Ryan Stancil,

Editor

July 19, 2022

Has relief finally come?

That seems to be the story as headlines champion the decline of gas prices from their recent all-time highs.

Gas prices, which served as the ugly face of recent trends of inflation, have been reversing over the past month. Anecdotally, the gas station closest to my house here in the Baltimore suburbs was at a high of $4.99, but as of last Friday had come down to $4.45. Nationwide, the average price is around $4.60 as of July 14 as opposed to $5.00 a month ago.

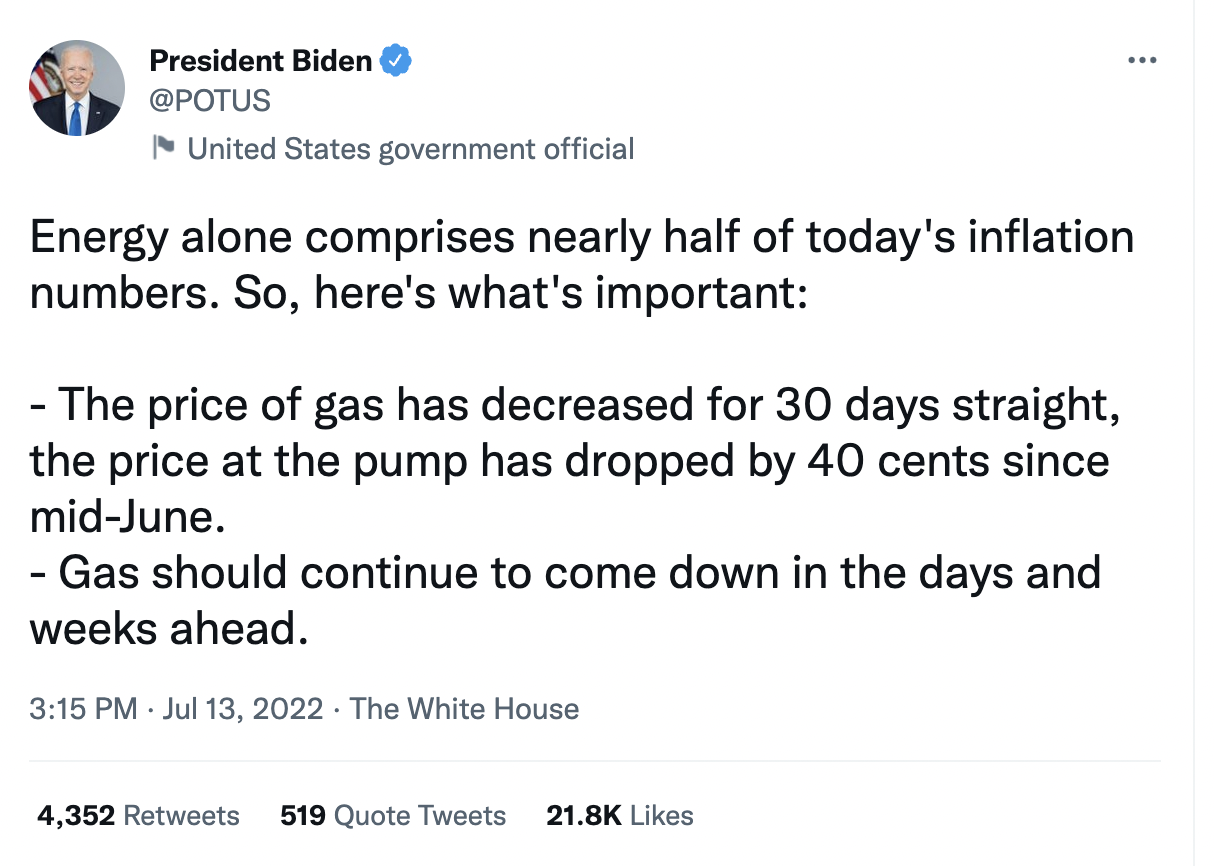

And while that’s sure to bring some relief for the people who need it most, it’s not even close to the economic cure-all many Americans need to not feel the pressure they’ve been feeling for months. Last Wednesday, the president tweeted:

And,

It would make sense for the administration to shout these things from the rooftops. The democrats face grim prospects in the coming midterms and the president’s approval ratings continue to look terrible. But this all feels like a big distraction from the reality of it all.

Pay no attention to the 9.1% increase in the Consumer Price Index that was reported last week.

Pay no attention to the fact that, while more supply and less demand have driven down gas prices, we’re still in the early days of hurricane season, and those have the potential to take refineries offline and limit supply.

And pay no attention to the fact that, while gas prices are lower than they were a month ago, they’re still about $1.50 higher than they were this time last year. That means, all things considered, more of your paycheck is still going into your tank.

And even if you don’t drive, you’re paying in other ways. Companies still need to transport goods, and that isn’t savings that many of them can afford to absorb.

The point is that these falling gas prices are just one part of the entire story. This whole inflationary trend has lasted longer than anyone thought it would. Leaders in the government are saying that they think we’re peaking and things will go down, but they said the same thing back in December. Reports in January showed that CPI rose 7% in December.

And then Russia invaded Ukraine in February, and you know the rest.

This whole ongoing saga, if nothing else, shows the disconnect between elected officials and just about everyone else.

It shows that hope, specifically placing hope in entities like the Fed, isn’t a winning strategy. In order to weather markets like this, investors are better served by proactively protecting their own assets.

That means watching trends, knowing when to buy, when to sell, and when to hold.

It means tuning out the noise of leaders who insist there’s no recession yet. Just like they insisted that this inflation we’re seeing now was supposed to be transitory.

It means knowing just when and in what to invest to take advantage of this market.

Ryan Stancil

Editor, Daily Profit Cycle