Mike Fagan's Precious Portfolio: Special Alert No. 12: Tier-2 Portfolio Addition

Alert No. 12

March 2, 2021

Special Alert: Tier-2 Portfolio Addition

Dear Precious Portfolio subscriber,

In today’s alert, we’re announcing a new portfolio addition for Tier-2 (Mid-Tiers) — B2Gold Corp.

B2Gold offers speculators exposure to gold via 3 producing mines and several gold exploration projects around the world.

Precious Portfolio Alert #12:

Tier-2: B2Gold Corp. (NYSE-Amer: BTG)(TSX: BTO)

Tier-2: B2Gold Corp. (NYSE-Amer: BTG)(TSX: BTO)

Headquartered in Vancouver, British Columbia — B2Gold Corporation is a low-cost international gold producer with three operating gold mines [Mali, Namibia, and the Philippines] and numerous development and exploration projects in various countries including Colombia, Finland, and Uzbekistan.

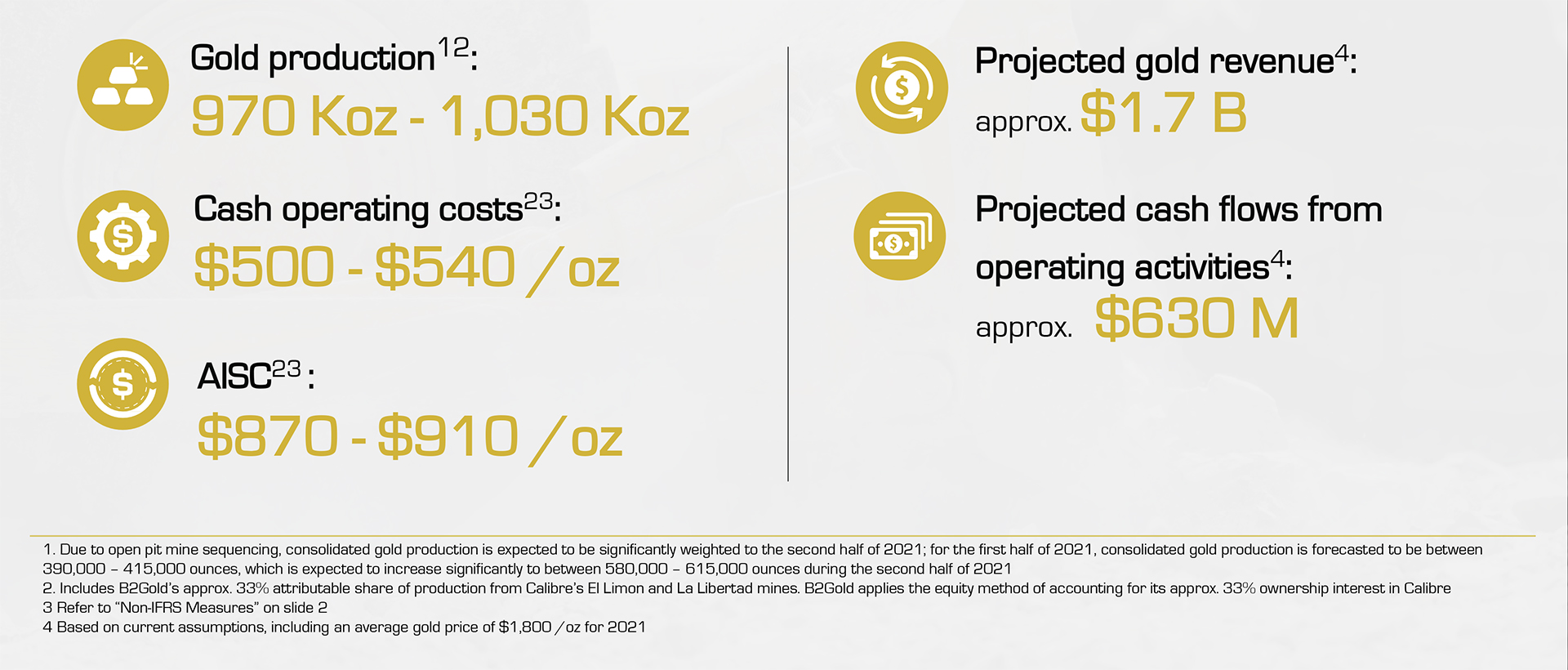

The company produces about 1 million gold ounces per year at All-in Sustaining Cost (AISC) of US$870 - US$910 per ounce. Projected gold production revenues and cash flows from operating activities for 2021 are C$1.7B and C$630M, respectively.

Mine & Project Locations

The company is led by Clive Johnson who previously led Bema Gold’s transition from a junior exploration company to an international intermediate gold producer.

Clive T. Johnson

President & CEO, B2Gold

Through his stewardship and that of his highly experienced team, B2Gold has done a tremendous job navigating the COVID-19 crisis throughout its global operations as evidenced by a strong full-year 2020 performance, which produced:

- Record annual total gold production of 1,040,737 ounces

-

Record annual consolidated gold production from the company's three operating mines of 995,258 ounces

-

Record annual consolidated gold revenues of C$1.79 billion

-

Record annual consolidated cash flow provided by operating activities of C$951 million

-

Total consolidated cash operating costs of US$423 per ounce produced and total consolidated AISC of US$788 per ounce sold

-

Net income of C$672 million; net income attributable to shareholders of C$628 million (C$0.60 per share); adjusted net income attributable to shareholders of C$515 million (C$0.49 per share)

B2Gold forecasts 2021 production to be between 970,000 and 1,030,000 gold ounces.

The company’s biggest mine is the Fekola Gold Mine in Mali which produced a record 622,518 gold ounces in 2020 at AISC of $599/oz.

Between the commencement of operations in September 2017 and the end of last year, the Fekola Mine produced 1.6 million ounces of gold.

B2Gold recently expanded its mill capacity at Fekola by 1.5 million tonnes to 7.5 million tonnes production capacity per annum.

Approximately 20 km north of Fekola, the company is advancing the Anaconda Area through drilling and expects to have an updated Mineral Resource out shortly.

B2Gold sees potential for a multi-million ounce discovery at Anaconda. And the close proximity to Fekola means eventual ore from Anaconda could potentially be trucked down to Fekola for processing.

The company’s Masbate Gold Mine in the Philippines achieved a strong year in 2020 — producing 204,699 ounces of gold at AISC of $985/oz.

And the company’s Otjikoto Gold Mine in Namibia delivered in 2020 as well — producing 168,041 ounces of gold at AISC of $920/oz.

Additionally, B2Gold is partnered [50/50] with AngloGold Ashanti on the Gramalote Gold Project, Colombia, where a Definitive Feasibility Study is due in short order with B2Gold as operator.

In regard to Gramalote, the company sees the potential to add yet another low-cost gold producer to its portfolio that could come in somewhere in the neighborhood of 400,000 ounces of gold production per year and that could be fully funded through cash flow.

B2Gold is also updating its current Feasibility Study for its Kiaka Gold Project in Burkina Faso, which is a 4 million ounce potential open pit gold mine.

Not surprisingly, management wishes to avoid any scenario where it is constructing two major mines concurrently. Thus, Kiaka is a project wherein the company could potentially bring in a partner or perhaps even put the asset up for sale.

Probable Mineral Reserves

| Country |

Mine |

Tonnes (t) |

Gold Grade (g/t Au) |

Contained Gold Ounces (oz) |

| Mali |

Fekola |

59,500,000 |

2.22 |

4,250,000 |

| The Philippines |

Masbate |

83,200,000 |

0.83 |

2,210,000 |

| Namibia |

Otjikoto |

17,500,000 |

1.70 |

960,000 |

Total Probable Mineral Reserves (includes Stockpiles) –

100% Project Basis |

7,420,000 |

|

Indicated Mineral Resources

| Country |

Mine or Project |

Tonnes (t) |

Gold Grade (g/t Au) |

Contained Gold Ounces (oz) |

| Mali |

Fekola |

110,600,000 |

1.70 |

6,050,000 |

| The Philippines |

Masbate |

121,900,000 |

0.86 |

3,370,000 |

| Namibia |

Otjikoto |

39,200,000 |

1.16 |

1,460,000 |

| Burkina Faso |

Kiaka |

138,500,000 |

0.95 |

4,250,000 |

| Colombia |

Gramalote |

78,200,000 |

0.85 |

2,140,000 |

Total Indicated Mineral Resources (includes Stockpiles) –

100% Project Basis |

17,27,000 |

|

Inferred Mineral Resources

| Country |

Mine or Project |

Tonnes (t) |

Gold Grade (g/t Au) |

Contained Gold Ounces (oz) |

| Mali |

Fekola

Anaconda |

7,000,000

21,600,000 |

1.23

1.11 |

280,000

770,000 |

| The Philippines |

Masbate |

19,800,000 |

0.91 |

580,000 |

| Namibia |

Otjikoto |

4,500,000 |

2.55 |

370,000 |

| Burkina Faso |

Kiaka

Toega |

28,400,000

17,500,000 |

0.99

2.01 |

900,000

1,130,000 |

| Colombia |

Gramalote |

129,200,000 |

0.68 |

2,830,000 |

| Total Inferred Mineral Resources — 100% Project Basis |

6,860,000 |

|

For 2021, B2Gold plans to allocate about C$65 million toward exploration/drilling; approx. 60% for brownfields exploration primarily focused around Fekola/Anaconda in Mali and eleshere around the world, with the other 40% geared toward greenfields exploration particularly in Uzbekistan, Japan, Finland, and Africa and where opportunities arise.

In November 2020, B2Gold increased its quarterly cash dividend to $0.04 per share [$0.16 per share on an annualized basis] — making it one of the highest paying dividends in the entire sector.

B2Gold offers significant upside potential as a near and long-term growth story through low-cost gold production and future discovery; I’m currently averaging down the cost basis of my BTG share position, which I initially established around US$6.50 per share.

Coincidentally, I’m presently doing the same for my position in Barrick Gold.

2021 Consolidated Guidance

B2Gold is well-funded with cash and cash equivalents, at 31 December 2020, of C$480 million.

Additionally, the company has repaid in-full its outstanding Revolving Credit Facility (RCF) balance of C$425 million with the full amount of the C$600 million RCF now undrawn and available.

B2Gold has approximately 1 billion shares outstanding for a current market cap of approximately US$4.6 billion.

And, as is the case for virtually all publicly-traded gold producers, the company’s shares have been negatively impacted by the temporary pullback in the gold price from US$1,950 per ounce in November 2020 to currently around US$1,735 per ounce.

We see this as a buying opportunity in B2Gold. And, as discussed in detail in your monthly issues of Hard Asset Digest, a rebound in the gold price could begin to materialize as soon as this month.

Current price: US$4.52 per BTG share: Buy up to US$4.57

Establish your B2Gold (NYSE-Amer: BTG)(TSX: BTO) position incrementally and look for opportunities to buy additional shares on any intermittent weakness. Learn more about B2Gold Corporation at www.b2gold.com.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 | Alert No. 6 | Alert No. 7 | Alert No. 8 | Alert No. 9 | Alert No. 10 | Alert No. 11