there's not a lot of $200,000 homes worth living in in Spokane, and certainly that you wouldn't have to pour money into to make adequate to live in. So that's going to obviously be a big issue, and part of the thing that needs to be corrected as this turning goes on. And for now, the service that we do is preaching what it means for people and hoping that they act. When the stimulus checks were being cut a year and a half ago, I was saying, you got to trade those for some assets that are going to inflate, or those dollars are going be worth less.

And maybe I wasn't 100% correct with the dollar index of 100, but you certainly could have parlayed that and more money than the stimulus check gave you. I'll tell you a funny, not funny story about where we are, and then how that could happen. My wife had a tiny little 401k in the job she worked, but before we had kids and then she stopped working. And I remember having asked her to convert it, and then seemingly forgotten about it, never did it or forgot to do it or something. Well, you know I'm in the process of consolidating funds and taking money away from the manager. And so I was going through everything the other day, and she had a separate log in to one of our banks because it was for her name, and I had my login for my name. And so I logged in with hers, and there's this IRA sitting there with $9,000 in it that I did convert in 2018. And I put 50% in Teck (NYSE: TECK) and 50% in Union Pacific Railroad (NYSE: UNP) and it doubled in a few years.

Gerardo Del Real: That's hilarious. That's hilarious. And again, our little quarter of the world, we try to provide research, we try to provide ideas on how you can protect and hopefully grow whatever that nest egg and that basket is for you. Whether it's $1,000, $5,000, $50,000, $5 million, right? Hopefully people find value in that. Hopefully people realize that you're going to have to be way more vigilant and active about the way money is managed, about the way it's allocated. This is not the 70s or the 80s or the 90s even, where you can just hand it to someone and expect them to know what the hell they're doing. These are different markets, these are different times.

And we're at an inflection point with a lot of things, with commodities, with inflation, with Fed policy, with debt, with so many things, but that does provide opportunities everyone. That does provide the chance to actually use some of that volatility and those changes to your advantage. And so hopefully we can provide more of that in the days and weeks and months and years to come. And I want to do it till I go stir crazy and I'm roaming around my country house forgetting what my name is, right? So that's the plan

Nick Hodge: And it's very difficult to do. You mentioned how it's new markets and it's changing. And that's a good place, I guess, to wrap it up. I was reading Greg McCoach this week, who I read from time to time when his stuff comes through. And he would say he's never felt more exhausted covering the markets. I mean typically you would cover our markets and our stocks and our networks, but now you got to cover everything, right? What's policy doing? What are interest rates doing? What's small caps doing? What are SPACs doing? We've got to cover everything now too because it's all... Not that it wasn't before, but it seems like now it's ever more interconnected, and there's different correlations going on, and you have new asset classes. I didn't even mention cryptos in that list of things, right?

There's just a lot to keep track of, and a lot to do frankly with the volatility that we've seen in the market. So no. I think that was a good way to wrap it up. And I think we continued to do that here as broader markets continue to "melt down." I mean, I feel pretty good about the performance so far in 2022 relative to what broader indexes are doing.

Gerardo Del Real: My Patriot Battery Metals IRA is looking good, Nick!

Nick Hodge: Absolutely. You told me that [inaudible 00:43:31].

Gerardo Del Real: That's all I got everybody. I'm Gerardo Del Real along with my cohost, Mr. Nick Hodge. This was episode 165 of Bizarro World. Tell your people you love them, everybody.

Nick Hodge: Enjoy the spring holiday everyone.

This transcript is unedited. Please excuse grammatical errors and run-on sentences.