Chris Curl,

Editor

March 29, 2023

With recent bank failures making headlines, Bitcoin and other blockchain projects are receiving renewed interest.

While decentralization is one of the key features of crypto, blockchain technology can be utilized in a centralized manner as well.

This is where central bank digital currencies (CBDCs) come into play.

CBDCs

Check out our latest free research reports for in depth analysis on specific market trends.

View ReportsCBDCs refer to central bank digital currencies, which are digital versions of a country's fiat currency that are issued and controlled by the country's central bank. CBDCs can be used similarly to physical cash and can be exchanged between individuals and businesses.

Unlike cryptocurrencies, CBDCs are not decentralized and are issued and controlled by a central authority (like the Federal Reserve Bank).

The purported goal of CBDCs is to enhance the efficiency and stability of the monetary system, increase convenience and security of retail payments, and provide a new means for implementing monetary policy.

CBDCs can be issued in two forms: account-based or value-based. Account-based CBDCs involve digital tokens created by a central bank that are recorded on an account held by a financial institution, while value-based CBDCs involve digital tokens that can be exchanged peer-to-peer.

Federal Reserve Chair Jerome Powell has previously discussed the potential for a U.S. central bank digital currency, also known as a digital dollar, amidst the rapidly changing global monetary system. Powell is on the record stating that a U.S CBDC could help maintain the dollar's international standing, especially as many major economies are already implementing instant, 24/7 payment systems.

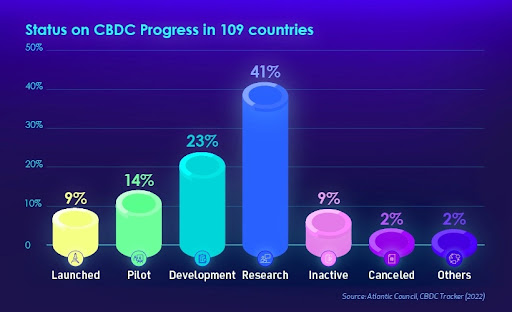

Currently, 105 countries representing 95% of global GDP are exploring CBDCs, with 10 countries having already launched them and 15 in pilot stages.

According to the Atlantic Council CBDC tracker, in 2023, over 20 countries will take significant steps towards piloting a CBDC. These countries include Australia, Thailand, Brazil, India, South Korea and Russia.

It’s important to note that there are potential risks associated with CBDCs. Firstly, CBDCs could lead to a loss of privacy for individuals as central banks can track and monitor all transactions made with CBDCs.

Secondly, CBDCs are theoretically programmable, which could lead to centralized control of currency usage and a lack of financial freedom for individuals.

Thirdly, CBDCs may lead to increased financial instability and negative effects on the economy if central banks use their power to manipulate the economy.

Additionally, CBDCs could pose a threat to the stability of the banking system and may have negative effects on traditional monetary policy tools. (It’s not as if the Fed is doing a good job managing all of this as it stands.)

I believe it's important to ensure that individuals have the freedom to choose between various means of exchange, such as stablecoins, cash, crypto, gold, and silver. People should never be forced to use only one means of exchange.

Before implementing CBDCs, central banks and governments must carefully consider these potential risks and take measures to mitigate them.

FedNow

Check out our premium publications for more trading recommendations and exclusive coverage on the markets.

View PublicationsThe Federal Reserve Bank of the United States has recently announced the launch of an instant payment transfer service called "FedNow Service." This move is believed to be the first significant step towards a digital dollar.

The FedNow Service will launch in July and will be available to all participating financial institutions, regardless of size or location, enabling them to offer a modern instant payment solution. The Fed states that it is committed to creating a leading-edge payment system that is resilient, adaptive and accessible, with further enhancements expected in the coming years.

FedNow will allow real-time payments, providing a faster and more efficient system for consumers and businesses to transfer funds. The system will be available to all banks and credit unions in the United States, providing widespread access to the service.

The system will facilitate nationwide reach of instant payment services around the clock, every day of the year. Despite this development, there is no imminent plan for the Fed to implement a "digital dollar." But I believe it’s only a matter of time now.

In 2022, a House bill was filed to authorize the Treasury to create one, and there has been opposition from critics who suggest that the private sector should be allowed to innovate and compete instead.

One advantage of FedNow is that it will not require the use of blockchain technology, which some experts argue can be inefficient and costly. Instead, FedNow will use a traditional centralized payment system, providing a more reliable and predictable system.

FedNow is expected to have a positive impact on the economy, providing faster payment processing times and reducing the need for physical checks. The system will also be more accessible to small businesses, providing them with the ability to receive funds more quickly and efficiently.

The launch of FedNow comes as several countries are exploring the development of CBDCs, with China leading the way with its Digital Yuan. However, the Federal Reserve has stated that it is not currently considering the development of a CBDC, instead focusing on improving the existing payment system.

Overall, the launch of FedNow is an exciting development for the payment industry, providing a faster and more efficient payment system for consumers and businesses. It will be interesting to see how FedNow compares to blockchain technology and CBDCs in terms of speed and cost-effectiveness.

ISO 20022

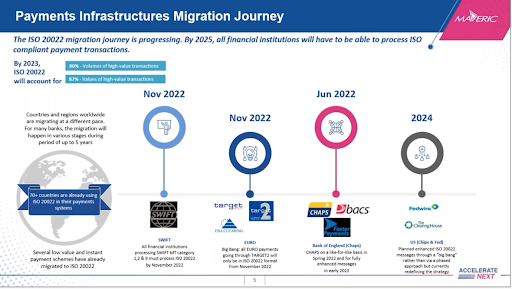

The financial industry has implemented ISO 20022 as the new standard for electronic data interchange (EDI) messages used in financial messaging, enabling consistent data exchange of payment instructions and account information between systems and networks.

It is designed to be adaptable and flexible, accommodating new technologies and business processes and supporting multiple languages and character sets. The European Central Bank (ECB) plans to implement ISO 20022 in 2023, with other countries such as Thailand, Malaysia, Singapore, Australia, and New Zealand having already migrated.

SWIFT plans to introduce a centralized transaction management platform as part of the migration to improve end-to-end transaction integration.

The U.S. Fed had initially planned to implement ISO 20022 in November 2023, but has since delayed to complete further testing. It is now scheduled to fully launch on March 10, 2025.

I believe that the transition to ISO 20022 is in preparation for the widespread rollout of central bank digital currencies (CBDCs) as well as the tokenization of assets. Blockchain (distributed ledger) technology is going to be a key component of the new financial system moving forward.

I highlight which cryptocurrencies are currently compliant with this new standard and how you can invest in them in my Crypto Cycle publication.

Chris Curl

Editor, Daily Profit Cycle