Nick Hodge,

Publisher

Nov. 17, 2022

Publisher’s Note: What follows is the introduction to the November issue of Foundational Profits. It was mailed to premium subscribers on November 11. Those readers have profited significantly this year as the rest of the market has melted down. To see the full issue, including all the stocks we’ve used this year to beat the market, click here.

—Nick

“Ignore the bird. Follow the river.” —High Aldwin, Willow

In the 1988 film Willow, the High Aldwin, a sorcerer, comes to a small village to select an apprentice.

A few eager young lads line up to be considered, and the sorcerer tells them:

“Forget all you know, or think you know. All that you require is your intuition. Now, the power to control the world is in which finger?”

He then holds up his hand and wiggles his fingers.

To be selected, the applicants must choose the correct finger. None of them do.

The sorcerer disappointedly slams his staff into the ground and shouts, “No apprentice this year.”

None of the young men chose their own finger, which is of course where power comes from.

They all thought the sorcerer had all the power.

Jerome is our modern-day financial sorcerer.

There will be no pivot this year.

The power to profit is yours. It doesn’t come from Jerome or any other fedhead. They are not in control of your financial destiny. You are.

Macro Update

“There are some things one can only achieve by a deliberate leap in the opposite direction.” —Franz Kafka

The S&P is down 20% for the year as we head to the Thanksgiving table. One single sector of the market’s eleven is up for the year — energy. The rest are down. Even the traditionally defensive consumer staples and utilities are down around 6% for the year. The worst of the bunch has been communication services, which has lost 42% of its value year-to-date as my fingers tap. Headlining that sector are three of the once-sharp FAANGS: Meta Platforms (formerly Facebook, the F), Alphabet (formerly Google, the G), and Netflix (the N). Let’s check in on them, shall we:

Forget FAANGS. You’d need dentures after getting your teeth kicked in being long those stocks this year. Those three alone have lost over $1.5 trillion — with a T — in market cap the past year.

Throw in the other canines — Apple (A) and Amazon (A) — and the losses jump to $2.1 trillion in the past year. Dogs, indeed.

Add in the less toothy Microsoft and Tesla, and the losses surpass $3 trillion.

That’s like flushing the equivalent of the entire United Kingdom economy down the toilet. And the irony is that almost happened this year as well!

Future economic historians will be talking about this the way we currently talk about tulips.

We happily aren’t chewing on any of those kinds of losses this year, having sold technology stocks for a profit just before reindeer hit the rooftops last year. In a December 23, 2021 alert I told you to:

Sell the SPDR Technology ETF (NYSE: XLK) above $173.00 for 12% gains since entering it in August. That is annual-type sector gains in four months, amid a Black Friday panic and choppy December. I want to be holding cash heading into the new year. Selling tech is another part of that.

That cash, which now makes up ~40% of my portfolio, has been the — pronounced in Ohio State fashion — place to be this year. The dollar index (DXY) has marched some 20% higher in the past year and is now dancing with the very interesting level of 115.

Interesting firstly because if it breaks through that level it is almost certainly going higher. Interesting secondly because the first time it broke through that level to all-time highs was the early 1980s, which is the last time we saw inflation and rate hikes comparable to what we’re seeing now.

Compared to the previous two dollar bull cycles, this one still has further to go.

A further breakout in the dollar would lead to more downside in stocks, which is what I’m expecting for another quarter or two.

The Fed will continue hiking in December and January. Whether it’s 75 or 50 basis points is largely irrelevant. While the media would try to position a 50 point raise as “dovish” or a “pivot,” it’s really just a continuation of the rate-hiking cycle.

There will be no pivot this year.

As of this week, the market is pricing in the Fed’s secured overnight financing rate (SOFR) peaking at just above 5% in May 2023.

And the Fed has the cover to do this because inflation remains sticky high while employment remains relatively strong.

“Relatively” is important because it will take a weakening of the job market for this current economic contraction cycle to complete. And we’re starting to see signs of it. Nonfarm payrolls increased by 261,000 in October. While that was good enough to beat expectations, it was the lowest monthly job growth in over a year. The unemployment rate also ticked ever so slightly higher, from 3.5% to 3.7%, which is still historically low.

But a defanging of the labor market is underway. Meta, after soiling its earnings bed last month, is conducting “large-scale” layoffs. The “itchy firing finger” I wrote to you about in the September issue is now squeezing the trigger, with the Wall Street Journal reporting on November 3rd that:

The outlook for tech industry jobs worsened on Thursday, with ride-hailing company Lyft Inc. and payments company Stripe Inc. both announcing major layoffs and Amazon.com Inc. saying it will freeze corporate hiring for months.

The stream of grim news for the industry came as the Federal Reserve has moved again to raise interest rates to combat inflation, signaling greater risk that the U.S. economy is sliding into a recession. Faced with that possibility, tech company executives are warning of tougher times ahead.

I would reiterate to you that there is no “risk” of recession. There will be one if we aren’t in it already.

The 10-year/2-year yield curve remains at 35-year lows, now nearly a full percent in the red as the short-end of the curve screams higher (because there is no pivot). The 2-year yield recently jumped to over 5%.

If that weren’t a sure enough sign of recession, the 10-year/3-month curve is now inverted as well. As Hedgeye’s Neil Howe pointed out this month:

How reliable is the 10Y-3M inversion as a recession indicator? Quite simply, it is the most reliable medium- and long-long indicator in our possession. Over the last 66 years (since 1956; earlier spread data are not comparable), it has never had a false negative--meaning that no recession has occurred without a prior inversion. And it has only had one false positive (in 1967), when an inversion was not followed by a recession... though it was followed by a near-recession.

Higher rates are crushing the consumer, especially on the housing front. New mortgage applications are down nearly 30% from a year ago and the United States Mortgage Refinance Index is down 86% in a year.

Tapping home equity is one of the primary ways Americans get cash to spend. Their current inability will further exacerbate the decline in corporate earnings we’re already seeing.

And speaking of earnings, I’ve been telling you they were contracting and would continue to contract, spending a good portion of last month’s issue on the topic. I mused:

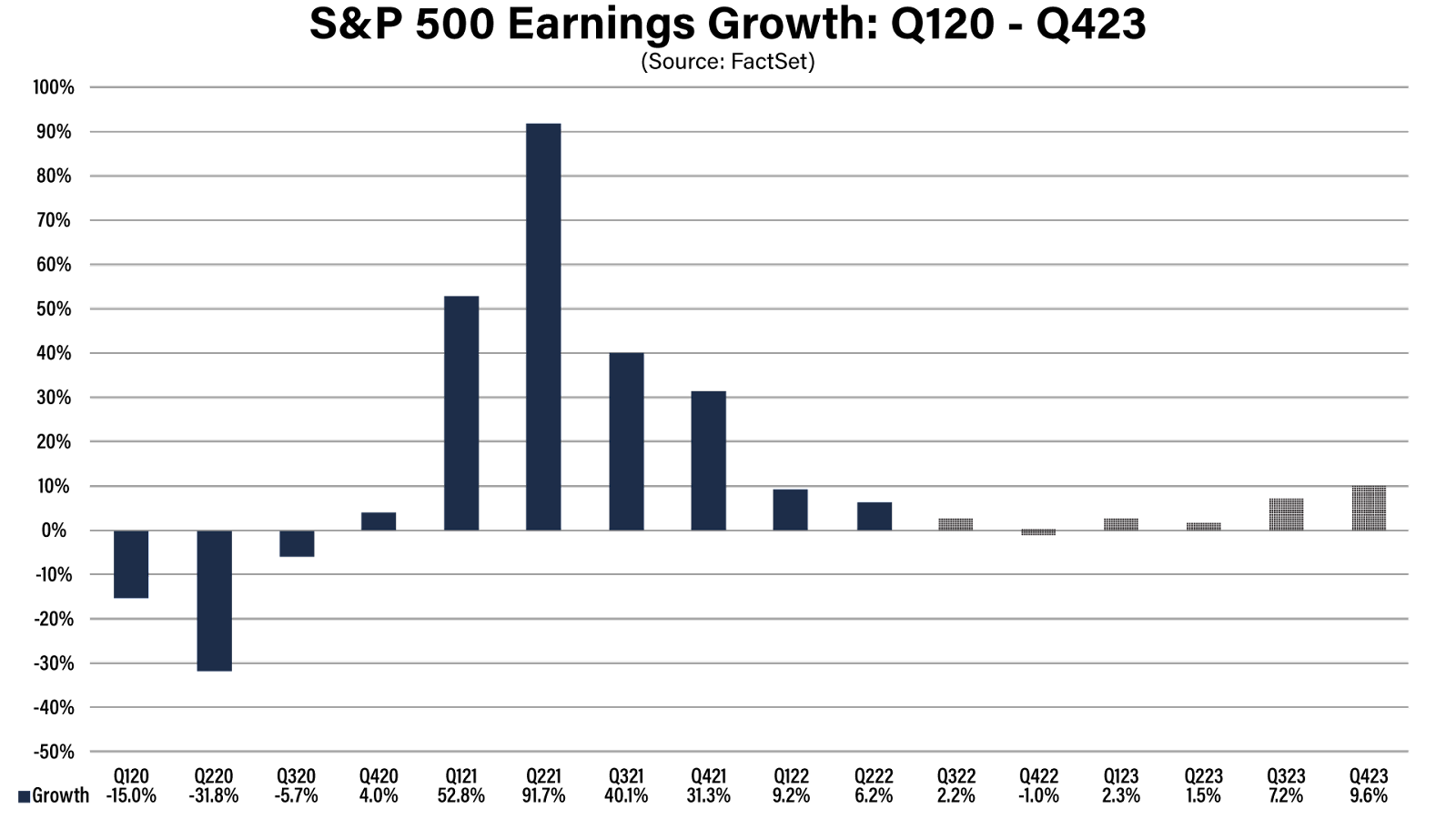

According to Factset, S&P earnings growth for Q3 will likely come in at 6% to 7%. Compared to the 40.1% earnings growth from Q3 2021, and it’s easy to see the wind is disappearing from the “sales.” If this dose of reality weren’t bitter enough, here’s some more medicine: We’ve seen a 24% decline in the S&P year-to-date with positive earnings growth. What happens when the growth disappears entirely in the coming two quarters?

We’re about to find out. With 440 of the S&P’s 500 companies now reporting Q3 earnings, the growth rate was a scant 3.23%. Expectations are now for negative earnings growth in Q4.

There will be no pivot — in earnings growth, in interest rates, or in dollar bullishness — this year.

Better find some strength in your own finger.

Nick Hodge

Publisher, Daily Profit Cycle