Hard Asset Digest March 2021

March 2021

This month, I’m sitting down with Mr. Adrian Day — founder of Adrian Day Asset Management and portfolio manager of the EuroPac Gold Fund.

Click here to jump straight to the interview.

A native of London, Adrian Day is considered a pioneer in promoting the benefits of global investing. After graduating with honors from the London School of Economics, Mr. Day spent many years as a financial investment writer where he gained a large following for his expertise in searching out unique investment opportunities around the globe.

He has also authored three highly-acclaimed books on the subject of global investing:

International Investment Opportunities: How and Where to Invest Overseas Successfully

Investing Without Borders

And his latest work,

Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.

Adrian is a recognized authority in both global and resource investing. He is president of his own money management firm,

Adrian Day Asset Management — where he specializes in global diversification and resource equities — and portfolio manager of the EuroPac Gold Fund.

Adrian is a frequent speaker at investment seminars around the world and has been featured in major publications such as

The Financial Times and

Barron’s and has made countless appearances on CNN, NBC, CNBC, FNN, BBC, and Good Morning America.

His firm takes a long-term, value-oriented approach to investments and offers individualized managed accounts for individual investors and small institutions.

His pleasures include fine dining, history, and the opera. I’ve been lucky enough to have gotten to know Adrian over the years as he’s been a longtime family friend, and I’m excited to bring this exclusive interview to you.

And I think the timing could not be better with gold and silver poised to move higher and with other metals already heating up!

Yet, before we get to that, I have a Special Report to share with you called

Exploration Opportunities.

Inside, we’ll be delving into the

Royalty and

Prospect Generator models, both of which offer speculators exposure to commodities and exploration upside at somewhat of a reduced risk factor compared to the pure explorers, developers, and producers.

Exploration Opportunities

Understanding the Royalty and Prospect Generator Models

The investment risks inherent in the junior resource sector are both well-known and well-documented. As a general rule of thumb, never speculate with more money than you can easily afford to lose… and don’t fall in love with your holdings.

In other words… Don’t bet the mortgage money… and be in the habit of taking gains off-the-table on the way up!

Successful speculation in the juniors takes time and dedication. I recommend subscribing to at least a few of the top resource newsletters out there to not only arm yourself with insights on the best investment ideas in the space but also as an ongoing educational tool for sharpening your speculative skills.

It’s all about making money while mitigating risk. And one way to do that is by speculating in two distinct types of juniors: Royalty Companies and Prospect Generators.

Both of these models allocate risk over numerous projects and/or investments. Let’s explore both with VOX Royalty Corp. and Skyharbour Resources Ltd.

VOX Royalty Corporation: A Well-Positioned Royalty Company

VOX Royalty Corp. (OTC: VOXCF)(TSX-V: VOX) is a precious and base metals royalty company wherein shareholders are provided with discovery, development, and commodity price optionality while limiting exposure to risks inherent to operating companies.

Many resource stock speculators have asked the question, “How does a royalty company operate?”

For simplicity, let’s explore this question from strictly a “gold royalty” perspective.

A gold royalty is a contract that gives the owner (a royalty company such as Vox) the right to a percentage of gold production revenues from a mineral producer in exchange for an upfront payment.

Gold royalty companies use these contracts as a way to finance mining companies in need of capital. This alternative form of mine financing is often more attractive to the developer/producer than traditional debt or equity financings.

Royalty companies such as Vox will also purchase pre-existing royalties as a way to build a diversified portfolio of royalty assets. Since royalties typically cover the life of a mine, gold royalty companies benefit from the exploration upside that may extend the life of the mine and thus increase the amount of gold (or revenue) they receive from the mining company at no additional cost.

There are several types of royalties. The two most common are NSR and NPI royalties:

A Net Smelter Return (NSR) royalty is an agreement whereby the mining company agrees to pay the royalty owner a percentage of the production revenue, less refining costs.

A Net Profits Interest (NPI) royalty offers the royalty owner a percentage of the profit from the mine.

Investors also ask, “What’s the difference between a royalty and a stream?”

As described above, a royalty is when a mining company agrees to pay a certain part of its production revenue to the royalty’s owner.

A stream is when the mining company actually sells physical metal to the holder of the streaming agreement. The price per ounce is either a set price (at a much lower rate than spot) or a percentage of the spot price.

The royalty company makes money by selling the physical metal for a profit at the current market value.

VOX Royalty Corporation: A Closer Look

Vox Royalty Corporation (OTC: VOXCF)(TSX-V: VOX) — which is one of the small-cap stocks currently in our Precious Portfolio — is a newly-listed precious and base metals royalty and streaming company with a portfolio of over 40 royalties and streams spanning 9 jurisdictions.

The royalty and streaming model offers a number of key advantages including:

- Leverage to commodity prices

-

Fixed operating & cash costs and strong margins

-

Exploration & mine expansion upside

-

No capex or cost overrun exposure

-

No limit to growth as execution of risk does not rise with each acquisition

Founded in 2014, Vox Royalty Corporation represents an early-stage opportunity to participate in the fastest growing royalty company in the world. Since 2019, Vox has conducted 15 transactions to acquire more than 40 royalties.

And, just since July 2020, Vox has acquired 10 royalties representing over 10 million gold equivalent resource ounces.

The company currently has 4 production-stage royalties and expects to have a minimum of 8 production-stage royalties by the end of 2021.

In addition to precious metals [~70% of the company’s current royalties], Vox has exposure to a diverse set of underlying assets including base metals and diamond royalties.

At present, there are over 120,000 meters being drilled annually across the company’s royalty portfolio [for which the company incurs zero costs], and approximately 75% of the company’s royalty assets are located in mining-friendly and geopolitically-safe Australia.

Representative of the type of royalty transaction typically sought by Vox — on 22 February 2021, Vox entered into a binding agreement with Gibb River Diamonds Ltd. pursuant to which Vox will acquire a Western Australian gold royalty portfolio for a total cash consideration of AUS$325,000.

The royalty portfolio comprises a 1% Net Smelter Return (NSR) royalty over the Bulgera Gold project operated by Norwest Mineral Ltd. (ASX: NWM); a 1% NSR over the Comet Gold Project operated by Accelerate Resources Ltd. (ASX: AX8); and a 1% NSR over the Mount Monger Gold Project operated by Accelerate and subject to a binding option agreement with Mt Monger Minerals Pty Ltd.

The Gibb River transaction alone:

- Strengthens Vox’s first-mover position as the second-largest publicly traded holder of royalty interests in Australia by royalty count behind Franco Nevada Corporation (NYSE: FNV) with an expanded total of 31 Australian royalties.

-

Provides Vox with exposure to 3 advanced exploration gold royalties in Western Australia, each located within trucking distance of third-party mills.

-

Offers Vox uncapped exposure to the Bulgera Gold deposit which hosts a JORC-compliant resource estimate of 2.92 million tonnes @ 1.0 grams per tonne gold for 93,880 gold ounces.

-

Generates significant organic news flow from the 5,000-meter reverse circulation drilling program at Bulgera.

Vox is deploying an intelligent growth strategy of establishing an overweighted presence in mining-friendly Australia while also pursuing royalty opportunities in other parts of the world, some of which carry a higher risk factor.

Already with 40+ royalties in its impressive portfolio, Vox expects to continue to close highly accretive royalty transactions in 2021 and beyond; Vox currently has access to over 7,000 existing royalties via its proprietary database.

The company expects to also benefit from organic newsflow from its 40-plus operating partners, which account for a combined ~30,000 meters of drilling each quarter.

Independent analyst firm Red Cloud Financial Services recently initiated coverage on Vox Royalty with a “Buy” rating and C$5.40 price target.

Cantor Fitzgerald and Paradigm Capital have followed suit with Buy ratings and price targets of C$4.00 and C$3.75 per Vox share, respectively.

And while Vox has yet to announce formal guidance, analyst estimates are presently coming in right around C$2 million in revenues for 2021, C$6 million for 2022, and C$8 million for 2023.

Vox Royalty CEO, Kyle Floyd, believes the company will be able to exceed those projections both from an organic standpoint and by way of acquisitions currently under evaluation in the pipeline.

Based on operator guidance, Vox expects to increase its producing royalty asset count within its existing portfolio from 4 to 6, including:

- Segilola – 1.5% net smelter royalty in Nigeria, capped at US$3.5M, with Thor targeting first gold pour in Q2 2021

-

Bulong – 1% net smelter royalty in Western Australia, with Black Cat targeting commencement of production in Q4 2021

-

Koolyanobbing (Deception Pit) – producing 2% Free On Board (“FOB”) revenue iron ore royalty over part of the Deception Pit in Western Australia

-

Higginsville (Dry Creek) – producing grade-linked tonnage royalty in Western Australia, covering part of the Hidden Secret, Mousehollow, and Paleochannels deposits

-

Brauna – producing 0.5% gross sales royalty interest in Brazil, South America’s largest operating diamond mine, currently mining 1 of 21 kimberlite occurrences on the property

-

Graphmada – 2.5% Gross Concentrate Sales care & maintenance stage graphite royalty in Madagascar with the operator targeting updates to its Mineral Resource estimate to support plans for a Stage 2 expansion of production

Vox also boasts a number of key catalysts for its exploration and development stage royalties in 2021, including: Bowdens (0.85% gross revenue royalty); Sulfur Springs (AUS$2/t ore production royalty capped at AUS$3.7M); Lynn Lake (2% Gross Proceeds post initial capital); Pitombeiras (1% NSR royalty); Montanore (US$0.20/t production payments); and Kookynie (tonnage royalty).

Vox has announced the following Growth Targets for 2021:

- To continue to be one of the fastest growing royalty companies in the industry; closing out calendar 2020 with the completion of 13 transactions to acquire 30 royalties including the acquisition of its Brits vanadium royalty and the Breakwater Resources Limited royalty portfolio in Q4 2020 and Q1 2021, respectively.

-

To continue to grow and acquire additional NAV-accretive royalties leveraging Vox’s proprietary royalty database and continuing discussions already underway with potential royalty vendors.

-

To increase analyst coverage of Vox beyond the current 3 independent firms providing coverage — Red Cloud Securities, Cantor Fitzgerald, and Paradigm Capital Inc.

-

To conduct a review of secondary exchange listing options.

Vox CEO, Kyle Floyd, commented via press release:

“The Company’s Q4 achievements rounded out a transformational 2020 year for Vox and promises a catalyst-rich 2021 year. We started 2020 with one producing royalty, being Graphmada, and added Koolyanobbing in Q2, Brauna in Q3 and Higginsville in Q4 to our growing list of producing royalties. We look forward to the organic news flow from our existing operators in 2021 as we see the number of producing royalties within our existing portfolio continue to grow.”

Vox Royalty Corp. (OTC: VOXCF)(TSX-V: VOX) has approximately 38.2 million shares outstanding for a current market cap of less than C$100 million, and the company is well-funded with approximately C$6 million in cash and no outstanding debt.

For more information, please visit www.VoxRoyalty.com.

Skyharbour Resources: A Well-Positioned Prospect Generator

Skyharbour Resources (OTC: SYHBF)(TSX-V: SYH) is a uranium exploration company that’s primarily following the Prospect Generator model while also advancing some of its own properties via its own dime.

Many resource speculators ask, “What is the Prospect Generator model?”

First, let’s take a quick look at how the vast majority of junior exploration companies operate: A typical junior exploration company will stake a single “promising” mineral property and then drill exploratory holes until one of two things happens: (1) they get lucky and hit a discovery hole, or (2) the company runs out of cash.

Of course, that can be great news for those select few juniors that do get lucky. Yet, it has been well documented that less than 1% of true grassroots explorers ever come across an economic mineral deposit.

Those are long odds to say the least!

In the Prospect Generator model, risk is spread across multiple projects through joint venture farm-in agreements with third-party firms with the aim of getting those firms to spend capital on advancing the Prospect Generator’s properties in return for an ownership stake.

Here’s how it works:

- The Prospect Generator company will stake prospective mineral licenses or acquire early-stage projects, oftentimes for pennies on the dollar.

-

The Prospect Generator company will partake in early-stage exploration work oftentimes without drilling a single hole.

-

The Prospect Generator company will package and market its early-stage projects to larger players that may be interested in the jurisdiction, the target commodity, or the geological story.

-

The joint venture partners (who are usually larger and more established than the Prospect Generator company) will spend their own money and time advancing the project in exchange for a majority ownership position.

-

The Prospect Generator company can then sit back and watch things unfold for each project on someone else’s dime.

In a best-case scenario, a project will reach production over a period of 5 to 10 years with the Prospect Generator company receiving a decent percentage of profits from production via their remaining ownership stake.

In a worst-case scenario, the JV partner ends up spending millions of dollars on a project only to decide that they are no longer interested in the project or partnership. In that scenario, the project is returned in full to the Prospect Generator company.

As noted, a key benefit of this model is that the risks are spread across multiple projects. Plus, a lower burn rate can mean less dilution to shareholders. More specifically, the company’s G&A expenses are spread over many projects versus only one or two.

The Prospect Generator model relies on intellectual capital which gains value with time. In essence, prospect generation is all about leveraging intellectual capital with other people’s money.

In general, Prospect Generators will see less upside in the euphoric stage of a bull market but will have much more staying power when the going gets rough.

The only real downside to the Prospect Generator model is that the company does not get to keep the entire project for itself. For instance, if a JV partner finds something that ends up turning into a mine, the Prospect Generator company will only get to keep around 10%-30% of a project that it previously owned outright.

That said, mineral deposits are oftentimes worth hundreds of millions, if not billions of dollars. Even a minority ownership in a sizable deposit can result in a 10-fold return for early shareholders.

Skyharbour Resources: A Closer Look

Skyharbour Resources (OTC: SYHBF)(TSX-V: SYH) is a hybrid prospect generator with the dual focus of partnering on multiple projects as well as advancing its flagship Moore Uranium Project on its own.

The company’s primary properties are located in the prolific Athabasca Basin of Saskatchewan, Canada — the #1 highest-grade depository of uranium on the planet.

The Athabasca hosts numerous world-class U3O8 deposits including:

-

Cameco’s McArthur River and Cigar Lake Mines

-

NexGen Energy’s Arrow Project

-

Fission Uranium’s PLS Project

-

Denison’s Wheeler River Project

Let’s start by taking a look at the prospect generator component of the company’s strategy.

Skyharbour brought in strategic partner, France’s state-run Orano (previously known as AREVA), via an earn-in option on its Preston Uranium Project located on the west side of the Athabasca Basin near NexGen’s high-grade Arrow deposit and Fission’s Triple R deposit.

The Preston project represents the largest and longest contiguous property portfolio adjacent to NexGen’s Rook-1 claims and trends nearly the full east-west property border covering multiple conductor corridors identified within the region.

The Preston project represents the largest and longest contiguous property portfolio adjacent to NexGen’s Rook-1 claims and trends nearly the full east-west property border covering multiple conductor corridors identified within the region.

The earn-in allows Orano Canada to acquire up to 70% of the project by spending up to C$8 million; that’s C$7.3 million in exploration expenditures and C$700,000 in cash payments over six years.

Orano is about halfway through the earn-in and has completed a large geophysical program at Preston.

Skyharbour CEO, Jordan Trimble, commented via press release.

“This initial geophysics and ground program being carried out by our strategic partner and industry-leader Orano will further advance the Preston Project and refine future drill targets. Skyharbour continues to execute on its key objectives by adding value to its project base in the Basin through ongoing mineral exploration at its flagship, high grade Moore Uranium Project with a 2,500 metre drill program underway while utilizing the prospect generator model to advance its other projects with strategic partners. In addition to Orano’s field program at Preston, Skyharbour’s other partner Azincourt Energy is carrying out a 2,500 metre drill program at our East Preston project which collectively will provide ample news flow and catalysts in the near term.”

Skyharbour’s Preston Uranium Project showing the Orano option in blue and the Azincourt option in green.

Skyharbour/Dixie Gold have a similar deal with Azincourt Energy at the East Preston Project where Azincourt has now earned-in their 70% working interest in the project.

They did this by completing C$2.5 million in staged exploration expenditures and making a total of C$1 million in cash payments over the previous four years as well as issuing a total of 9.5 million common shares of Azincourt divided evenly between Skyharbour and Dixie Gold.

The current exploration program at East Preston [fully funded by Azincourt] is aimed at identifying high-priority targets at the East Preston Zone for anticipated follow-up drilling.

Skyharbour CEO, Jordan Trimble, commented via press release:

“Skyharbour continues to execute on its business model by adding value to its project base in the Athabasca Basin through focused mineral exploration at its 100% owned flagship Moore Uranium Project as well as utilizing the prospect generator model to advance its secondary projects with strategic partners. We are excited to have the opportunity to work with Azincourt as a joint-venture partner at East Preston going forward and will benefit from any upside at the Project with our minority interest. This partnership also complements the recent option agreement we signed with Valor Resources at our North Falcon Point Uranium Project as well as our partnership with Orano Canada at our Preston Project adjacent to East Preston. Skyharbour maintains a dominant land position in the Athabasca Basin with six drill-ready uranium projects.”

And last but not least, Skyharbour (as noted in the above comments from Mr. Trimble) has an arrangement whereby Australian company Valor Resources can earn 80% of its Hook Lake Project (previously called North Falcon Point).

The terms of the deal are C$3,975,000 in exploration expenditures by Valor over a 3-year period and just under half a million dollars in cash payments as well as 233 million Valor shares issued to Skyharbour.

Skyharbour CEO, Jordan Trimble, commented via press release:

“We are thrilled to have this Definitive Agreement signed as we continue to execute on our business model by adding value to our project base in the Athabasca Basin through strategic partnerships as well as focused mineral exploration at our flagship Moore Lake Project. We are excited to have the opportunity to work with new partners in Pitchblende and Valor led by experienced management and technical teams at our North Falcon Point Project while maintaining a 100% interest at the Frasers Lakes Uranium and Thorium Deposit at the South Falcon Point Project. News will be forthcoming on exploration plans and the timing is excellent given the recent upward momentum in the uranium market.”

All three of the partnerships detailed above are key to Skyharbour’s prospect generator model and serve as a sound and strategic way for the company to ensure that its projects are being advanced.

And in the case of Preston, East Preston, and Hook Lake — they’re being advanced via the treasuries of Skyharbour’s partner companies.

Also important, Skyharbour receives cash payments from its partner companies as they earn-in on the various projects, which helps Skyharbour to minimize equity dilution.

It also allows the company to focus its own time, money, and efforts on its flagship Moore Uranium Project located in the eastern Athabasca Basin — which we’ll take a look at now.

100%-owned Flagship Moore Uranium Project

Skyharbour is the 100%-owner of the 137 sq mi Moore Uranium Project following its completion of an earn-in from Denison Mines.

The Moore project is situated 9 miles east of Denison’s Wheeler River project and 24 miles south of Cameco’s McArthur River mine — the world’s largest high-grade uranium deposit.

The image below shows the location of the Preston Uranium Project with Azincourt’s East Preston option area and Skyharbour’s 100%-owned Moore Uranium Project with Cameco’s McArthur River and Cigar Lake mines situated just to the north.

The Moore project — where the company has announced a 2,500-meter drill program — hosts the high-grade Maverick Zone where 2017 drilling returned 6.0% U3O8 over 5.9 meters — including 20.8% U3O8 over 1.5 metres — at a vertical depth of just 265 metres.

Skyharbour CEO, Jordan Trimble, commented via press release:

“We are excited to have this fully funded drill program commence at our flagship Moore Uranium Project. This will serve as an important near-term catalyst for the company as we continue to drill test the fertile Maverick Structural Corridor with the intent of expanding known high-grade zones as well as discovering new ones. Partner funded exploration programs at Skyharbour’s other projects are slated to commence shortly as well. The uranium market has recently shown notable signs of an accelerating recovery including increasing uranium prices and improving sentiment as we enter a more seasonally active time of year. This acceleration appears to be due to several sector developments including mine closures and production curtailment.”

Skyharbour Resources is well-positioned with multiple drill-ready projects at the epicenter of North American uranium production — Saskatchewan, Canada — which is consistently ranked in the top five mining jurisdictions globally by the Fraser Institute.

The fundamentals are also in place for higher uranium prices going forward: Current annual global uranium consumption is 190 million pounds while annual global mine production is 140 million pounds — resulting in a 50-million pound deficit.

What the market needs next is for the major utilities to come in and start signing U3O8 contracts at higher prices. Once that starts happening, the long-awaited rebound in the uranium sector will finally be underway.

Skyharbour Resources is one of only a handful of North American uranium juniors with multiple, high-potential, drill-ready uranium projects in a Tier-1 jurisdiction.

Once this highly cyclical market turns higher — which it has shown to do with great ferocity in the past — it will be those rare, few, well-positioned companies like Skyharbour Resources that’ll attract the lion’s share of buying in the junior uranium space.

For more information, please visit www.SkyharbourLtd.com.

I hope you’ve enjoyed our Special Report. And now without further ado, here is my exclusive interview with Mr. Adrian Day.

Yours In Profits,

Mike Fagan, editor

Hard Asset Digest

Exclusive Interview with Adrian Day

Founder, Adrian Day Asset Management

Mike Fagan: Adrian, it’s so nice to talk to you, and I want to thank you for joining me today. Not to age you… but I know you and my dad go back decades together in the business and have helped each other quite a lot through the years. You’ve been in this business a long time, and you’ve had great success and staying power in a sector that’s really known for its volatility — which certainly is no small feat!

As founder of Adrian Day Asset Management and portfolio manager of the EuroPac Gold Fund, I’m extremely excited to pick your brain on the current gold market. But before we get into that and other related topics, would you mind… for those in my audience who may not know you… providing a bit of your background and insight into what first intrigued you about gold and investing?

Adrian Day: Sure, and thank you, Mike, very much for having me on. Of course, I remember your mom and dad. We’ve spent — not so much in the recent decade — but in years past, we spent a lot of time together.

Yeah, it’s interesting. I first came to gold, as many people do, not from an investment point of view, but from a political economy or hard money point of view, if you like. I studied history at the London School of Economics. I obviously looked at the gold standard and how well it worked. And so I was attracted to gold from that angle. My very first investment — not when I was at the London School of Economics but actually when I was a little school boy in short pants — was a gold Britannia coin! So that’s how I came to gold originally.

1/4 oz British Gold Britannia Coin

And then, of course, when I got interested in investing, it’s a short, sometimes not so short, leap from gold itself to gold mining companies.

So I’ve been managing money now since 1991. Our firm actually is a global money manager. We invest in global equities, we invest in stocks around the world. We’re primarily equity, but also do currencies and occasionally we do bonds. And then, we also manage, as you mentioned, the Euro Pacific Gold Fund, which is exclusively gold and silver.

Mike Fagan: Thank you for that, Adrian. So undoubtedly, it’s been a bit of a rough start to the year for gold with the yellow metal retreating from the mid-$1,900 per ounce level to where we are now — which is closing in on the mid-$1,700 per ounce range where things appear to be firming up some.

Of course, there are a lot of competing venues for speculative capital these days including things like $50,000 Bitcoin, Reddit-driven stocks like GameStop, NFTs, and what have you.

With that being said, we’re also seeing a number of catalysts pointing to higher gold prices in this era of historically and perpetually low interest rates and “blank check” monetary policy. So, Adrian, I have to ask… what does your gold thesis look like for the remainder of 2021 and into next year?

Adrian Day: Yeah, I think you laid the groundwork very well actually. To me, the central factor affecting gold and gold prices is money creation. And I use the word money in quotes, because, of course, the Central Banks aren’t actually creating money — they’re creating credit, or fiat money. That’s the central factor. And when you have excess money creation — a very loose monetary policy — although they’re two different things, it goes along with low interest rates, and that is fundamentally bullish for gold.

So I think the scenario, the environment that we have now, is extremely favorable for gold. Now, the question people ask then is, “Well, if that’s the case, why hasn’t gold gone up?” And I think there’s some obvious answers to that. We’ve seen, as you said, competition from Bitcoin and other assets.

Frankly, and this is not derogatory, I think that your typical GameStop investor is not choosing GameStop over gold. I think they’re two different categories of investor. With Bitcoin, I tend to think that the move from gold into Bitcoin is very much at the margin. Now, there’s no question that you’ve had outflows of money from gold ETFs for basically all of this year, and you’ve had an inflow into Bitcoin. That doesn’t mean the two things are correlated or causal; they’re just happening at the same time. So there’s definitely some of that — but I think it’s at the margin.

You’ve also had interest rates move up in the US. The 10-year treasury has gone from about 0.6% to 1.65% in seven weeks. In percentage terms, that is an astonishing jump in interest rates. And obviously, other things being equal, when interest rates move up, gold goes down. So I think that’s definitely part of what’s driving the narrative.

But if we put it in context, number one, rates at the short end haven’t gone up at all. In fact, in the US and in many other countries around the world, they’ve actually declined this year. And number two, even after an almost tripling of the yield on 10-year bonds in the US, they still have a negative yield; the yield is still less than inflation. And for gold, fundamentally, it’s the positive yield that matters, not the nominal yield. So I think the effect of higher interest rates has been really overblown.

The other thing, of course, is we’ve seen rates triple. And then, there’s a sense that maybe rates are going to continue to move up, because, again, here in the US — and I’m sorry to be so US-centric — recent 10-year and 3-year treasury auctions have had a rather mediocre response. Judging on the bid and the tail and so on, they were fairly mediocre. So there’s a sense of, “Uh-oh, there aren’t enough buyers even at these prices.” And that’s a concern.

Again, I don’t think rates are going to move up meaningfully in the US. I think you’ll get some rates moving up on things like junk bonds where the current yield is quite pathetically low. The spread between treasuries and junk is just idiotic. A high-yield company, by definition, is where there’s a meaningful risk of the company going bankrupt.

And when you’re lending to such companies with a 4% return — to me, that’s a symptom that there is just so much excess money around. And when you have excess money, it has to go somewhere. It can be $50,000 Bitcoin; it can be a company that has a significant risk of going bankrupt and only getting 4% on your money. But I don’t think treasury yields, or AAA yields, are going to move up meaningfully.

We’ve seen Japan, Australia, and, most recently, Europe — all take action to stop the increase in rates at the long end. The Fed, last week, decided not to take action but to talk instead; the Fed has always preferred jaw, jaw over war, war! And you can see that it didn’t really have much of an impact. Bonds rose for the first half hour and then fell sharply… meaning that bond investors — and I think this is significant — are demanding a higher return when they lend money for the longer term. And that’s a significant change.

A year ago, before COVID, even though rates were at such historically low levels, bond investors — and I don’t mean mom-and-pop bond investors or people who put 10% of their portfolio into bonds — but people who are specialists in bonds, the majority of them were all still bullish on bonds even though yields were so low, because they said:

“If interest rates go negative, my quarter of a percent on my bond is going to pay me in capital gains; it’s going to be an incredible return!”

And they were all still very, very bullish. That has changed this year with optimism on the economy — based on the COVID vaccinations — and bond investors are now not so sure that rates are going to continue to go down. And if you don’t think rates are going to go down, you want more than half a percent for lending money to the government for 10 years. And that’s what’s been happening; the bond investors are demanding more money.

But I think eventually the Federal Reserve will follow Europe. And if they have to, they will take action to suppress yields at the long end. And that’s very easy for them to do when they are allowed to print as much money as they want — again, money in quotes — with no restraint. It is obviously incredibly easy for them to suppress rates at the long end if they want to, and I think eventually they will.

So I think all of the reasons that you see for gold being weak are real to some extent. But I think the perception of them is way overblown.

Mike Fagan: I’d imagine — and I’m curious to see if you’ll agree with this — that most gold producers are perfectly content with $1,700 gold as margins, and the ability to raise capital, are quite good at those levels… and it’s a major contributing factor as to why so many of the senior producers are boasting vastly improved balance sheets as compared to where they were just a year or so ago.

So not trying to pin you down on a gold price prediction per se… but what would a move back above $2,000 an ounce — which we saw briefly last August — mean for the better run senior and mid-tier producers?

Adrian Day: You make a very, very compelling point there, Mike. Most mining companies are doing quite well at the current price level, especially when you consider that oil — which is the largest cost input in running a mine — despite the recent run, is still significantly below where it was in 2011-12… remembering that in 2011, 2012, and 2013, oil was over $100 consistently and got up to $140 a barrel.

The second largest cost input in running a mine are the local costs. So the cost of labor, the cost of building and maintaining a camp; not the big items you have to import but all of those local costs. And one of the largest factors determining local costs is the price of the currency.

So again, if you look at the price of what we call commodity currencies; the Australian dollar, Canadian dollar, South African rand, Chilean peso. If you look at those, take the Australia dollar, for example; it’s moved up in the last six months from a little over $0.70 to $0.76. That’s a pretty big move for a currency, right? But go back to 2011, and we were looking at the Australian dollar over par… an Australian dollar that was 50% higher than it is today.

Obviously, things like that have an immense effect on costs. The point of that diversion being that the price of gold is pretty darn good today. Of course, it’s not as high as it was at this point last year. But the costs are that much lower than they were the last time gold was at $1,700 an ounce, back in 2011, 2012, which generally points to higher margins for mining companies.

Now, if gold were to move up to $2,000 on any sustained basis, it would most likely be accompanied by increasing inflation which we’re already seeing; cost inputs are going up, food is going up, commodities are going up.

It’ll also be accompanied by higher commodities across the board similar to what we witnessed from 2004 to 2008; as the price of gold went up, so did the price of oil and all of those cost inputs of building and running a mine. So as you can see, margins didn’t really expand in that scenario. I think what you’re going to see is a situation similar to that where mining costs increase along with the gold price.

But it’s very interesting. I mean, if you look at Newmont, the No. 1 gold miner in the world, and Barrick, the No. 2 gold miner in the world, along with several others that have actually priced their year-end reserves at the $1,200 range — when gold trades at $1,700 an ounce… they’re very, very happy!

Mike Fagan: So with that being said, Adrian, do you think that the share price performances of the majors could get quite impressive if we indeed get a sustained gold rally of that magnitude?

Adrian Day: Oh, absolutely! More than quite impressive… I think it would be very impressive! Remember what we saw in the first half of last year, from March to August, when gold had that incredible move? In US dollar terms, it was up over 40% in a little over four months. That’s a phenomenal move for an asset like gold. And during that period, we saw a huge rally in the gold stocks with the vast majority more than doubling during that period.

So I think we’ll easily see something like that here again soon. You’ve got to remember — as you implied in your earlier comments — that the sentiment on gold right now is pretty weak and is particularly weak among generalists. And I think, frankly, that’s one of the reasons why gold has declined as much as it has for as long as it has. You had a lot of generalist investors jumping in as gold was moving up. And now they’ve all moved out.

So you need gold to make a solid move, and, more importantly — to make a sustained upward move. For instance, a sustained move above $1,800 an ounce is where I believe you’re going to start seeing a lot more generalists returning to the sector. And these stocks are only so big, so they can move very, very rapidly as we all know. I’m talking about the big ones here; not the little ones.

Mike Fagan: You mentioned Barrick and Newmont; both very well-run companies. Are there any other senior producers, or perhaps even a mid-tier, that you see as particularly attractive at current price levels?

Adrian Day: Well, I didn’t actually say I was keen on either Barrick or Newmont. As it happens, I think Barrick Gold (NYSE: GOLD)(TSX: ABX) is just ridiculously inexpensive at the moment. It’s a very well-run company, especially since they merged with Randgold and with Randgold’s Mark Bristow taking over as CEO of Barrick.

The company has literally been transformed from $4 billion in debt two years ago to now being cash positive. Their mines are all operating well, and the cost of running the mines has improved. G&A costs have also been slashed, which is important because it was a very bloated company prior to the merger. So in my mind, it’s an incomparably better company than it was just two years ago, and certainly 10 years ago, when the price was almost triple what it is today.

So Barrick is a very, very good company. I’m also a fan of some of the royalty companies as they give you less downside risk than the mining companies while also providing exposure and leverage to higher gold prices. People tend to think that the big royalty companies, while good in a down market for protection, aren’t very good in an up market. There’s certainly some truth to that. But if you were to pick, say, forty gold mining companies, there would be several that would outperform the royalty companies in a strong market. Yet, I will also say that, on average, the big royalty companies would do just as well as the average mining company in a strong market at a much, much lower risk factor.

So I like Franco-Nevada (NYSE: FNV)(TSX: FNV) a lot. That’s the biggest, obviously. But it’s also, in my mind, the best. It’s very well-diversified. They’ve got revenue coming from over 40 different assets. No single asset represents more than 13% of their revenue. So very well-diversified with a strong balance sheet and a great pipeline.

Royal Gold (NASDAQ: RGLD), which is a US company, is another one that has, in my mind, a lot of upside ahead of it.

Osisko Gold Royalties (NYSE: OR)(TSX: OR) is a hybrid royalty company that’s been sort of punished in the market because it’s not a pure royalty company. As you probably know, they’ve spun off their development assets into Osisko Development. Osisko Gold Royalties owns most of it; they own about 75%. Over the course of time, they’re going to reduce that and just keep the royalties.

So I think as you see the transformation in Osisko Gold Royalties — it’s a very strong company.

You also asked me about the mid-tiers. Honestly, I feel like a kid in a candy store right now! There are so many good quality companies at very good prices. To me, B2Gold (NYSE-Amer: BTG)(TSX: BTO) is a superb company.

You also asked me about the mid-tiers. Honestly, I feel like a kid in a candy store right now! There are so many good quality companies at very good prices. To me, B2Gold (NYSE-Amer: BTG)(TSX: BTO) is a superb company.

While it’s possible that their Fekola Gold Mine in Mali will have a slightly less good year this year as compared to last year — it’s still a very good company at a very good price with a solid dividend.

And I would still buy Premier Gold Mines (OTC: PIRGF)(TSX: PG), which, as you know, has been bought by Equinox Gold. And then, they’re spinning off all of their assets in Nevada into something called i-80. If you buy Premier today, you also get Equinox, which is Ross Beaty’s company; a great company that’s growing very, very well and selling at a good price. And then you also get the i-80.

And I would still buy Premier Gold Mines (OTC: PIRGF)(TSX: PG), which, as you know, has been bought by Equinox Gold. And then, they’re spinning off all of their assets in Nevada into something called i-80. If you buy Premier today, you also get Equinox, which is Ross Beaty’s company; a great company that’s growing very, very well and selling at a good price. And then you also get the i-80.

So you can still buy those assets at a discount today by buying Premier; not much of a discount because the transaction is almost complete. But yeah, there’s a couple of majors along with a couple of mid-tiers.

Mike Fagan: Yes, thank you for that! What about this mass influx of junior royalty companies we’re seeing right now… any interest in those?

Adrian Day: Yes, absolutely… and we own several. I do, nevertheless, think the space has become just a tad overcrowded recently. I mean, in just the last year, there’s probably been seven or eight to hit the market. Now, some of them were existing companies, like Elemental Royalties, which had been a private company for about five years prior to going public.

Some of them are run by people who’ve been in the royalty business a long time, such as Nomad Royalty (OTC: NSRXF)(TSX: NSR), which was formed by a couple of people from Osisko Gold Royalties and so on. There’s also some brand new ones, so it’s become a little crowded, which means there’s increased competition for royalty and streaming assets.

What we’ve seen recently, particularly with buying existing royalties, is that prices have just become, in most cases, shall we say, a little overdone. Some royalties are being sold with a non-discounted internal rate of return of zero, which essentially means you’re trading dollars and hoping for the commodity price to go up or for exploration upside. Naturally, you might see exploration upside, so it may not be a totally unwise thing. Yet it’s always nice to get some kind of return up front, especially when you are buying non-producing assets where there is some risk.

The key for these companies, really, is to become more and more diversified, at which point the stocks see multiple expansion. For instance, you can have a royalty company with one royalty; it might be the best royalty in the world. But with only one royalty, they’re not going to trade at as high a multiple as, say, a Franco-Nevada that boasts 40 different royalties. Having said all that, we own several of the newer ones; all good companies run by very good people.

Mike Fagan: Any particular names you’d like to mention?

Adrian Day: Sure. I mean, I do like Metalla Royalty (NYSE-Amer: MTA)(TSX-V: MTA). But of course, that’s been out several years now and that’s not such a small one anymore. And I mentioned Nomad Royalty, which, again, is not such a small company.

Among the smaller ones, I like Elemental Royalties (OTC: ELEMF)(TSX-V: ELE) a lot. The people… they’re young, they’re dynamic, and they have some senior, experienced people on the board as advisors. So you’ve got a nice combination there.

I think Star Royalties (TSX-V: STRR) is going to do well. Star Royalties is a royalty run by Kevin MacLean, who’s been one of Canada’s top fund managers for many, many years. Interestingly, he’s not taking a salary. So his return comes from the stock going up and eventually paying a dividend. So he’s completely aligned with shareholders. And he’s not the only one; all of the leading people at that group are similarly aligned.

In terms of growth, even if these companies do everything properly, it’s going to take them a bit longer to get there simply because there’s so much competition for royalties and streams these days. And, keep in mind also that mining companies have greater access to capital in the equity markets than they did three or four years ago.

Three, four years ago, an established royalty firm could go to a mining company and say, “We will buy a royalty or a stream… these are our terms… and so on.” Well, gosh, that’s a little bit rich, isn’t it? “Well, you can go and raise a hundred million dollars in the market if you like.” And, of course, the mining company suddenly realizes, after talking to the bankers, that they cannot so easily raise a hundred million dollars in the market.

Today, of course, the mining companies are more than capable of raising money in the market — so you’ve got increased competition there as well.

Mike Fagan: Adrian, the resource sector can be broken down into a number of different categories, including, as we just talked about, the juniors, and then you have the mid-tiers and senior producers.

Would you mind giving my readers a bit of insight into some of the “absolute must haves” that you personally look for when evaluating the merits of a resource stock opportunity… and do those criteria change much depending on the particular subsector?

Adrian Day: Yeah, that’s an interesting question, Mike. I would say management is number one. For me, management is critical… and critical even with the largest mining companies.

I mentioned Barrick earlier which has had an absolute transformation due to the appointment of a single individual, Mark Bristow, as CEO. So management is critical in my mind.

Mark Bristow, CEO

Barrick Gold Corp.

And the smaller the company, the more critical it becomes. Of course, it’s a two-edged sword because if you have a small company that’s relying on one individual — God forbid anything happens to that individual or he says the wrong thing on Twitter and is forced to resign (laughs!) — it can have a major detrimental effect on the company.

Balance sheet is also critical. Now, there is a difference to me between the big companies and the smaller exploration companies. I’m not a geologist so I have no edge over lots of other smart people in looking at a particular property and trying to decide whether a project has exploration upside. What I can judge, though, are people and balance sheets. And those, to me, are the top two.

And I guess the third one would be history; what they’ve done, and did they do what they said they were going to do. So, with a smaller company, I will take great management with a lousy property and no cash over a great project, lots of money, and lousy management. That’s because lousy management, even if they’re not crooks, they’ll manage to spend the money and won’t get the full reward out of the project. I’ll go for “people” over “project” every time!

Mike, many of the stocks that have been my biggest winners of all-time — and I’m talking many thousands of percent returns over time — the interesting thing is that these companies started with a project or an asset or a business plan that subsequently changed. So, again, people and their history of getting things done for shareholders are the most critical things.

Mike Fagan: Absolutely, I couldn’t agree more. As speculators, we see that playing out all the time. Also, how important a factor is jurisdiction in resource stock speculation in terms of where a Canadian or US company has its mining assets?

And are there any particular countries or continents you see as particularly attractive right now or, on the flip side of that, are there any you’re actively avoiding?

Adrian Day: Yeah, that’s another interesting point. I mean, I’m sort of willing to go anywhere at the right price. Yet, you expect a pretty good discount if you’re going to, say, somewhere like Venezuela or some other risky country. And it’s especially true in exploration. In exploration, you’re taking enough risk as it is; all sorts of risks including the commodity price, the geologic risk, etc. Do you really want to add political risk on top of all those things? My answer is no!

And I know there are plenty of very, very smart people in the business like the Lundin family, Rick Rule, and many others who are much more willing than I am to go into risky jurisdictions. But my thinking, as I said, is that you’re taking enough risk anyway — so why multiply it?

Adrian Day: Yeah, and the problem with resource assets is that you can’t move them, and you literally have to spend all your money up front! So you spend a decade or so, along with tens of millions of dollars, exploring an asset. Let’s say you find something of value, and you spend a billion dollars building it. Well, now you’re stuck! You can’t move it, and your only option is to shut it down if you don’t like what the local government is doing.

So if the government decides they want to increase taxes on the asset, you have no choice but to pay up. And if they threaten you with expropriation — well, you’re basically out of luck!

Mike Fagan: Right… your hands become tied the moment you start spending big money!

Adrian Day: Right! So yeah, jurisdiction does mean a lot to me. Now, having said that, all countries present some degree of political risk, even Tier-1 jurisdictions like Alberta. Even a low-risk, first-world country can impose new taxes, or, as in the United States, stop a pipeline from being built, etc.

Of course, we could name hundreds of examples, whether it’s a specific thing, like stopping the Keystone pipeline, or in Alberta, increasing taxes on oil companies, or just the general macro climate of increasing taxes and making permitting difficult and so on. It really comes back to the amount of money you’re paying for the risk you’re taking on.

Mike Fagan: True. And continuing with that premise, we just saw Newmont expand its footprint in a Tier-1 jurisdiction — British Columbia’s Golden Triangle — with a C$393 million purchase of GT Gold resulting in a 38% premium for GT Gold shareholders.

Are you anticipating more of the same in terms of increased M&A activity in the resource space especially as travel restrictions are eventually eased around the globe?

Adrian Day: Yes, I think so. I mean, on a macro basis, the companies that are producing gold cannot discover enough gold to replenish what they’re producing — so they have to acquire. If you’re Barrick or Newmont and you’re producing 5 million ounces a year — or Yamana Gold at 2 million ounces — no company wants to say to their shareholders, “Hey, our production goal for the next five years is to shrink!” Naturally, nobody wants to say that.

We’ve gotten away from this mantra of growth-at-any-price, which is a good thing. Yet, at a very minimum, companies want to at least stay where they are production-wise. And so there has to be more acquisitions.

Mike Fagan: Adrian, as fellow contrarians, one thing that can keep us up at night is too many people agreeing with us, right? At present, there seems to be this wide consensus among gold experts and financial analysts that gold has put in a bottom and is heading to much higher levels in the near-term.

So the question is… are there certain fundamentals that maybe are being overlooked to some extent — perhaps related to what many economists predict will be a very robust US-led global recovery as high as 6% — that could derail gold’s rise such as a rising dollar?

Adrian Day: Mike, that’s a good question. I do think the dollar is definitely one factor. I’m not overly concerned with the strength of the recovery because I think it’s pretty clear that not all countries or industries are going to be recovering rapidly. And secondly, the Federal Reserve has made it very clear that they do not intend on tightening even following what we anticipate will be a strong year of economic growth.

I think we’re looking further out. So a very strong economic recovery would have to be accompanied by the Federal Reserve tightening, along with other central banks, and I don’t see any indication of that any time soon. If you look at Europe, Japan, and the US — there’s no indication that these banks are going to cut back anytime soon.

To me, the biggest downside factor for gold is sentiment.

Critics will tell you that the problem with gold is that gold doesn’t have a yield. So the analysis of gold is a lot more tricky and depends much more on sentiment than most other assets. If you have a company that’s trading at 10X earnings and is paying out a 3.5% dividend yield and is consistent year after year… well, there’s only so much lower it can go because the value is backed by fundamentals. With gold, there’s really no limit to how low or how high it can go because sentiment plays such a large role.

So I think the biggest risk with gold at the moment is the potential for this negative sentiment — of course, not among gold investors but among the broader investment public — continuing for whatever reason.

Mike Fagan: Adrian, transitioning to the base metals, we’ve seen a pretty big move so far this year — particularly copper and nickel — in anticipation of the global recovery and the electrification of everything.

Are you seeing that as a case where the base metals have moved too far, too fast? Or if the current administration is able to get a big infrastructure deal done this year or perhaps next year, do you envision even higher base metal prices as the recovery goes into full swing?

Adrian Day: Yeah, Mike, good point and an interesting observation. I do think they’ve moved a little bit too far, too fast — particularly the equities. And you’re beginning to see inventories in China starting to build up slightly. That’s sort of your first indication that demand might pull back a bit. If you look ahead two to three years, I think metals like copper and nickel are going to be extraordinarily strong. Copper, I would say, even more than nickel because you’ve got far less opportunity for substitution with copper.

As you know, with nickel, you can replace a lot of the nickel in a battery with other elements; they’re more expensive at the moment but the substitution is possible. With copper, that substitution just isn’t there. I’m always careful talking about physical shortages, other than for a short period of time, because shortages are typically taken care of by price. At the right price point, there is no shortage — there’s just frustrated would-be buyers.

Yet, with copper, let’s say you have a genuine inability to be able to increase supply dramatically for the foreseeable future. In that case, most analysts would say there’s a physical shortage coming.

With copper, as you know, the mines take a very long time to build. From discovery to production, they can literally be decades in the making. Even from the time a board of directors gives the go-ahead to build a project, you’re still looking at 7 to 10 years before the start of production.

Of course, this differs quite a lot from gold where gold mines can come online fairly quickly. For copper, it’s quite reasonable to look at copper projects around the world that are in development, and at the depletion in existing mines, and make a reasonably good assessment of how much copper potentially could be produced in 3 to 5 years. And when doing so, it’s pretty evident today that there will not be enough copper coming online to meet that demand.

So I think over the next few years, copper in particular — but also nickel and many other base metals — are going to be super strong.

Mike Fagan: Any particular base metals companies — whether that might be a junior, mid-tier, or senior — you’re seeing as particularly undervalued right now?

Adrian Day: Well, not really. The problem is that the mining companies have moved up even more dramatically than the metals themselves. Take, for example, a company like Freeport-McMoRan. It’s gone from, my gosh, $5 per share a year ago to $30 today. That’s a pretty darn good move. And a lot of that is justified. But if you have a slide, even a small, temporary slide in the copper price — that stock falls back quite a bit.

So one of the things I’m doing is I’m looking at mining companies that have a significant byproduct in a metal that I like.

For example, I mentioned Barrick earlier. About 5% or 6% of Barrick’s revenues come from copper. Obviously, you’re not going to buy Barrick as a copper miner. Yet, when you own Barrick, you’re owning some copper with it. So that’s an example of what I’m doing and what I like.

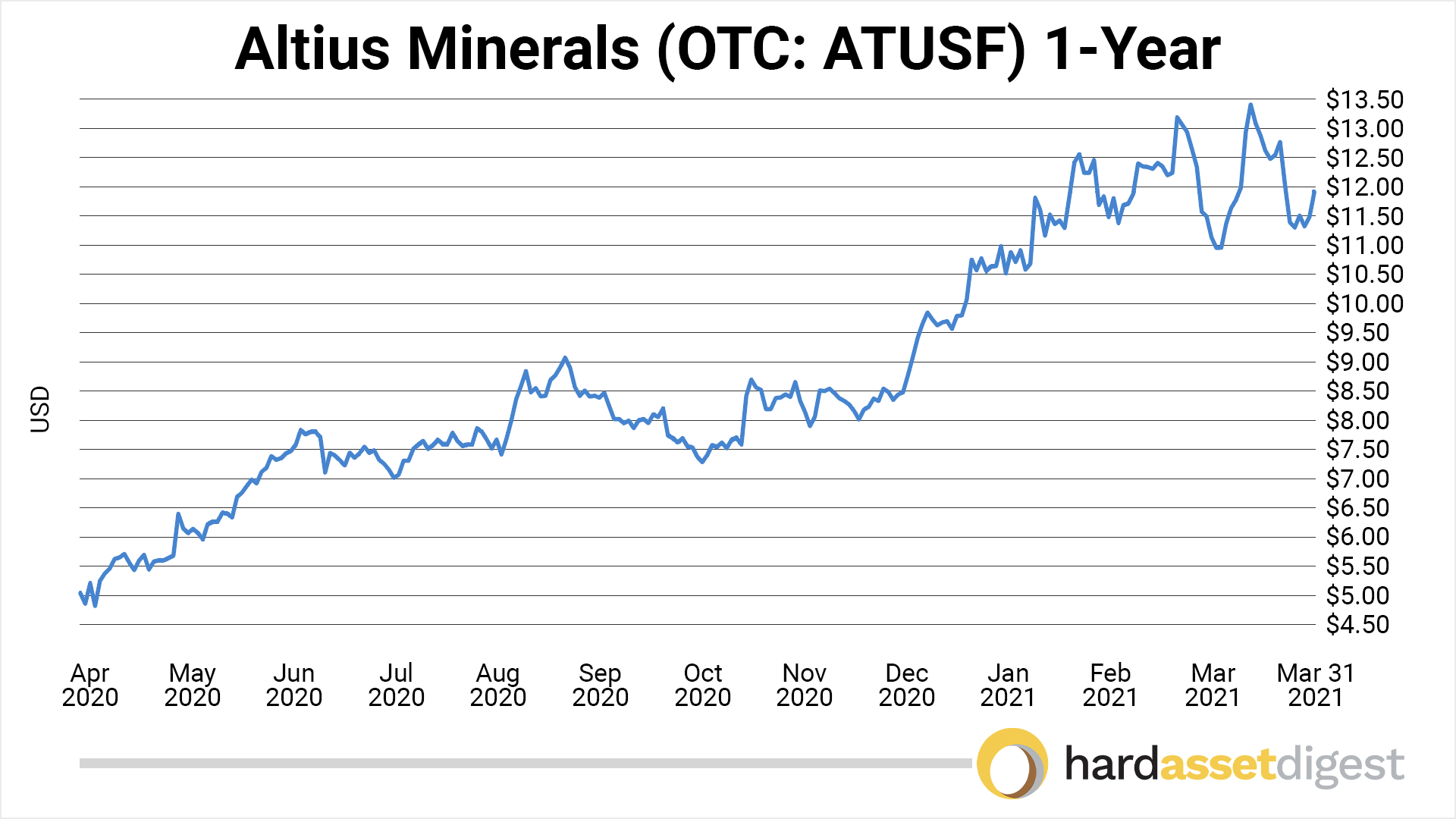

Another company I like a lot is Altius Minerals (OTC: ATUSF)(TSX: ALS), which is a resource royalty company but non-gold. Potash is actually their number one revenue source. Copper, at about 30% of revenue, is number two. Obviously, if the price of copper comes down, the royalty revenue they receive goes down… but it’s very well-diversified.

It’s got potash, copper, nickel, lithium, coal, and renewables. In the current environment, you’re not going to see the whole complex going down at the same time. Also, things like potash and coal are not very correlated with, say, copper and nickel and so on.

So you’re getting a lot of diversified exposure in a company like that. In terms of actual base metal miners, I don’t think I own any at the moment to be honest.

Rick Rule

Resource Stock Legend

Mike Fagan: Adrian, you briefly mentioned legendary resource expert Rick Rule earlier. He’s fond of saying — and I’m paraphrasing here — that gold leads a precious metals bull market and silver follows suit and can actually outperform gold in the longer-term due to its industrial and green technology applications.

Is that something you’re anticipating for silver as we get deeper into the recovery and, likewise, as developed nations make good on their shared goal of transitioning away from fossil fuels in favor of green energy innovations?

Adrian Day: Yeah, absolutely! Even before the green revolution, silver typically would have these spurts — often toward the end of a bull run — that were far, far stronger than that of gold. And there’s lots of reasons for that. Part of the reason is just because of its lower price point. So as gold goes to, say, $2,000 an ounce, there are people who can’t afford to buy an ounce of gold. But they can afford to buy a few ounces of silver. So as a market develops, you get a natural transition toward the less expensive product. That’s one reason.

And the other reason — and this is important — is that most silver today is a byproduct, meaning it’s not from primary silver mines. And so it might be a byproduct of lead or it might be a byproduct of zinc or some other metal. Now, if you’re a lead miner in Bolivia, and the price of silver goes way up, you’re not going to go out and build a new lead mine… because the silver is a by-product, right? And so the point is that silver production does not respond to price movements as much as, say, gold or copper where you have a lot of primary gold and copper mines.

And so when the price of silver starts moving up, you get investors buying physical product and you also get ETF movements. And ETFs are more important for silver than they are for gold in a bull market. Plus, you’re not getting that increase in supply. And of course, now you add in the green energy revolution — and that’s just one more factor adding upward price pressure to silver.

Mike Fagan: Any silver names you can share with my audience… perhaps a junior or mid-tier?

Adrian Day: Sure. I’ll name a big one first. To me, Pan American Silver (NASDAQ: PAAS)(TSX: PAAS) is the gold standard in the silver space. And below $31 per share — it’s a superb buy!

They have two free options that are not factored into the current stock price; the Escobal Silver Mine in Guatemala and the undeveloped Navidad silver deposit in Argentina. These are two very large, world-class silver projects that are on hold because of local opposition, etc. But eventually, one or both will come into production, which will boost the stock price tremendously. In the meantime, it’s a great company, period.

One I’m looking at — I think my favorite at the moment — is Fortuna Silver Mines (NYSE: FSM)(TSX: FVI), which is at a very, very attractive price today. It’s currently below $7 per share. They’ve built a new gold mine in northern Argentina; the Lindero Mine. Of course, Argentina is not the easiest place in the world to operate. Yet, with that said, I think it’s the least expensive of the better gold mining companies out there.

On the smaller end, there’s an interesting one in Sonora, Mexico called Magna Gold (OTC: MGLQF)(TSX-V: MGR). It’s really a silver company so you might say it’s time they changed their name. They just recently put their San Francisco Mine back into production. They’re focused on consolidating a lot of smaller silver mines in the area. Good management, well-financed, and it has some leverage to silver as well.

Mike Fagan: Excellent… thank you for those! Adrian, earlier we discussed some of the key components in selecting resource stocks. Of course, knowing when to sell a mining stock can be equally if not more important!

Would you mind sharing with my readers your evaluation process as it relates to profit-taking and, perhaps more importantly, the types of red flags you typically keep an eye out for that can determine when it’s time to walk away from an underperforming resource speculation?

I think you touched on that a little bit in terms of when a company sort of changes course or reneges on prior promises…

Adrian Day: Sure, and I’ll answer your questions in reverse order then. That “change of course” you mentioned, really, is number one for me. And it could be that the manager retires and a new one comes in. Or it could be a takeover. Or it could just be the company consistently failing to do what they said they were going to do.

My number-one rule is that, if I buy a company for A, B, C & D — which doesn’t necessarily mean I’m right by the way — but I end up with E, F, G & H… well, I’m going to sell and reevaluate. I may decide to come back in at some point. But I don’t often just hold through fundamental changes.

And the way I do that is in the actual buying. I divide companies at one extreme into core holdings such as Franco-Nevada. And at the other end, I have my short-term speculations. For me, the critical thing is remembering why you bought something and not constantly second guessing yourself by overreacting to short-term price moves.

You don’t want to say, “Okay, this is a short-term speculation, and I’m buying it for this particular drill program. I think the results could be very good.” Then, the drill results come out; they’re lousy, and the share price is cut in half. Then, you change to, “Well, maybe it’s a core holding now because it’s too cheap to sell.” I think you’ve always got to focus on why you bought something and stick with that.

And similarly, at the other end of the spectrum, if you have Franco-Nevada as a core holding, and the price of gold goes down and the share price goes from $150 to $110 — well, that’s a pretty big drop in anyone’s book. Yet, because it’s a core holding, you don’t go and start putting 20% stop losses on it.

As I said, it’s crucial to remember why you bought something and what you’re expecting to get out of it. Of course, that doesn’t mean being overly stubborn and riding something all the way down. What I’m saying is you want to avoid constantly second guessing yourself. That way, the sells come more naturally from your actual buying process.

Mike Fagan: That makes a lot of sense… and it’s a good way of looking at things especially in a sector that’s as rife with risk as resource speculation!

Adrian, it’s been absolutely wonderful having you on… I’ve really, really enjoyed the conversation and I want to thank you ever so kindly for sharing your knowledge and wisdom with me and my audience. I know they’re going to get a lot out of it as did I.

Before I let you go, can you give my readers just a real quick overview of some of the services your firm offers to individual investors and how they can get involved?

Adrian Day: Oh, sure. I appreciate that, Mike. And it’s been wonderful spending some time chatting with you as well.

So we manage money in separately managed accounts on a discretionary basis. These accounts are not available to residents of Canada, I’m afraid, as we’re not registered in Canada at the moment. Although Canadians, if they’re interested, can send me their email, and once we’re registered, I’ll let them know. But we can’t take their account at the moment.

We’re very flexible on minimums. Of course, it needs to make sense for the client and, as well, for us. But yes, we’re very flexible on minimums. And we offer, as I mentioned, global as well as gold-focused accounts.

Your readers can reach out to me at AssetManagement@AdrianDay.com or they can visit our website at www.AdrianDayAssetManagement.com and find information there and ask questions.

Mike Fagan: Excellent! Thank you again, Adrian. I’ll look forward to catching up with you again soon… and hopefully we’ll be talking $2,000-plus gold!

Adrian Day: Absolutely! My pleasure, Mike.

We have four reports now available highlighting several opportunities for investment in the resource space.

Opportunities discussed in those reports and past issues include:

March 2021 Issue: Opportunities Mentioned by Adrian Day

- Barrick Gold (NYSE: GOLD)(TSX: ABX)

- Franco-Nevada (NYSE: FNV)(TSX: FNV)

- Royal Gold (NASDAQ: RGLD)

- Osisko Gold Royalties (NYSE: OR)(TSX: OR)

- B2Gold (NYSE-Amer: BTG)(TSX: BTO)

- Premier Gold Mines (OTC: PIRGF)(TSX: PG)

- Nomad Royalty (OTC: NSRXF)(TSX: NSR)

- Metalla Royalty (NYSE-Amer: MTA)(TSX-V: MTA)

- Elemental Royalties (OTC: ELEMF)(TSX-V: ELE)

- Star Royalties (TSX-V: STRR)

- Altius Minerals (OTC: ATUSF)(TSX: ALS)

- Pan American Silver (NASDAQ: PAAS)(TSX: PAAS)

- Fortuna Silver Mines (NYSE: FSM)(TSX: FVI)

- Magna Gold (OTC: MGLQF)(TSX-V: MGR)

January 2021 Issue: Opportunities Mentioned by Nick Hodge

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Roxgold (TSX: ROXG)(OTC: ROGFF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Generation Mining (TSX: GENM)(OTC: GENMF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

December 2020 Issue: Opportunities Mentioned by Van Simmons

- 19th century: Liberty Seated half dimes, dimes, quarters, half dollars, silver dollars

- 20th century: Buffalo Nickels, Mercury Dimes, Walking Liberty Halves, Standing Liberty Quarters

- Barber dimes, quarters, and halves

- Common date: $10 Liberties, $5 Liberties

- 19th century quarter sets: Draped Bust Quarter, Capped Bust Quarter, Liberty Seated Quarter, Barber Quarter

- 20th century coin sets: Mercury Dimes, Walking Liberty Halves, Buffalo Nickels, Standing Liberty Quarters; other various: 8-piece sets, 10-piece sets, 12-piece sets

November 2020 Issue: Opportunities Mentioned by Gerardo Del Real

- Nevada Sunrise Gold (TSX-V: NEV)(OTC: NVSGF)

- Chakana Copper (TSX-V: PERU)(OTC: CHKKF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX-V:RVG)(OTC: RVLGF)

- Integra Resources (TSX-V: ITR)(NYSE-American: ITRG)

- Liberty Gold (TSX: LGD)(OTC: LGDTF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Energy Fuels (TSX: EFR)(NYSE-American: UUUU)

October 2020 Issue: Opportunities Mentioned by Joe Mazumdar

- Pan American Silver (TSX: PAAS)(Nasdaq: PAAS)

- Liberty Gold Corp. (TSX: LGD)(OTC: LGDTF)

- HighGold Mining (TSX.V: HIGH)(OTC: HGGOF)

- Bluestone Resources (TSV.V: BSR)(OTC: BBSRF)

- Trilogy Metals (TSX: TMQ)(NYSE-Amex: TMQ)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

- Blackstone Minerals (ASX: BSX)

- Clean Air Metals (TSX.V: AIR)

August 2020 Issue: Opportunities Mentioned by Jeff Phillips

- Lynas Corp. (OTC: LYSCF)

- MP Materials: Private Company

- Leading Edge Materials (TSX.V: LEM)(OTC: LEMIF)

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Revival Gold (TSX.V: RVG)(OTC: RVLGF)

- Almaden Minerals (TSX: AMM)(NYSE: AAU)

- Chakana Copper (TSX.V: PERU)(OTC: CHKKF)

- Regulus Resources (TSX.V: REG)(OTC: RGLSF)

May 2020 Issue: Opportunities Mentioned by Brien Lundin

- Great Bear Resources (TSX.V: GBR)(OTC: GTBDF)

- Energy Fuels Inc.(NYSE American: UUUU)

- Bluestone Resources (TSX-V: BSR)(OTC: BBSRF)

- First Mining Gold (TSX: FF)(OTC: FFMGF)

- Libero Copper & Gold (TSX.V: LBC)(OTC: LBCMF)

- GR Silver Mining (TSX.V: GRSL)(OTC: GRSLF)

April 2020 Issue: Opportunities Mentioned by Nick Hodge

- Azarga Uranium (TSX: AZZ)(OTC: AZZUF)

- Skyharbour Resources (TSX-V: SYH)(OTC: SYHBF)

- Ivanhoe Mines (TSX: IVN)(OTC: IVPAF)

- Midas Gold (TSX: MAX)(OTC: MDRPF)

- Teranga Gold (TSX: TGZ)(OTC: TGCDF)

- Sibanye-Stillwater (Nasdaq: SBSW)

- Wheaton Precious Metals (TSX: WPM)(NYSE: WPM)

- Franco-Nevada (TSX: FNV)(NYSE: FNV)

February 2020 Issue: Opportunities Mentioned by James Dines

- Agnico Eagle Mines (TSX: AEM)(NYSE: AEM)

- Kirkland Lake Gold (TSX: KL) (NYSE: KL)

- Pan American Silver (TSX: PAAS) (NASDAQ: PAAS)

- Lynas Corp. (OTC: LYSCF)

- Canopy Growth (TSX: WEED) (NYSE: CGC)

- OrganiGram Holdings (TSX: OGI) (NASDAQ: OGI)

Make sure you never miss an update or issue from Hard Asset Digest by adding editor@hardassetdigest.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here.

Hard Asset Digest, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at editor@hardassetdigest.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Hard Asset Digest does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.