Mike Fagan's Precious Portfolio: Special Alert No. 11: Tier-3 Portfolio Addition

Alert No. 11

February 16, 2021

Special Alert: Tier-3 Portfolio Addition

Dear Precious Portfolio subscriber,

In today’s alert, we’re announcing a new portfolio addition from Tier-3 (Juniors) — American Pacific Mining.

The company offers speculators exposure to gold, silver, and copper via multiple joint venture agreements on exploration-stage mineral projects within the US.

Precious Portfolio Alert #11:

Tier-3: American Pacific Mining Corp. (OTC: USGDF)(CSE: USGD)

Tier-3: American Pacific Mining Corp. (OTC: USGDF)(CSE: USGD)

American Pacific Mining is a junior gold exploration company focused on precious and base metals opportunities within the Western United States.

The company is led by president, Eric Saderholm, a highly experienced Professional Senior Geologist and former exploration manager for the Western United States with industry leader Newmont Mining (NYSE: NEM).

Eric has worked on numerous large-scale mines and projects including Bingham Canyon, Carlin, Midas, Gold Quarry, Twin Creeks, Lonetree, Mule Canyon, Black Pine, Genesis, and Yanacocha — a true testament to his wealth of experience in advancing mineral projects from the early exploration phase all the way through to production.

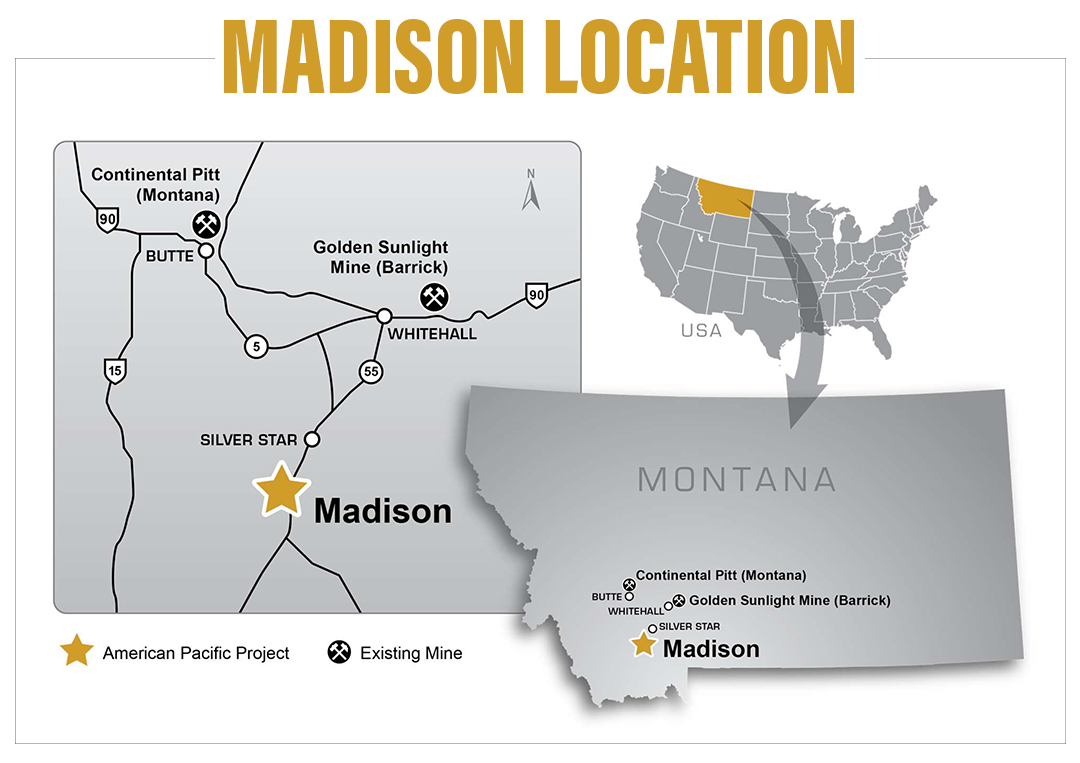

The company’s flagship is the 2,514-acre Madison Copper-Gold Project in Montana which is being advanced by way of a joint venture agreement with Rio Tinto/Kennecott.

Rio Tinto/Kennecott can attain a 70% interest in the Madison project upon spending $30 million on exploration — giving American Pacific the remaining 30%.

American Pacific CEO Warwick Smith, commented: “We believe that ultimately owning 30% of a Rio Tinto size project would be a huge win for USGD shareholders and having a free carried interest frees up our capital to advance our other high potential Nevada gold assets.”

As referenced above, America Pacific is also advancing three early-stage, high-grade precious metals projects in Nevada, USA — Gooseberry Gold-Silver Project, Tuscarora Gold Project, South Lida Gold Project.

Gooseberry Gold-Silver Project: American Pacific has entered into a joint venture agreement with private company GRAC on the past-producing Gooseberry project near Reno, Nevada, where a 12-hole drill program is slated to commence in Q2 2021.

Mineralization at Gooseberry is gold-silver bearing quartz-calcite vein structures characterized as low-sulfidation epithermal-style mineralization. Next steps will include surface sampling and drilling of parallel vein targets.

GRAC can earn an 80% interest in Gooseberry through a combination of cash and share payments plus $4.5 million in project expenditures and the completion of a feasibility study.

Tuscarora Gold Project: Located 50 km northwest of Elko, Nevada – The Tuscarora project is 100%-owned by American Pacific Mining subject to an earn-in by Soldera Mining.

Mineralization at Tuscarora is gold dominant quartz-adularia and stockwork vein structures characterized as low-sulfidation epithermal-style mineralization.

Soldera can earn a 51% interest in Tuscarora through a combination of cash and share payments totaling $200,000 plus $1.35 million in project expenditures over the next two years.

Both Nevadan properties are considered early-stage exploration projects in proven mining districts.

The Flagship: Madison Copper-Gold Project

The Madison Copper-Gold Project (JV with Rio Tinto/Kennecott) is located in the heart of Montana’s prolific copper-gold belt approximately 38 km southeast of the world-renowned Butte Mining District.

Madison is a past-producing high-grade mine [2008 - 2012] which boasts historic production of approximately 2.7 million pounds of copper with grades ranging from ~20% to over 35% copper and 7,570 ounces of gold at 16.1 grams per ton (g/t).

| Hole_ID |

Thickness (m) |

Au_g/t |

Cu% |

| UG17-05 |

30.18 |

24.497 |

0.39 |

| UG17-06 |

10.97 |

41.65 |

0.38 |

| UG17-06 including |

4.60 |

82.87 |

Not significant |

| 86-6 |

7.31 |

25.75 |

Not significant |

| C05-06 |

14.69 |

12.10 |

Not significant |

| C05-06 |

61.63 |

Not significant |

6.97 |

| C05-06 including |

8.47 |

Not significant |

40.03 |

| C06-08 |

84.70 |

Not significant |

1.89 |

| C06-08 |

2.70 |

41.73 |

19.58 |

The project is analogous to the Butte mine which churned out 21 billion pounds of copper, 2.9 million ounces of gold, 715 million ounces of silver plus significant zinc, lead, and manganese while it was in production between 1955 and 1982.

Last month, American Pacific reported assays from the first 2 of 7 holes drilled at Madison, in 2020, by its JV partner with both holes intersecting significant mineralization.

Hole #17 hit 43.7 meters of 1.76 g/t gold — including 1.5 meters of 19.5 g/t gold. That new intersection served to extend mineralization at Madison down-dip by 60 meters.

Hole #22 intersected 15.5 meters of 0.96% copper and 11.5 meters of 1.1% copper — creating yet another extension of the mineralization; this time to the west by 30 meters.

The remaining 5 holes are currently at the assay lab, which means speculators could receive some potentially significant news flow – particularly if the solid grades & widths hold up – over the coming few weeks.

American Pacifc Mining president, Eric Saderholm, commented via press release:

“The interval in MADN0017 contained strongly anomalous gold values with several higher-grade intercepts including 1.5 metres of 19.50 grams/ton, 6.17 metres at 7.36 grams/ton and 18.28 metres at 3.69 grams/ton with lower grade intervals in between. This indicates multiple mineralized structures in this portion of the system and that is a good thing. This drill hole intercept is approximately 60 meters from the known high-grade mineralization. The 15.45-metre interval of 0.96% copper in drill hole MADN0022 is also an impressive run and most importantly broadens the mineralization 30 meters to the west. This apparent flattening and broadening may be due to stratigraphic controls that remain untested and open along strike.”

An earlier 2020 hole returned 43.6 meters of 1.7 g/t gold; including 15.4 meters of 0.96% copper; and including 1.7 meters of 69.4 g/t gold and 23.7 meters of 2.2% copper.

Altogether, the consistency of high-grade mineralization suggests the drill program American Pacific’s partners completed last year is expanding the mineralized footprint at Madison — which, in turn, should translate to numerous high-priority targets for 2021 drilling.

American Pacific’s model of maintaining a vested interest in multiple high-potential mineral projects – primarily on other companies’ dimes – is akin to having a lottery ticket in your pocket with multiple chances to win built right into it.

And paraphrasing American Pacific Mining CEO, Warwick Smith — it’s not a bad thing having a 30% interest in a Rio Tinto-size property with them footing the bill to the tune of tens of millions of dollars to advance the project!

And with assays from 5 additional holes from Madison due in just a few weeks, if not sooner — speculators won’t have to wait long for the news flow to begin heating up.

| Corporate Structure |

| American Pacific Mining Corp. (OTC: USGDF)(CSE: USGD) |

| Common Shares |

65,489,626 |

| Stock Options |

2,850,000 |

| Warrants |

32,227,111 |

| Fully Diluted |

100,566,737 |

| Cash Position |

$1.5M

*~$6.1M in warrants at $0.20 |

| Monthly Burn Rate |

$100k |

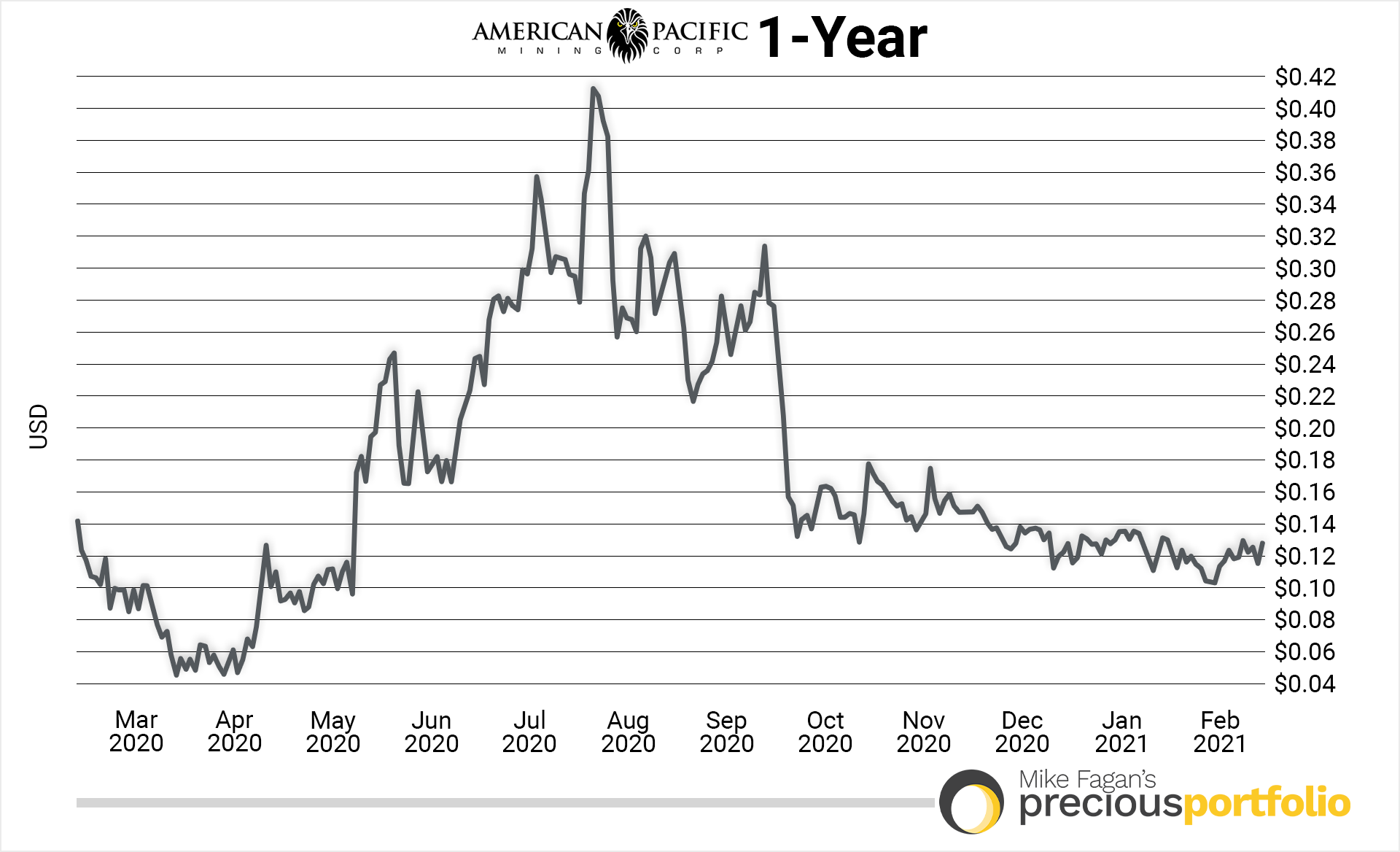

American Pacific Mining has approximately 65.5 million shares outstanding for a current market cap of around US$8.5 million.

Current price: US$0.13 per USGDF share: Buy up to US$0.15

Establish your American Pacific Mining (OTC: USGDF)(CSE: USGD) position incrementally and look for opportunities to buy additional shares on any intermittent weakness. Learn more about American Pacific Mining at www.AmericanPacific.ca.

Yours In Profits,

Mike Fagan

Editor, Precious Portfolio

Mike Fagan has mining in his blood. As a teenager he staked countless gold and silver properties in Nevada alongside his dad Brian Fagan, who created the Prospect Generator model that’s still widely used today in the resource space. One of those staking projects was put into production by a major Canadian mining company — a truly rare and profitable experience. That background uniquely qualifies him as a mining stock speculator. One of the most well-known names in the business, Mike is now putting that experience to use for the benefit of Resource Stock Digest, Hard Asset Digest, and Mike Fagan's Precious Portfolio readers.

Previous Alerts

Alert No. 1 | Alert No. 2 | Alert No. 3 | Alert No. 4 | Alert No. 5 |

Alert No. 6 | Alert No. 7 | Alert No. 8 | Alert No. 9 | Alert No. 10