The New Standard in Silver: SilverCrest Metals Inc.

SilverCrest Metals Inc.

NYSE-American Stock Exchange: SILV

Toronto Stock Exchange: SIL

Rick Rule of Sprott Inc. (NYSE: SII) says…

We are near rock bottom in the gold market… and each and every time this market has recovered over the last 40 years… the upside has been between 200% and 1,200%!

That means select gold and silver stocks are poised to do very well in 2021 and that they belong in your well-diversified portfolio as a hedge against rising geopolitical uncertainty and a depreciating US dollar.

Like Rick says…

“If past is prologue, investors will do well in gold… speculators will do well in physical silver… but intelligent speculators could do extraordinarily well in the silver stocks!”

Rick Rule, President & CEO, Sprott US Holdings, Inc.

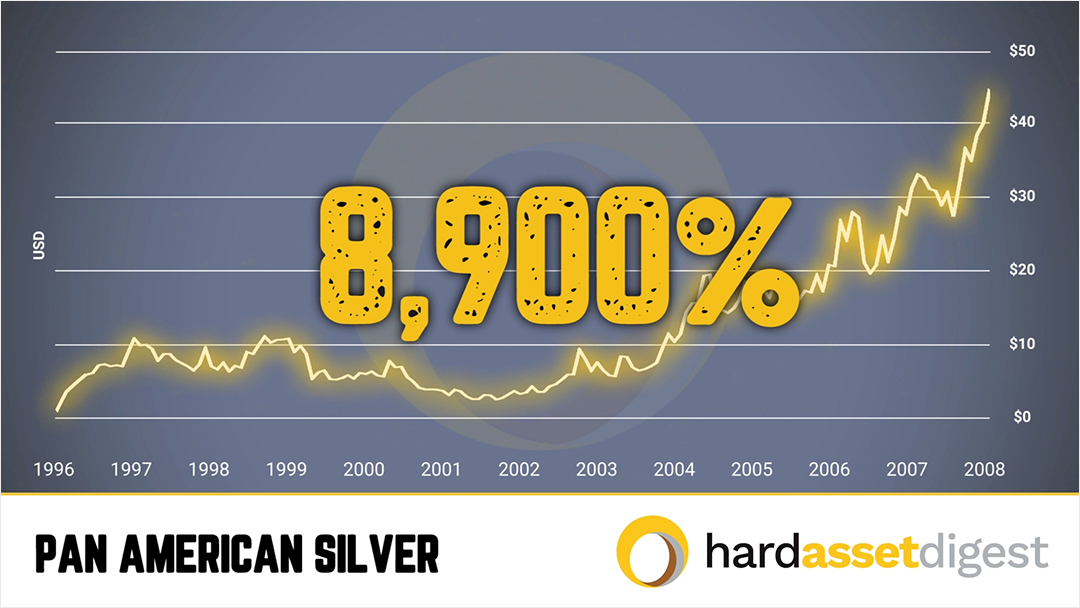

That’s the sector where Rick took Silver Standard from $0.72 to $45 and Pan American Silver from $0.50 to $45.

This Special Report, brought to you by Hard Asset Digest, details a silver exploration and development company Rick has been following for a number of years: SilverCrest Metals Inc. (NYSE-American: SILV)(TSX: SIL)

Overview

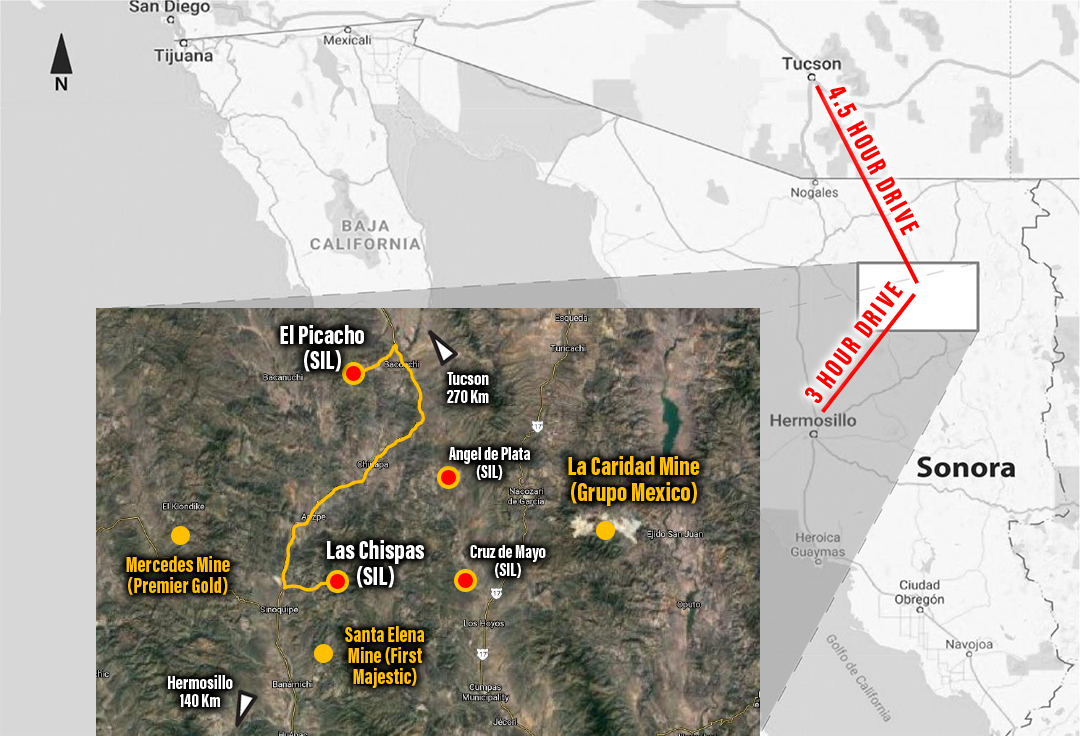

SilverCrest Metals Inc. is a Canadian-based precious metals exploration and development company focused on advancing its 100%-owned Las Chispas Silver-Gold Project — Sonora, Mexico.

Las Chispas, a past producer, is considered the 3rd highest-grade primary silver deposit in the world.

The ore from this project is so impressive that specimens from Las Chispas are on display at the New York Museum of Natural History.

2020 Drilling: Hole BV2-201 from the Babi Vista Splay Vein at Las Chispas reported 2.4 meters estimated true width grading 555 grams per tonne gold and 19,453 g/t silver — including 0.4 meters grading 3,366 g/t gold and 114,814 g/t silver.

The property consists of 28 concessions totaling 1,400 hectares (3,460 acres) and is located approximately 180 km (112 mi) northeast of Hermosillo — Sonora, Mexico.

SilverCrest Metals currently has 8 drill rigs turning at Las Chispas with several rigs focused on converting “resources” to “reserves” and the other half looking for new silver ounces to add to existing resources.

Translation: There should be no shortage of exciting drill results throughout 2021 as the company continues to intercept high-grade silver at a high rate of success.

2021 Feasibility Study

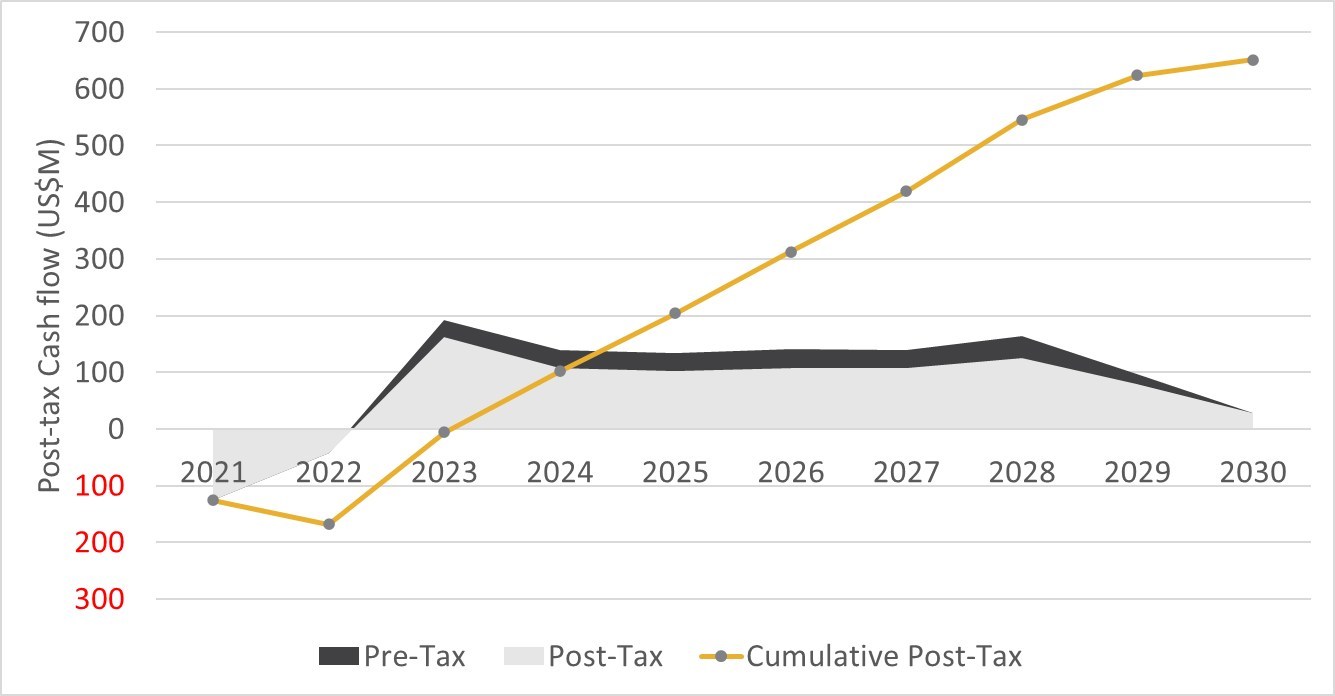

On February 2, 2021, SilverCrest Metals released a positive Feasibility Study on Las Chispas.

Feasibility Study Highlights

Using base case metal prices of $1,500/oz for gold and $19/oz for silver, Las Chispas generates a post-tax NPV of US$486 million with a post-tax IRR of 52% and a one-year payback (8.5 year mine life) at a 1,250 tonne per day throughput.

|

Downside Case (PEA Prices) |

Base Case |

Upside Case

(Spot Price -

Effective Date) |

|

Metal Prices |

| Gold ($/oz) |

$1,269 |

$1,500 |

$1,946 |

| Silver ($/oz) |

$16.68 |

$19.00 |

$27.36 |

|

Economics |

| Post-Tax NPV (5%, $ M) |

$370.4 |

$486.3 |

$802.5 |

| Post-Tax IRR |

42% |

52% |

74% |

| Undiscounted LOM Free Cash Flow ($ M) |

$510.7 |

$656.4 |

$1,054 |

| Payback period in years |

1.2 |

1.0 |

0.7 |

SilverCrest CEO, N. Eric Fier, commented:

“We are thrilled to have completed a robust Feasibility Study within five years of drilling the first hole at Las Chispas. The Feasibility Study confirms what we have believed for a while, that Las Chispas is economic as a stand-alone operation. It is important to note that the Feasibility Study is just a snapshot in time. We are already working hard to increase our high-grade reserves while simultaneously constructing the mine and process plant. We are excited about the extensive opportunities that remain to grow and optimize Las Chispas. We are greatly appreciative of our employees, partners in the community, contractors and our shareholders, who together have supported us to achieve this important milestone safely, quickly and in a very capital efficient manner. While there is a lot of hard work ahead of us, we look forward to making the shift to production and cash flow which we expect will finance our continued growth.”

The highlight factor for Las Chispas is its high-grade ore. The updated resource estimate includes:

- 107 million Indicated silver equivalent (AgEq) ounces in 2.66 million tonnes grading 6.82 grams per tonne (g/t) gold and 659 g/t silver; plus

-

29.7 million Inferred AgEq ounces in 1.24 million tonnes grading 4.35 g/t gold and 367 g/t silver; for a total of

-

136 million AgEq ounces.

Also highly relevant in the study are the Mineral Reserve estimates which reveal the project to be economically viable:

- Total Proven and Probable Reserves at Las Chispas now stand at 3.35 million tonnes grading 4.81 g/t; and gold;

-

461 g/t silver (879 g/t AgEq); for

-

94.7 million oz AgEq.

| Classification |

Tonnes |

Grade |

Contained Metal |

| (k) |

Au

(gpt) |

Ag

(gpt) |

AgEq

(gpt) |

Au

(koz) |

Ag

(Moz) |

AgEq

(Moz) |

| Total |

Proven |

336.5 |

6.21 |

552 |

1,091 |

67.1 |

6.0 |

11.8 |

| Probable |

3,014.7 |

4.65 |

451 |

855 |

451.0 |

43.7 |

82.9 |

| Proven + Probable |

3,351.2 |

4.81 |

461 |

879 |

518.1 |

49.7 |

94.7 |

Capex came in higher at $137 million versus the PEA number of $100 million due primarily to higher spending on underground access and a beefed up mill circuit (1,250 tonnes per day with capacity for 1,750 tpd) to deal with high contained clays in the ore.

Other main positives are increases in both the diluted grade and metallurgical recoveries.

The life of mine (LOM) diluted grade increased 23% from 714 g/t AgEq in the PEA mine plan to 879 g/t AgEq in the Feasibility Study.

Such a grade increase is not only impressive but also quite rare for deposits of this type. Typically, in underground mining [as you move into feasibility], you’ll see a slight decrease in average grade as more stringent dilution factors are applied with infill drilling smoothing out the higher grade areas.

Thus, the sharp 23% grade increase at Las Chispas is a testament to the particularly high-grade mineralization of the main Babicanora Zone coupled with the overall exceptional nature of the deposit.

The study produced solid improvements in metallurgy as well. Gold recoveries increased to 97.6% from 94.4% with silver recoveries increasing to 94.3% from 89.9% as compared to the PEA.

To sum up the 2021 Feasibility Study, the numbers are as good or better than what was produced in the PEA, which is a nice surprise and indicative of the significant grade increase.

The end result is an increase in LOM annual production from 9.6 million oz AgEq to 12.35 million oz AgEq.

The increased grade also allows SilverCrest to improve upon the life of mine AISC (All-in Sustaining Cost) to $7.07/oz AgEq from the PEA estimate of $7.57/oz AgEq.

And remember, silver is currently trading at almost 4X that level above $27 per ounce and appears on track to move even higher over the coming quarters.

Overall, the improvements from the PEA to the FS are considerable and place Las Chispas firmly in the lowest quartile for silver production costs.

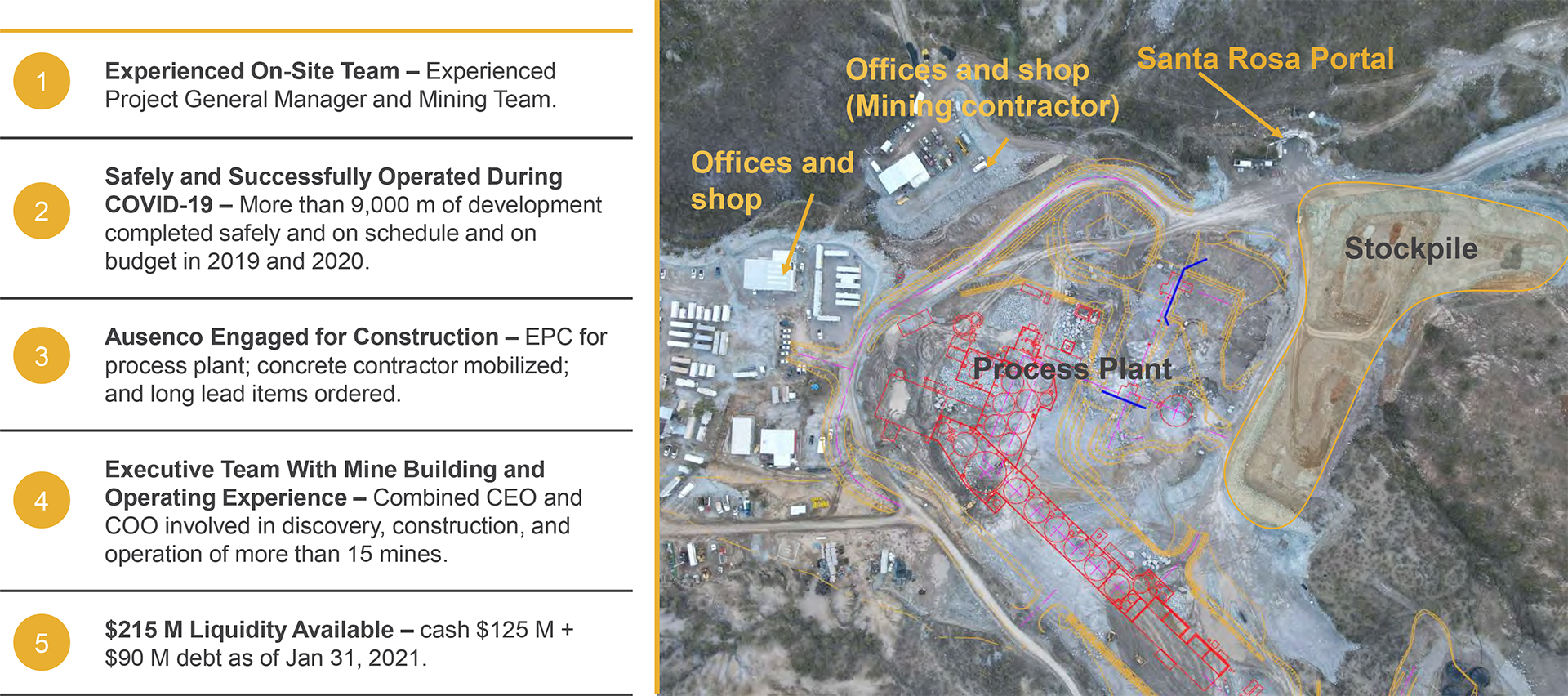

SilverCrest has announced its decision to build the Las Chispas mine – which is fully financed and permitted – with production slated to commence in Q2 2022.

Ready to Build

That’s pretty fast and, again, is a testament to the SilverCrest team which has a history of coming in on-time and under budget throughout the project’s timeline.

The primary remaining upside at Las Chispas lies in resource expansion drilling wherein SilverCrest has been able to hit on approximately 70% of its drill holes to-date via a finding-cost-per-ounce of just C$0.70 AgEq.

Hence, the prospects of SilverCrest increasing reserves through further exploration of the primary vein structures – as well as exploration of numerous undrilled vein structures – on the property remains high.

That also means the odds are very good that, ultimately, the mine life is extended with average production volumes increasing as the mine is developed.

The company is also highly committed to minimizing the environmental impact of the Las Chispas project with an unwavering focus on sound ESG policy with the finalization of its ESG Strategy Framework and with an ESG governance structure being established.

Environmental Focus

For speculators, the production decision moves SilverCrest out of the precarious “development stage” into the more predictable “pre-production” stage where share prices of companies with excellent projects like Las Chispas oftentimes double in share value.

Nevertheless, that could take some time for SilverCrest since traders started pricing in a production scenario for Las Chispas some time ago.

Yet, a substantial rise in share value could very well develop assuming we’re able to get silver prices back on a sustained upward trajectory to above $30 an ounce coupled with additional high-grade intercepts from 2021 drilling at Las Chispas.

Thus far, 45 veins have been identified with only 21 having had sufficient drilling to support at least an Inferred Mineral Resource estimate — and, thus, only those initial 21 are included in the current Feasibility Study.

The company intends to target Mineral Resource additions from those remaining veins while evaluating the significant potential to identify additional veins through continued surface exploration and drilling programs.

Surface exploration and initial drill-testing has identified an additional ~30 km of potential vein strike length to explore with the Mineral Resource currently representing approximately 18 km of vein strike length.

Several of the priority exploration opportunities announced for 2021 are within, or close to, the proposed footprint of the underground development. Hence, with successful exploration and potential Mineral Reserve conversion, these opportunities could allow for optimization of LOM, LOM grade, and ramp-up profiles.

Importantly, SilverCrest is well-funded to accomplish its near-term goals with the closing of a US$138 million bought deal financing with the bulk of those funds to be allocated toward:

- Expansion of the Las Chispas resources and reserves through drilling

-

Optimization of the mine and processing plant design

-

Exploration of regional targets

SilverCrest Metals: Proven Leadership

Remember, when it comes to astute resource stock speculation, Rick Rule says to focus on “serially successful” people and on deposits that have the ability to become large-scale operations.

“The serially successful people win again and again and again!” — Rick Rule

Led by N. Eric Fier, SilverCrest Metals is run by a highly successful team of industry professionals.

And, the company’s Las Chispas Silver-Gold Project – the 3rd highest-grade primary silver deposit in the world – has the potential to be a bona fide game changer.

BUILDING ON A TRACK RECORD OF SUCCESS

Experienced Team With A Proven Track Record

- N. Eric Fier, CEO – Built six mines and discovered over 1B ounces of Silver

- Pierre Beaudoin, COO – Designed and built Canada’s largest gold mine

|

Impressive “Base Case” Potential Economics (Feb 2021 Feasibility Study)

- Post-tax NPV of US$486 million with a post-tax IRR of 52% and a one-year payback (8.5 year mine life) at a 1,250 tonne per day throughput

- Feasibility Study includes only 21 of 45 veins and excludes potential to depth and newly acquired El Picacho

|

Strong Balance Sheet / Modest Capital Requirements Remain

- Cash and available debt of US$215 million as of 31 January 2021

- Potential for low capital intensity

|

Drilling Leverage

- 8 drill rigs turning – 20 km of untested strike length, 40% of drill hits above 350 gpt AgEq

- 552 intercepts over 1,000 gpt AgEq 143 over 5,000 gpt AgEq. 63 over 10,000 gpt AgEq

|

Efficient Use of Shareholder Capital

- ~ US$10 of EV created for every US$1 invested. US$138M spent as of Oct 30, 2020

- Finding cost per AgEq oz ~ US$0.70

|

Progressing Towards a Re-Rate

- Aggressive drill program ongoing, major permits in hand, strong social license, modest capital needs

- Growing high-grade Ag-Au stockpile on surface

|

|

SilverCrest Metals is headed by CEO, N. Eric Fier — a Certified Professional Geologist and Engineer with over 30 years of experience in the international mining industry including exploration, acquisition, development, and production of numerous mining projects in Mexico, Central America, Chile, Brazil and Peru.

N. Eric Fier

CEO & Director

30+ years experience,

Geological & Mining Engineer

Eric has in-depth knowledge of project evaluation and management, reserve estimation and economic analysis, construction, as well as operations management. Mr. Fier previously worked as Chief Geologist with Pegasus Gold, Senior Engineer & Manager with Newmont Mining, and Project Manager with Eldorado Gold.

Prior to the formation of SilverCrest Metals, Eric was a co-founder and COO of SilverCrest Mines Inc., which was acquired by First Majestic Silver in 2015. He was largely responsible for the successful implementation of a systematic and responsible “phased approach” business model that built the Santa Elena project into a successful and profitable mine.

Pierre Beaudoin

Chief Operating Officer

30+ years experience,

Operating & Project

Development and

Mineral Processing

Pierre Beaudoin, COO — is a mineral processing professional with over 30 years of international operating and project development experience. Prior to joining SilverCrest Metals, Mr. Beaudoin held the position of Senior VP of Capital Projects with Detour Gold where he led the design and construction of the Detour Lake Mine.

Prior to that experience, Pierre spent 16 years with Barrick Gold where he held management positions at the processing plants of Barrick operations in Canada and Western Australia and led study teams in Tanzania, Alaska, and Chile.

Recent Las Chispas Drilling

In January 2021, SilverCrest released assays for more than 100 infill holes from the Babicanora target — producing the following highlights:

- 2.4 metres at 38.06 grams per tonne gold (g/t Au) and 4,213.8 grams per tonne silver (g/t Ag), or 7,068 grams per tonne silver equivalent (g/t AgEq);

- 2.0 metres, 96.53 g/t Au and 2,898.9 g/t Ag, or 10,139 g/t AgEq;

- 0.4 metres 90.57 g/t Au and 75.4 g/t Ag, or 6,868 g/t AgEq; and

- 1.8 metres, 72.22 g/t Au and 160.8 g/t Ag, or 5,577 g/t AgEq

SilverCrest CEO, N. Eric Fier, commented:

“These Babicanora in-fill drill results show that we generally 'moved ounces around within a confined area' for these previously defined four veins, resulting in less continuous mineralized footprints but with higher grades, which is typical of late-stage exploration drilling. The reduced mineralized footprint in the Babi FW Vein will have minimal impact on total district mineralization. With the benefit of greater drilling density and understanding of lithologic and structural controls, we now have a higher confidence in our ability to identify additional high-grade mineralization for all veins in the Las Chispas district. The feasibility resource estimation will include 21 veins (5 veins containing a majority of the high-grade mineralization) of the known 45 veins. The best opportunities for resource expansion for the upcoming Feasibility Study are the Babi Vista Vein and Babi Vista Splay Vein, which were both discovered after the PEA release. We look forward to the announcement of the Las Chispas Feasibility Study later this month, which will include a Resource update and our maiden Reserve Estimate.”

As noted, SilverCrest currently has 8 rigs spinning at Las Chispas with the aim of expanding zones on the more recently discovered veins, which means the potential exists for additional resource expansion by way of the drill bit.

All in all, the veins have been determined to be a bit narrower on average than what was assumed in the previously announced PEA… yet, the average grade has come in 23% higher in the Feasibility Study — which essentially evens things out.

In Summary

Remember, in an incipient precious metals bull market, Rick Rule is fond of saying…

Gold moves first… Silver moves second but moves the furthest!

We went looking for The New Standard in Silver — and SilverCrest Metals certainly checks all of the pertinent boxes.

With cash and available debt of US$215 million [at 31 January 2021] and 135.3 million shares outstanding on a fully-diluted basis, SilverCrest Metals is well-positioned to advance its Las Chispas Project in 2021 and beyond to the benefit of SIL / SILV shareholders.

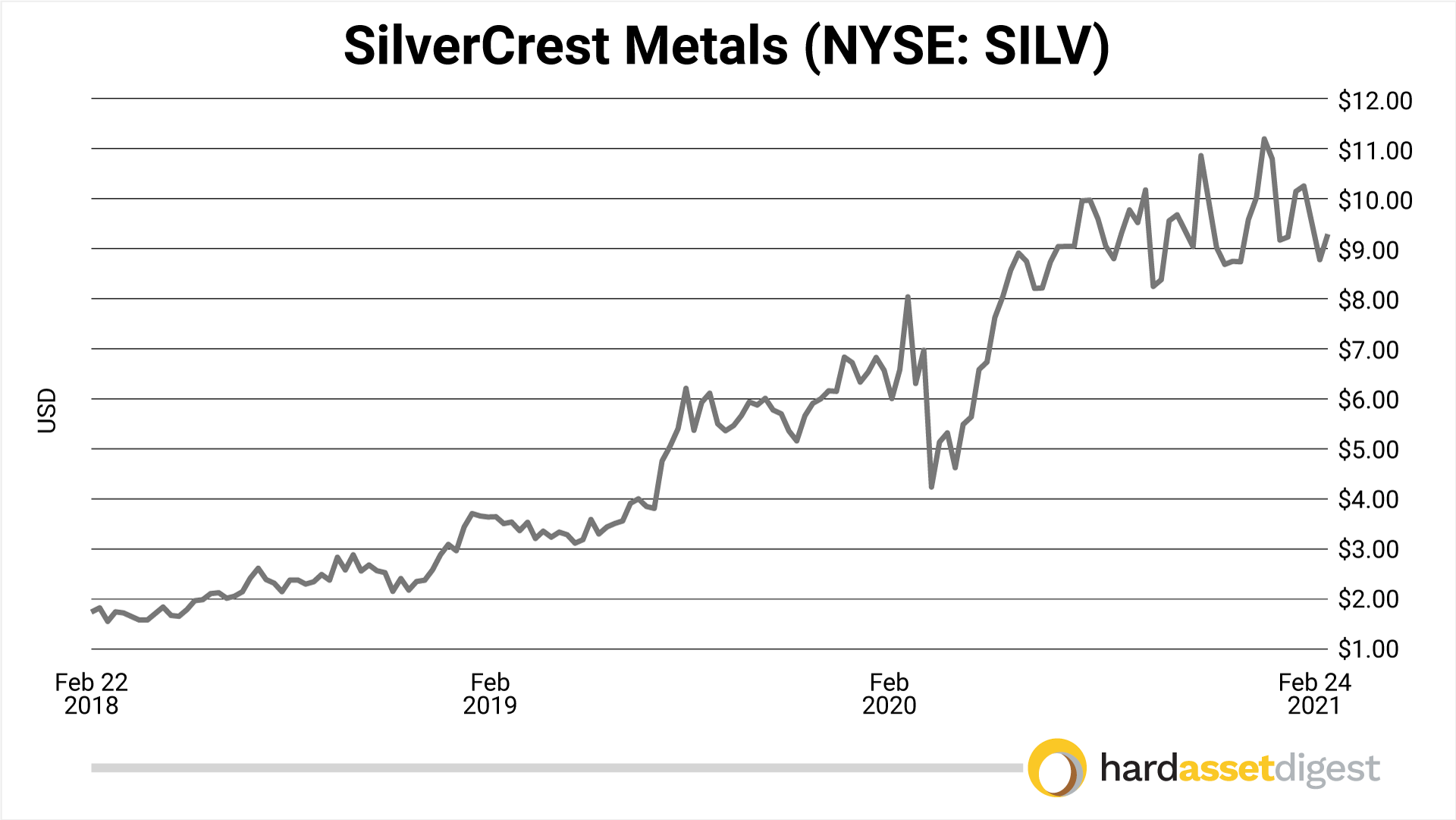

The company’s management team – led by N. Eric Fier and Pierre Beaudoin – has a proven record of delivering value to shareholders as demonstrated by the company’s 3-year price-chart below.

Rick Rule says…

Don't pay attention to the small mine narrative...

Small mines make small money but have big risks!

The company’s newly released Feasibility Study outlines an average production profile of 12.4 million oz AgEq over the seven full years of mine life (with years 2022 and 2030 as "partial years of production" due to ramp-up and ounces produced at the end of the mine life).

Average annual production over the full LOM is 10.0 million oz AgEq.

And as mentioned, the project is considered the 3rd highest-grade primary silver deposit on the planet… not to mention the fact that the current resource estimation includes just 21 of the known 45 veins.

Translation: SilverCrest’s Las Chispas Project offers resource stock speculators size, scale, and grade.

Naturally, there are numerous risks and potential pitfalls inherent in the resource stock arena, and SilverCrest Metals is not immune to such risks; always conduct your own due diligence.

Naturally, there are numerous risks and potential pitfalls inherent in the resource stock arena, and SilverCrest Metals is not immune to such risks; always conduct your own due diligence.

To learn more about SilverCrest Metals (NYSE-American: SILV)(TSX: SIL) be sure to: