March 2021 Foundational Profits

March 2021 Issue

by Nick Hodge

» Macro Musings & SPACeships

» Buy/Sell Recap

» Existing Portfolio & Gold Buys

» Sunrun Recommendation Report

Another round of stimulus is on the way. An infrastructure bill will follow that.

Trillions and trillions have been spent. It will never be paid back.

One of the main financial arguments of our day is if that matters.

Do debts and deficits matter? Or can governments borrow infinitely without worry?

The ferocity with which the stock market recovered from its Covid infection made many think the latter.

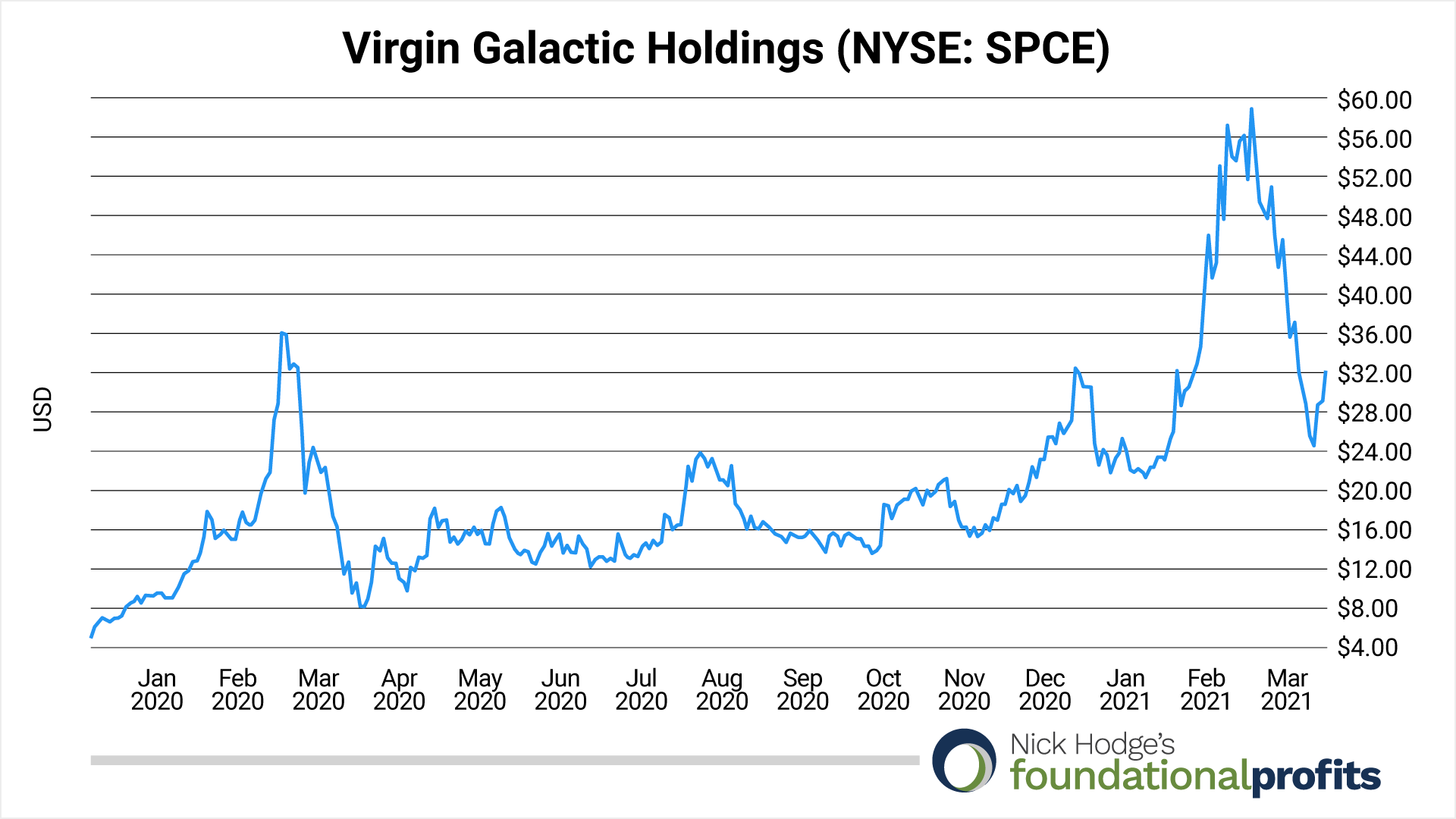

It has been a rocket ship higher since the March 2020 selloff we’ll never forget. A Virgin Galactic SPACeship, if you will.

But, alas, even financially engineered rocket ships can’t propel indefinitely higher.

When Virgin Galactic (NYSE: SPCE) went public in 2019 via one of Chamath Palihapitiya’s SPACs, the company was forecasting $31 million in revenue for 2020 and $210 million for 2021.

Shares of Virgin Galactic have ripped from a low of $6.90 in 2019 when it went public to $62.80 this year. That’s over 800% in about 18 months. At its peak this year it had a market cap approaching $15 billion. Pretty good for a company that doesn’t generate revenues, let alone profits.

But Virgin Galactic did “not generate significant revenue” at all in 2020 executives admitted in February as shares proceeded to lose more than 60% of their value.

Is Mr. Palihapitiya hurting? Hardly.

He jumped off the SPACeship on the way down, unloading his entire personal stake — 6.2 million shares — for $213 million, at around $34 per share.

The dream of going to space is only a dream if you don’t sell.

And if you bought the line that some company was going to start offering space rides this year, well, you probably believe other silly stories as well… like the government doesn’t have to pay its debts or that there is no inflation.

Be like Chamath. Sell stock to the story believers.

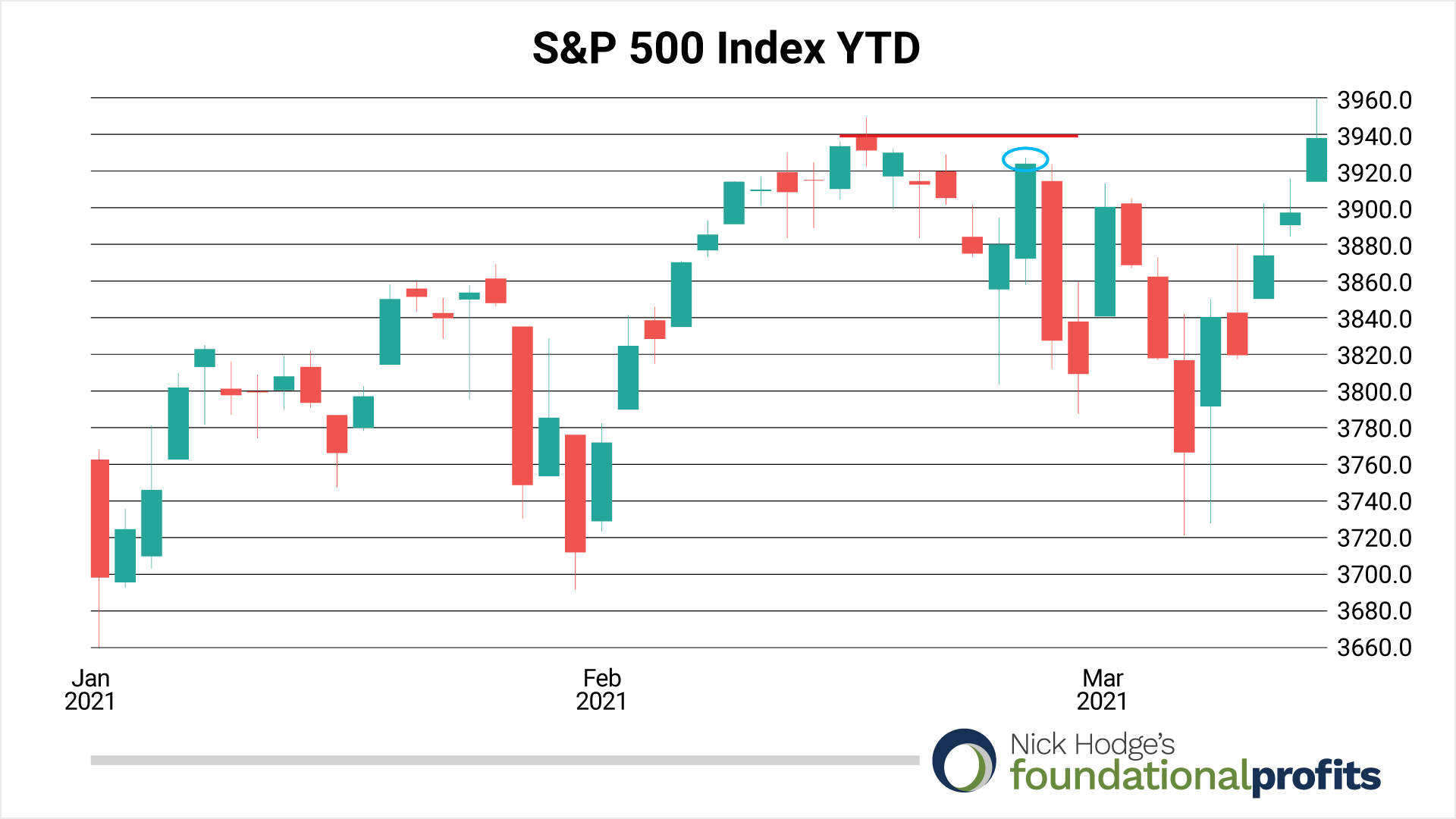

You’ll have noticed that I issued several sell recommendations over the past month. This is no coincidence as the S&P 500 has now put in its first lower high of this bull cycle.

It’s prudent to prune here like I did with the blackberries this past weekend.

It was a month full of actions to maximize macro gains. So a recap is in order to get us all on the same page and to understand why we did what we did.

Over the past month I’ve recommended:

- Selling half your Ivanhoe Mines (TSX: IVN)(OTC: IVPAF) above C$6.65. We have now done that as the stock ran to over C$8.00 on the back of copper breaking out to decade highs. That put over 280% in the bank and left us with half a position that now has a negative cost basis. Now you can forget about it so your grandkids one day realize that they have a bunch of shares in some of the world’s largest copper-PGM mines.

- Selling IBM (NYSE: IBM) above US$122. That was a tiny loss, less than 2%. I got nervous on tech and rightly so. The NASDAQ entered true correction territory over the past month. I know IBM trades on the NYSE, but I thought it was a baby and bathwater situation. No regrets.

- Selling Energy Select SPDR (NYSE: XLE) for 40% gains in four months. We bought it late last year ahead of coming energy inflation that has now materialized. Oil is up nearly 100% over the past year — after going negative last year! — and gas prices are now creeping up. We harnessed that inflation beautifully and now don’t have to be upset about paying more at the pump.

- Selling half your MP Materials (NYSE: MP) above US$40.00 for up to 185%+ profits in less than six months. Similar to copper and oil, rare earth prices are inflating. They also have a lovely story about electric vehicles and China to go with them. Now you can say you invested in the cleantech future and still have half your position in a vital rare earth mine with a negative cost basis.

Existing Portfolio

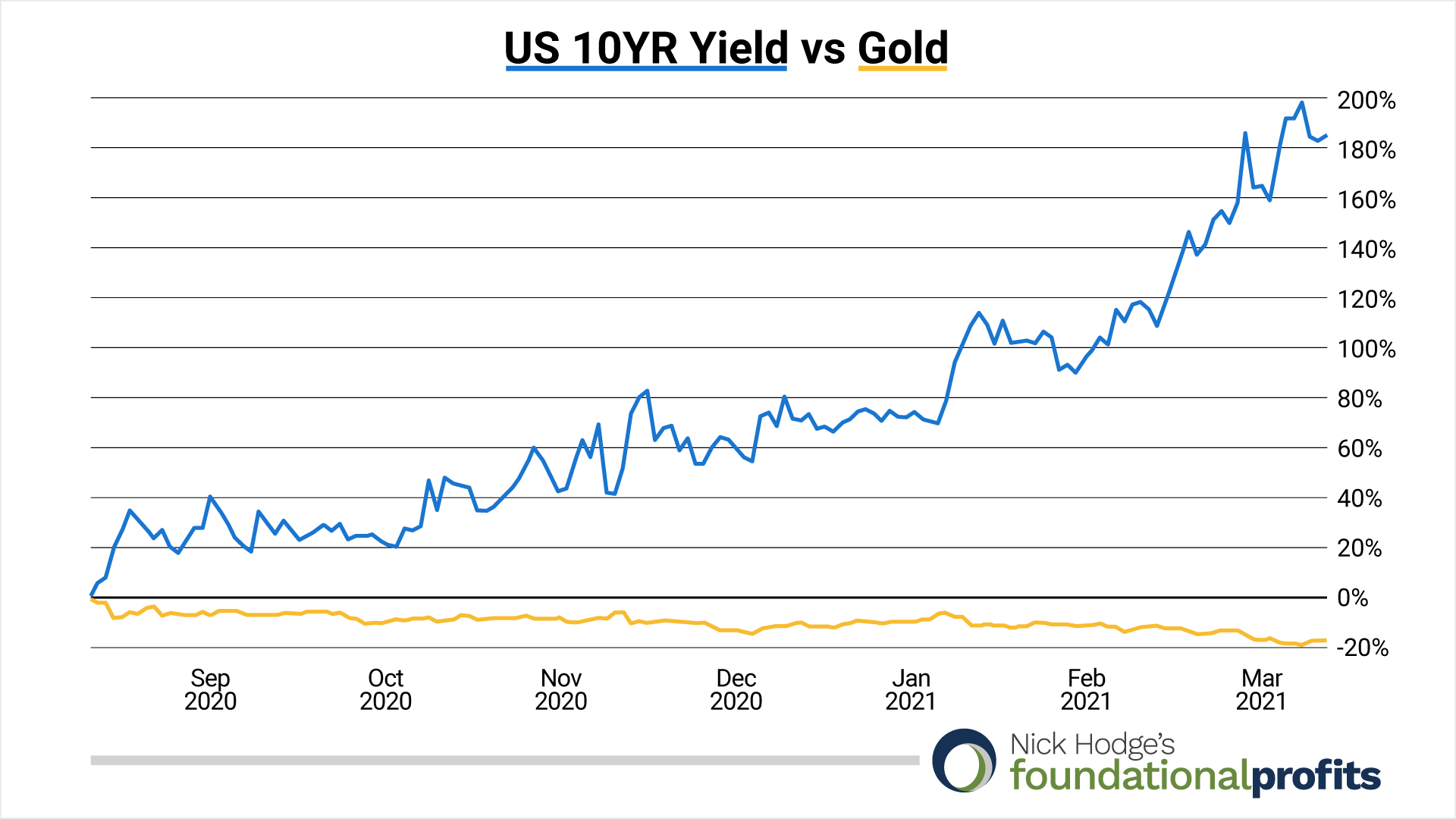

Gold is still unloved as interest rates continue higher. The gold price has lost ~18% since it peaked last summer as the yield on the 10-year bond has climbed more than 180% to over 1.5%.

And while it’s too early to tell just yet how much longer rates can inflate… I’ll be keeping a watchful eye — and some dry powder — to capitalize on whatever the next cycle is. Gold is trying to find footing at the $1,700 mark. The market has sold off gold stocks along with the gold price, creating an opportunity to peck away at quality names, which I’ve been doing.

While $1,700 doesn’t have the same ring as $2,000, producers are nonetheless very profitable at that price. And buyouts will come as they deploy that cash. Newmont made a move on GT Gold earlier this month, for example.

Alamos Gold (NYSE: AGI)(TSX: AGI) is a buy under US$10.00. I bought more recently near US$7.00. The company recently announced record earnings from operations of US$227.6 million for 2020, compared to US$126.0 million in 2019. That was on record revenues of US$748.1 million from 424,325 ounces sold. All-in costs were US$1,046 per ounce. The company raised its dividend by 67% over the past two quarters and now pays US$0.10 per share, or ~1.4%. That’s as good as a US bond! Plus, Alamos plans to produce even more gold this year — up to 510,000 ounces — and is both an acquirer and a potential takeout target.

Artemis Gold (TSX-V: ARTG) has been below it’s buy under of C$5.50 for most of the past month. It has submitted for an expedited environmental permitting process for the Blackwater project given the detailed work that went into the environmental assessment, which was approved by the federal and B.C. governments in 2019. Ore grade control drilling, metallurgical test work, geotechnical drilling, a B.C. Hydro study, and work to advance the guaranteed maximum price (GMP) contracts construction are all underway — with a definitive feasibility study due out in mid-2021 and the start of major construction in Q2 2022. The project has an after-tax net present value (NPV) of C$2.2 billion while it trades with a market cap of C$657 million. And that NPV is based on US$1,541 gold. It is a buy under C$5.50.

Franco Nevada (NYSE: FNV) is a buy under US$130.00. Now is looking like a decent time to scale back in. The “record” theme continues, with the company delivering record annual results for 2020 that included revenue of US$1.02 billion an adjusted net income of US$516.3 million. The company has no debt and is sitting on US$1.9 billion in cash. It also raised its dividend for the 14th year in a row, and will now pay US$0.30 per share quarterly starting in June.

Hecla (NYSE: HL) is a buy under US$6.00. It had record 2020 sales of $691.9 million. Silver production for the year was 13.5 million ounces and gold production was 208,962 ounces at all-in costs of US$11.89 and US$1,302, respectively. It will widen its lead as the largest silver producer in the U.S. as it grows to 15 million ounces by 2023.

Midas Gold has changed its name to Perpetua Resources (TSX: PPTA)(NASDAQ: PPTA). Please also note the new ticker symbols. The share consolidation for the NASDAQ uplisting now complete, we are buying Midas… er, Perpetua below C$10.00. I don’t think it stays below that price for long if it gets its permit. That seems to be on the way sooner than later given the recent news of the company being allowed to start clean-up operations at the site as well as a three-month stay recently being placed on a related lawsuit. That three months lines up awfully close with when we’re expecting the draft record of decision. I have been buying more.

Wrap-Up

You should notice we’ve been lightening up a bit. Now at 16 positions in the portfolio, but a few of them — MAG, IVN, MP — are half positions.

This is intentional as stocks, commodities, and gold approach inflection points. I want to have cash and open slots to buy things once I see which sort of cycle develops next.

One sector we are starting to build a position in is cleantech and virtual power plants.

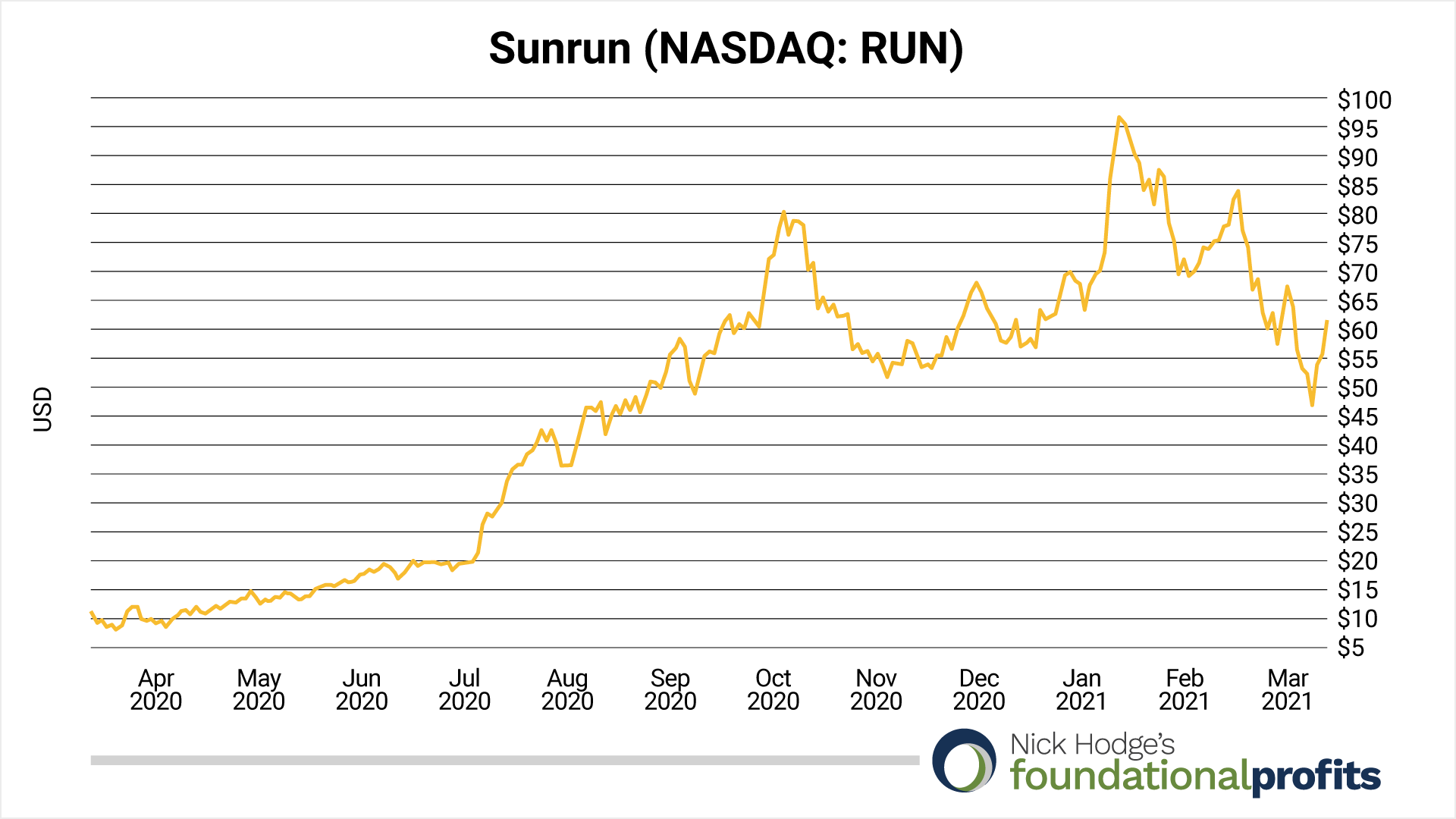

I recommended you buy Sunrun (NASDAQ: RUN) last week below US$58.00. You had the opportunity to do that as low as $47.00 last week when the NASDAQ was selling off, which I used as an entry point.

Below is your full recommendation report on Sunrun, as promised.

Sunrun Recommendation Report

Rolling blackouts have been growing more common.

In California last year, a heat wave caused power plants to unexpectedly shut down at the same time demand was surging from air conditioners.

State regulators had to force blackouts because of the imbalance. Those regulators then started sending desperate emails.

But they didn’t send them to a wind farm or a coal plant. Instead, they sent emails pleading for help to the owners of energy storage systems (batteries) at homes and businesses across the state.

And the owners of those energy storage systems responded. More than 30,000 of them united to help balance the grid during the crisis by proving as much power as a midsize natural gas plant.

This uniting of batteries to balance the grid is the way of the future. It’s a virtual power plant.

In this example — but there have been numerous examples of large scale blackouts from Texas to Oregon — the California Solar and Storage association called upon its members to discharge batteries they managed for customers.

These solar and battery system owners saved the day, providing 310 megawatts to the grid and having a total 510 megawatts available — enough to entirely offset the natural gas plant that went offline because of the heatwave.

One of the member-companies that manages those batteries in California is called Sunrun (NASDAQ: RUN).

The Amazon of Energy

Sunrun is the largest residential solar company in the country. It also installs batteries that can store the solar electricity and discharge it later. The system is called Brightbox.

Sunrun’s model is to market, sell, install and manage rooftop solar and battery storage systems. The “manage” part is important, because that’s where virtual power plants come in.

The company was formed in 2007 and has over 8,500 employees. It has over 550,000 customers in 22 states, DC, and Puerto Rico.

Sunrun has the industry’s leading customer acquisition platform, customer experience capabilities, and extensive financing experience — all of which drive significant barriers to entry and high incremental returns.

In 2020, it had year-over-year customer growth of 18% and had networked solar energy capacity of 3,885 megawatts.

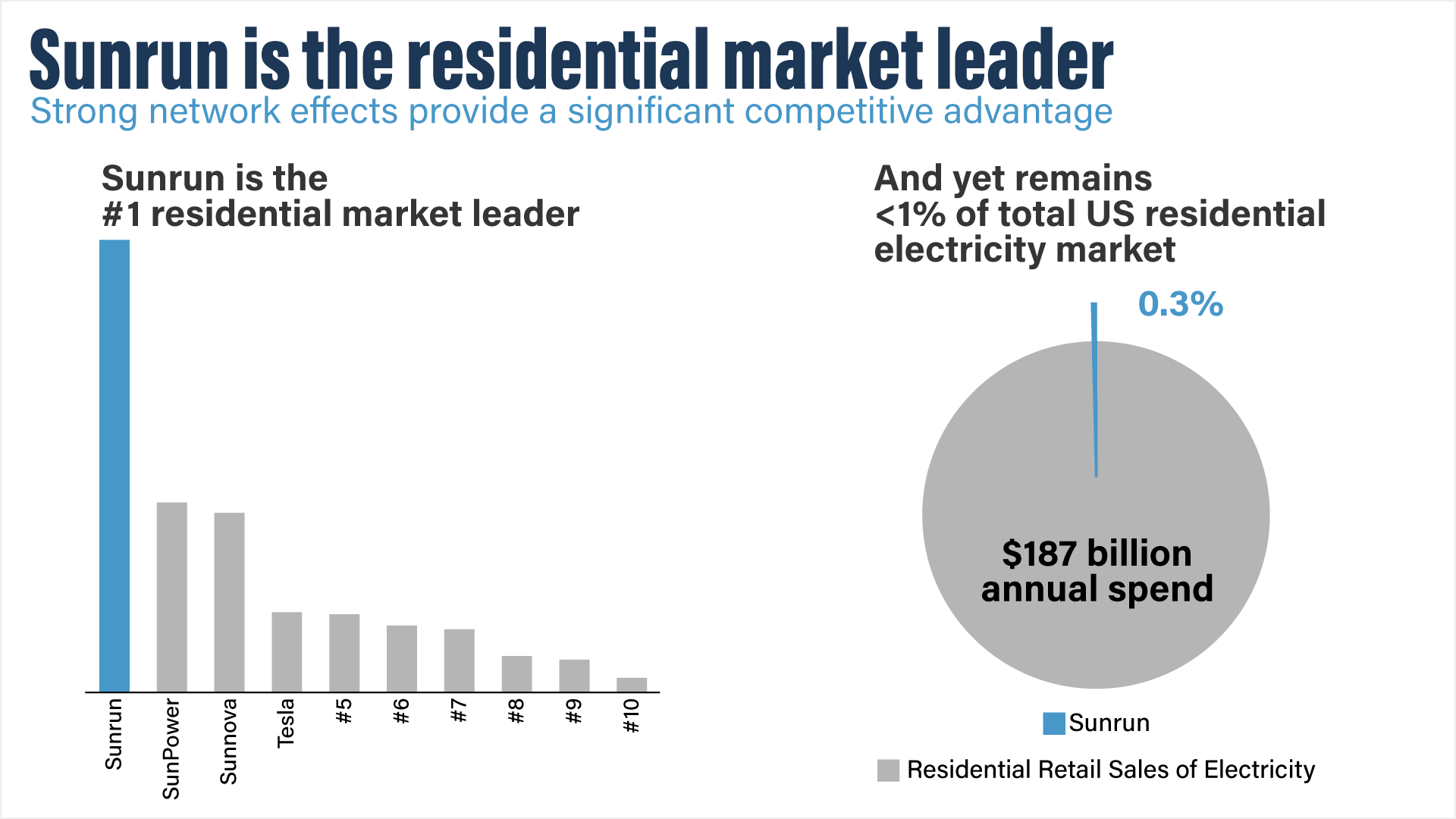

It is by far the U.S. residential solar market leader, with more than twice as many megawatts deployed as its nearest competitors, according to Wood Mackenzie research.

And it’s leveraging its leadership status in solar to also sell its customers batteries, and link it all together with virtual power plants to displace traditional utilities.

Virtual Power Plants

Decentralized and distributed is the way of the future.

Much like cryptocurrencies are decentralized currencies tracked on a distributed ledger…

The future of energy will be millions of decentralized power plants (homes, cars, etc.) distributed via a smart grid.

And Sunrun is leading the way here, too.

It has established virtual power plants and grid service programs in markets with over seven million potential customers.

It has provided backup power for thousands and thousands of hours to homes across the country… from New York and New Jersey after Tropical Storm Isaias… to the rolling blackouts from heat waves and wildfires in California.

Here a typical example…

In November 2020, Sunrun signed a virtual power plant agreement with Southern California Edison (SCE), which is one of the largest electric utilities in the country. According to the release of the agreement:

SCE will send signals to Sunrun during high-demand events such as extreme heat waves when the energy grid is strained. In response, Sunrun will dispatch energy from thousands of its Brightbox solar-powered battery systems installed in the SCE territory, providing five megawatts (MW) of energy capacity to help support the overall energy system. The same solar-powered home batteries will also provide reliable backup power to these households if the power goes out.

By bundling the power from these batteries together to create a “virtual power plant”, Sunrun will release stored solar energy to the grid when it’s needed most, lowering the overall cost of power and reducing critical strain on the energy system.

It has virtual power plant agreements with several utilities in several states.

Sunrun generates revenue not only from fixed contract pricing on the electricity from the virtual power plants, but generates recurring revenue for grid services involved in the contract.

Sunrun is offering these services after announcing a partnership in June 2020 with AutoGrid, the market leader in flexibility management software for the energy industry. Under the partnership:

Sunrun will use features of the AutoGrid Flex platform to help manage its fleet of Brightbox rechargeable solar batteries and offer new, innovative grid services and energy management solutions. The cloud-based platform enhances Sunrun’s ability to work with utilities and other electricity providers to optimize and dispatch its storage fleet.

So what’s the future of energy worth?

Sunrun Recommendation & Valuation

Shares of Sunrun (NASDAQ: RUN) have a 52-week range of $7.83 to $100.93. It has a market cap ~$12 billion.

For reference, Amazon has a market cap of $1.55 trillion — or nearly 130X higher. Tesla has a market cap of $650 billion, or more than 50X higher. So that’s the imaginative blue-sky potential.

Sunrun did $922.2 million in 2020 revenue, up 7% from 2019. Over 72% ($668M) of that was recurring revenue.

So the stock is being valued around 13X revenue.

We know from company data that each new customer has a net present value (NPV) of $9,051.

Using this metric, Sunrun is being valued at 2.2X the NPV of its customer base of 550,000.

It has been adding customers at an 18% annual clip. If we assume 20% for 2021, Sunrun will have 650,000+ customers. And applying the same multiple will give you a valuation of ~$12.9 billion. That translates into $65 per share.

At its highs of 2020, it was being valued at 5.5X the NPV of its customer base. Applying that multiple to 2021 estimated customers gets you a $32.3 billion valuation, or $160 per share.

That’s with no blue sky. No upside surprises. And, most importantly, no value given to virtual power plans or their growth.

Sunrun presents a compelling opportunity. It is a buy under US$58.00, and I will adjust that as new information becomes available.

Blue Sky

There are many ways to look at blue sky potential. One way is to compare it to Tesla or Amazon, like I did above.

Here are a few more…

- By 2030, 13% of U.S. detached homes are expected to have solar panels. Using Sunrun’s current market share of ~16%... it would have 1.6 million customers by then. Using the same 5.5X multiple would put shares over $390, or 550% higher than they are today.

- The market cap of the top 20 electric utilities in the United States is over $500 billion, or $25 billion each. Every one Sunrun displaces represents a 100% increase in share price.Displacing all utilities puts it 41X higher.

Reality is likely somewhere in the middle of those two scenarios. But either one of them point to much higher share prices for Sunrun than we see today.

Call it like you see it,

Nick Hodge

Nick Hodge

Editor, Foundational Profits

Here is the current portfolio:

Open Positions

| Large Cap Sector Selections and Funds |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| AdvisorShares Pure US Cannabis ETF |

MSOS |

NYSE |

$34.00 |

| Altria Group Inc. |

MO |

NYSE |

$40.00 |

| Sunrun |

RUN |

NASDAQ |

$58.00 |

| Metals & Minerals |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| Alamos Gold |

AGI |

NYSE |

$10.00 |

| Artemis Gold |

ARTG |

TSXV |

C$5.50 |

| Cameco Corporation |

CCJ |

NYSE |

$11.00 |

| Franco-Nevada Corp. |

FNV |

NYSE |

$130.00 |

| GoldMining Inc. |

GOLD |

TSX |

C$2.50 |

| Hecla Mining |

HL |

NYSE |

$6.00 |

| Ivanhoe Mines |

IVN |

TSX |

C$3.75 |

| MAG Silver Corp. |

MAG |

NYSE |

$11.00 |

| Perpetua Resources |

PPTA |

TSX |

C$10.00 |

| MP Materials |

MP |

NYSE |

$13.00 |

| Rio Tinto |

RIO |

NYSE |

$52.00 |

| Sibanye Stillwater |

SBSW |

NYSE |

$8.50 |

| Uranium Energy Corp. |

UEC |

NYSE |

$1.63 |

Make sure you never miss an update or issue from Nick Hodge's Foundational Profits by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here.

Nick Hodge's Foundational Profits, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Nick Hodge's Foundational Profits does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.