April 2021 Foundational Profits

April 2021 Issue

by Nick Hodge

» Overview of Macroland

» Cannabis 2.0

» Kings of the Drip

» Portfolio News

» Wrap-Up

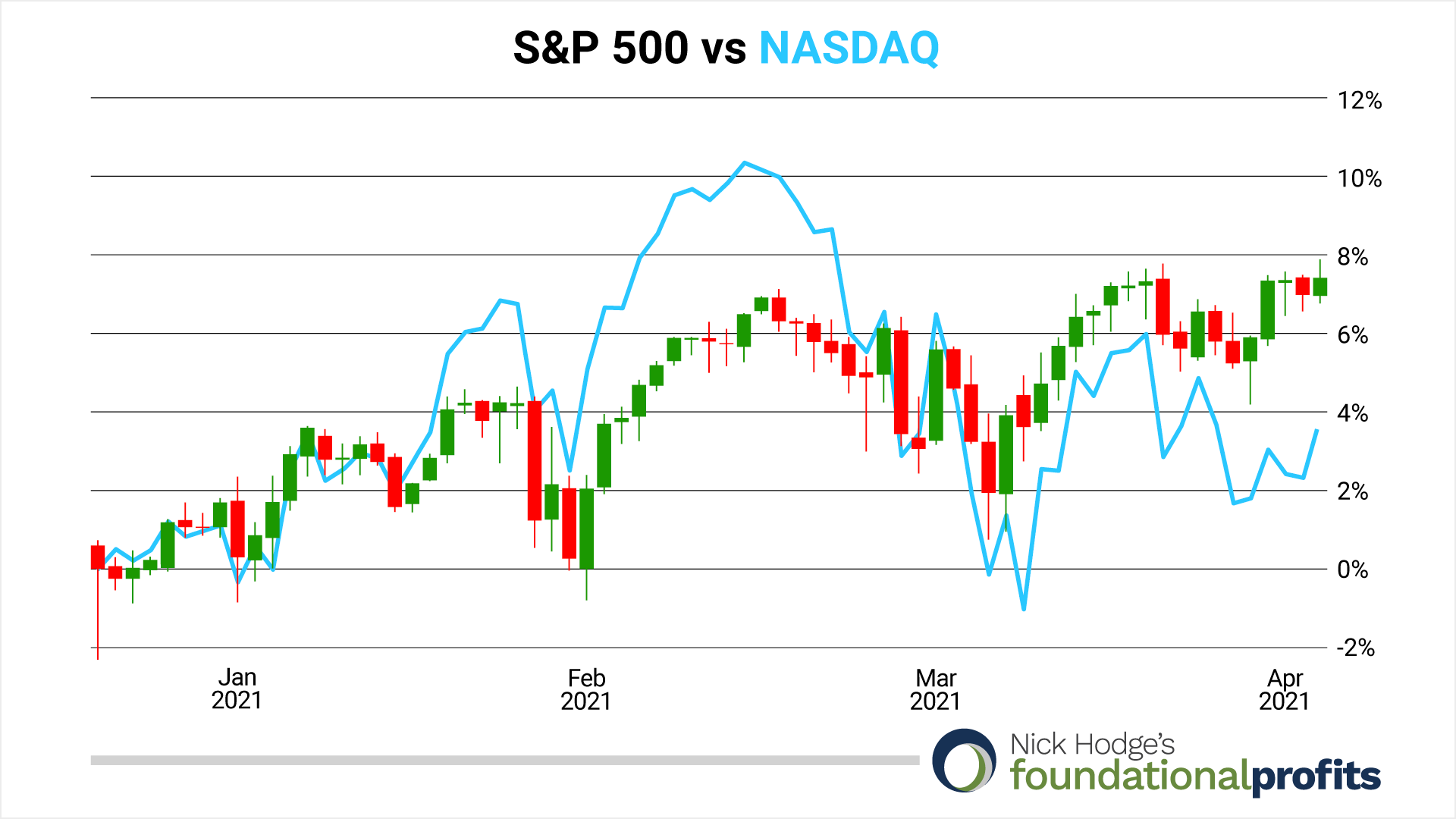

Stocks have gone back to record highs after March came in like a lion, but tech is no longer the darling.

The S&P 500 finished the first quarter up 6.5% while the NASDAQ diverged, up “just” 2.5%.

It was energy that outperformed in Q1 2021. That happened to be the one S&P sector we owned — via the SPDR Energy Select Fund (NYSE: XLE) — entering in late Q4 2020 and exiting in March for a 39% win.

For the record, here is the performance of each of the 11 S&P sectors at the end of Q1:

| Sector |

YTD Performance |

| Energy |

30.5% |

| Financials |

16.3% |

| Industrials |

11.3% |

| Materials |

9.1% |

| Real Estate |

8.9% |

| Communication Services |

7.35% |

| Health Care |

2.8% |

| Consumer Discretionary |

1.5% |

| Consumer Staples |

1.1% |

| Utilities |

0.77% |

| Information Technology |

0.1% |

Until the next cycle comes via stagnation or deflation, energy and commodities have been the places to be.

With over a third of American adults now receiving at least one dose of the vaccine, and the northern hemisphere now getting a bit more sun, the “reopening trade” is also on, with select industrial and material names starting to outperform.

Elsewhere in macroland:

- Yields continue to rise. The U.S. 10-Year bond yield is now the highest it’s been since COVID started its worldwide tour, now breaching 1.75%. These rising rates are still keeping gold down. If they get to 2% the Federal Reserve will step in to rein them in, as rates that high make debt payments untenable. That’s what happens when the tab runs in trillion$.

- The dollar is “off its lows”, as they say, with DXY moving nothing but higher all year — so far. It’s in no danger of breaking out into true bullish territory. Just running its mouth, so to speak. If it does break out, we may get that next cycle I mention. The more it breaks out, the more deflationary pressures we’d see. If it mildly breaks out and middles along, you’ll get more stagflation. If it is just running its mouth and shuts up and turns around… inflation persists. You got it?

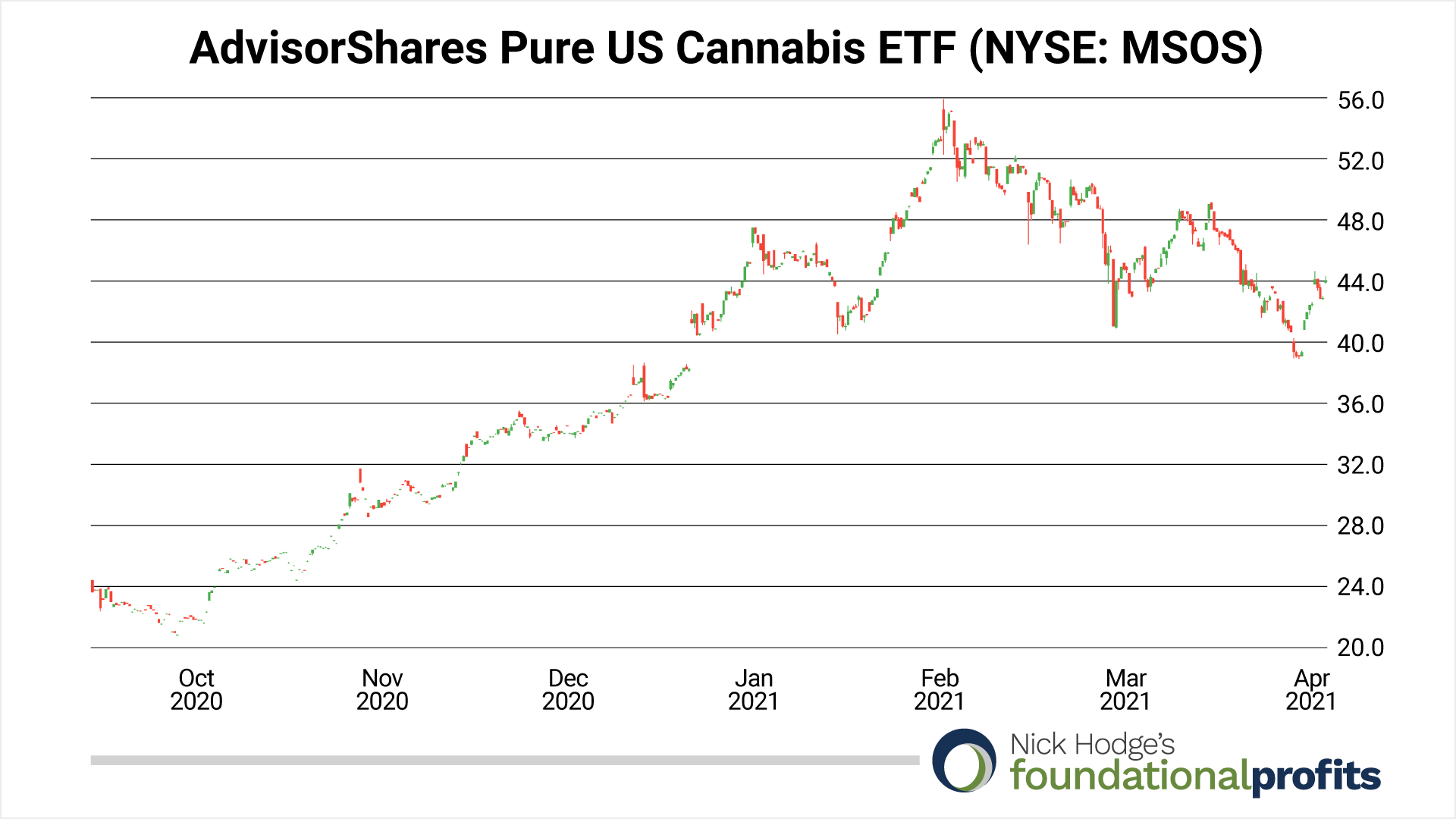

- Cannabis has been weak. Mostly earnings not matching expectations from what I can see. The fundamentals for the sector remain incredibly strong.

- Uranium and other energy metals — now the “green metals”! — are still very interesting.

Cannabis 2.0

The 10 largest cannabis firms in the U.S. are expected to generate US$5.5 billion in sales this year, up from $3.3 billion last year.

Topline revenues are expected to grow at a 50%-100% clip with 30%-40% gross margins for the next few years.

Multi-state operators, or MSOs, are seeing the bulk of the action.

In March 2021, legislation was introduced in Mexico that could make recreational cannabis legal. This comes only months after Mexico issued regulations for medical marijuana. Legalization there, with 130 million citizens, would make it the largest legal recreational market in the world.

The U.S. market, of course, would be at least twice as large. But the ganja is still a no-no in the freest country in the world. But that might not last much longer now that the Mexican domino is falling.

Indeed, the U.S. seems primed to begin legalizing cannabis at the federal level. Key senators have said as much. But more importantly, key industry — and, therefore, lobbying — groups are now giving their blessing, and even advising how it should be rolled out.

The alcohol industry, for example, has now taken its stake in cannabis with Molson Coors, AB InBev, and Constellation each holding significant investments in the space.

The Wine and Spirits Wholesalers of America (WSWA), whose members distribute more than 80% of all wine and spirits sold at wholesale in the U.S., is now advising how the government should roll out legalization. It released a 16-page document called Principles for Federal Oversight of the Adult-Use Cannabis Supply Chain. It covered:

- The Federal Permitting of Cannabis Producers, Importers, Testing Facilities, and Distributors

- The Approval and Regulation of Cannabis Products

- The Efficient and Effective Collection of Federal Excise Tax; and

- Effective Measures to Ensure Public Safety

The Marijuana Revenue and Regulation Act, introduced two years ago by Senator Ron Wyden, has already proposed putting the Alcohol and Tobacco Tax and Trade Bureau in charge of cannabis instead of the Drug Enforcement Agency — a seemingly de facto descheduling.

The bill would allow states to regulate retail licenses and proposes taxing cannabis similar to alcohol — when it leaves the producer or importer, and at a higher rate for THC potency.

Surely the end of national cannabis prohibition is nigh. And even if it doesn’t come under Biden’s watch, the emergence of dominant multi-state operators (MSOs) is already at hand.

And the way we’re investing in this new round of cannabis gains is by owning shares in the ETF with the same ticker: AdvisorShares Pure US Cannabis ETF (NYSE: MSOS).

It’s the only actively managed U.S.-listed ETF dedicated exclusively to U.S. cannabis exposure, giving you access to:

- Growers and cultivators

- Dispensaries

- Real Estate

- Biotech

- Hydronics

- CBD

All in one fund for a 0.87% expense ratio.

At the end of Q1 2021, the fund’s top 10 holdings, comprising nearly 70% of total portfolio weight, were:

- Trulieve Cannabis

- Curaleaf Holdings

- Green Thumb Industries

- Cresco Labs

- Ayr Wellness

- Terrascend

- Innovative Industrial Properties

- Columbia Care

- GrowGeneration

- Jushi Holdings

We began buying the AdvisorShares Pure US Cannabis ETF (NYSE: MSOS) below US$34.00 in December. It’s since been as high as US$56.00, but has now consolidated.

Now is a good time to add to or initiate a position. I am raising the buy-under price to US$44.00.

Kings of the DRIP

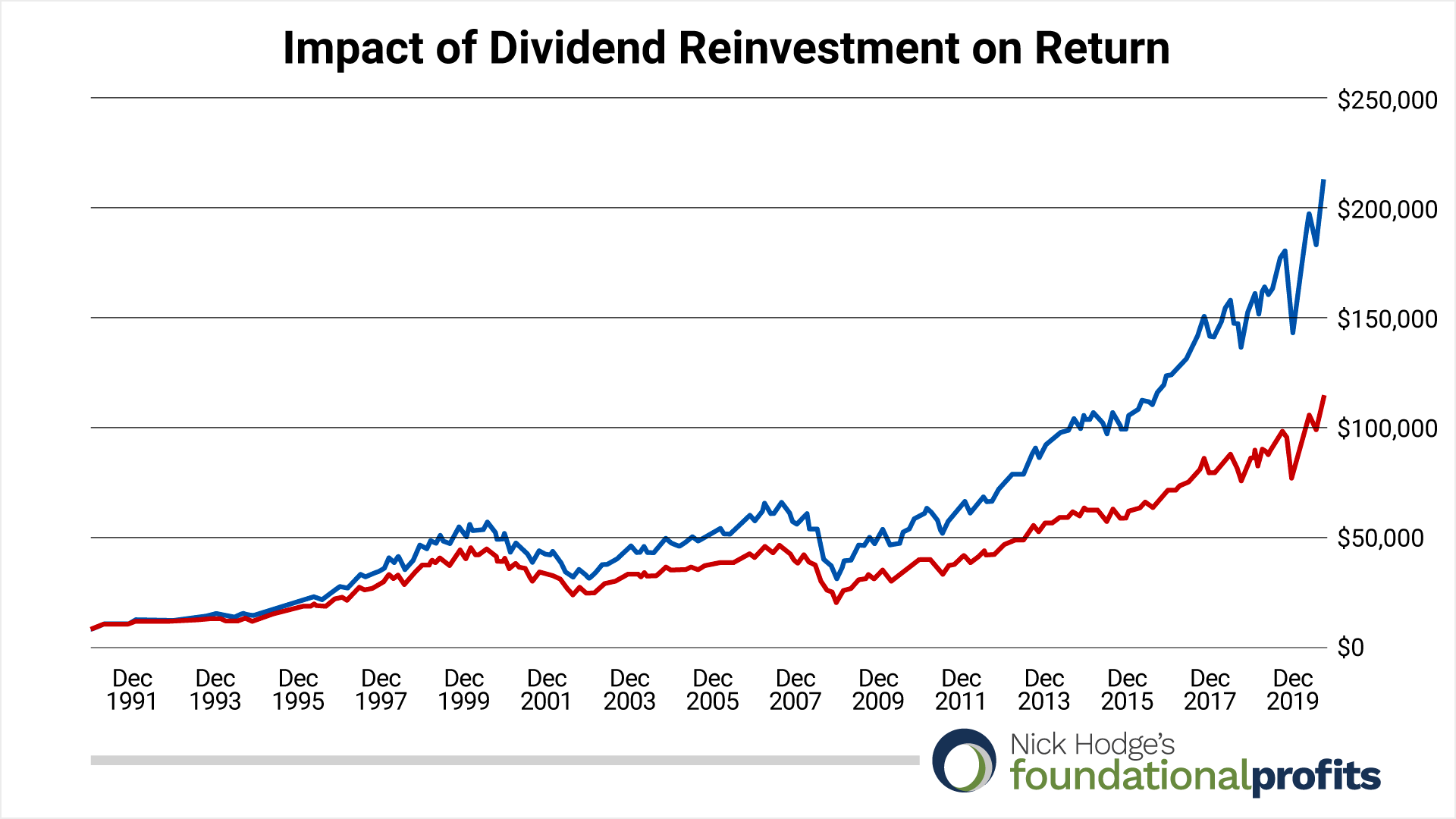

I don’t talk about it often enough but one of the ways for passive investors to supercharge their retirement accounts is through dividend reinvestment plans, or DRIPs.

Growth stories are great but the richest families in history have stayed that way by generating recurring income.

And reinvesting dividends is the best way an investor can do that. According to Schwab:

$10,000 in a hypothetical investment that tracked the S&P 500® Index fund in 1991 would have swelled to more than $211,000 by the end of 2020 had dividends been reinvested, but only to $114,000 had dividends not been reinvested

I always keep a couple of quality dividend stocks in the Foundational Profits portfolio. As of Q2 2021, they are:

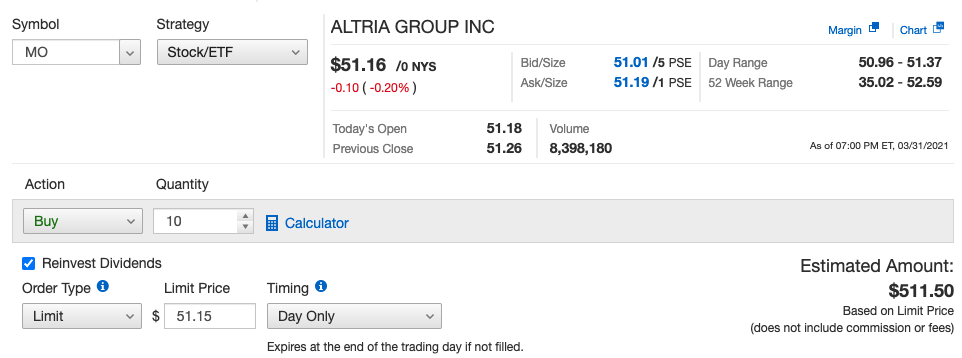

- Altria Group (NYSE: MO), current yield ~6.5%

- Rio Tinto (NYSE: RIO), current yield ~6%

Both of these companies offer their own dividend reinvestment plans, administered by Computershare, which is a transfer agent. Companies sometimes also offer these programs administered entirely in-house.

But buyer beware, as with anything. These programs come with fees.

If you enroll through Altria, for example, the fine print says “Each dividend reinvestment will entail a transaction fee of 5% of the amount reinvested, up to a maximum of $3.00 plus $0.03 per share* purchased.”

Rio Tinto’s says “each time Shares are purchased you will be charged a dealing commission of 0.5% by the Plan Administrator of the value of Shares purchased, subject to a minimum fee of £1.00. You will also have to pay stamp duty reserve tax at the prevailing rate (currently 0.5%) on the value of the Shares purchased.”

There is a better way.

Most online brokerages now offer a free dividend reinvestment program. And because buying stocks is now zero commission at most brokerages as well, setting up your own DRIPs becomes entirely free.

There is usually a box you check indicating that you would like your dividends reinvested.

In this case, you’re buying shares on the secondary market instead of directly from the company. The only time this wouldn't be cheaper is if the company offers a share discount for purchasing through them. So do your own due diligence, as always.

Neither Altria nor Rio Tinto offers such discounts, so setting up your DRIP through a brokerage would be the way to go.

With free dividend reinvestment and companies that are yielding more than three times the U.S. 10-year bond, you’ll be King of the DRIP in no time.

Portfolio News

Sunrun (NASDAQ: RUN), bought in early March 2021, is our newest recommendation. We’re buying it because of the virtual power plants it creates and manages via rooftop solar and battery backup systems. It’s the largest such company in the country. We’re buying it below US$58.00, and it trades just below that price. Goldman Sachs targets shares at US$70.00, saying over the past month that solar demand is now above pre-pandemic levels.

Franco-Nevada (NYSE: FNV) has been a gold leader as well. I told you last month it had dipped below our buy-under price of US$130.00 and it was “looking like a decent time to scale back in.” Since then, it has announced record financial results and raised its dividend. And it’s gone back over our buy-under price. See how that works?

Artemis Gold (TSX-V: ARTG)(OTC: ARTGF) has hired Ausenco to construct the processing facility and infrastructure for its Blackwater gold project in British Columbia. It was done via a guaranteed maximum price (GMP) contract for engineering, procurement, and construction (EPC) of C$236 million. The project has an NPV of C$2.5 billion and IRR of 34.8% at US$1,541 gold. Shares have consolidated — along with the rest of the gold space — just below our buy-under of C$5.50. This will be one of the better performers once gold starts going back up.

GoldMining (TSX: GOLD)(NYSE: GLDG) is below its buy-under price of C$2.50. The company has been very busy. It recently created Gold Royalty Company, and listed it on the New York Stock Exchange while remaining a 49% shareholder. It has a resource inventory of over 30 million ounces of gold equivalent. It has initiated preliminary economic assessments on the La Mina and Yellowknife gold projects. And it is planning two drill programs. This was all covered in a recent shareholder letter. Shares are a buy now as they’re under C$2.50.

Perpetua Resources (TSX: PPTA)(NASDAQ: PPTA) is the last gold company I’ll mention. No news to speak of but shares are down around C$8.00. The new floor for the stock seems to be near C$7.00, and we’re buying under C$10.00. Not going to get a lot of chances to buy the stock this cheap in the future.

Wrap-Up

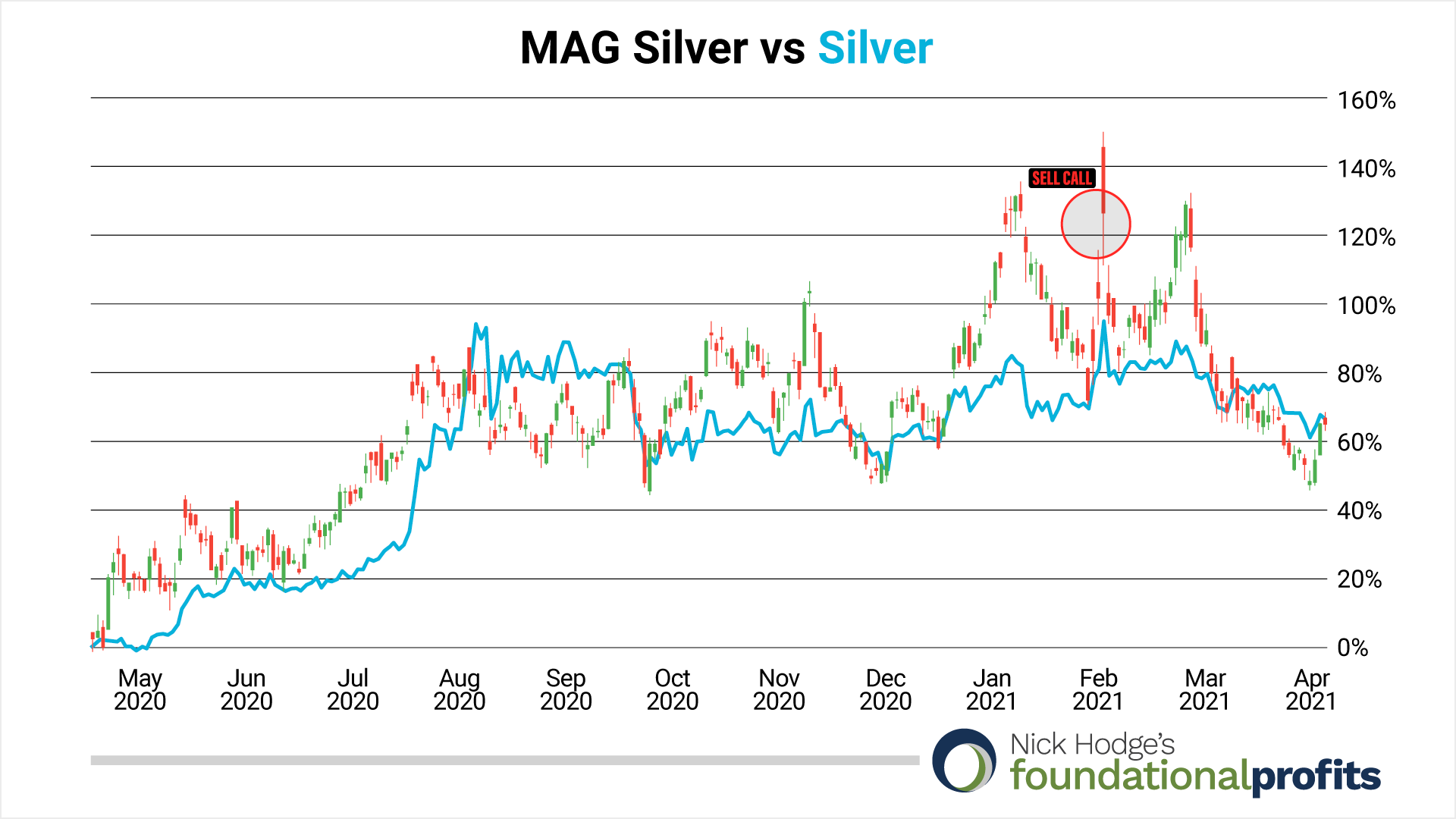

Aren’t you glad we didn’t get caught up in Wall Street Bets and the purported silver squeeze?

While the naive and the true believers thought “this was it” for silver. The moment they had been waiting for. A new Hunt brothers saga…

I told you to sell into it.

Specifically, we sold some MAG Silver (NYSE: MAG) for over 100% gains.

Lookie what MAG and silver have done since then.

What’s that they say about being contrarian or being a victim?

And that brings me to uranium.

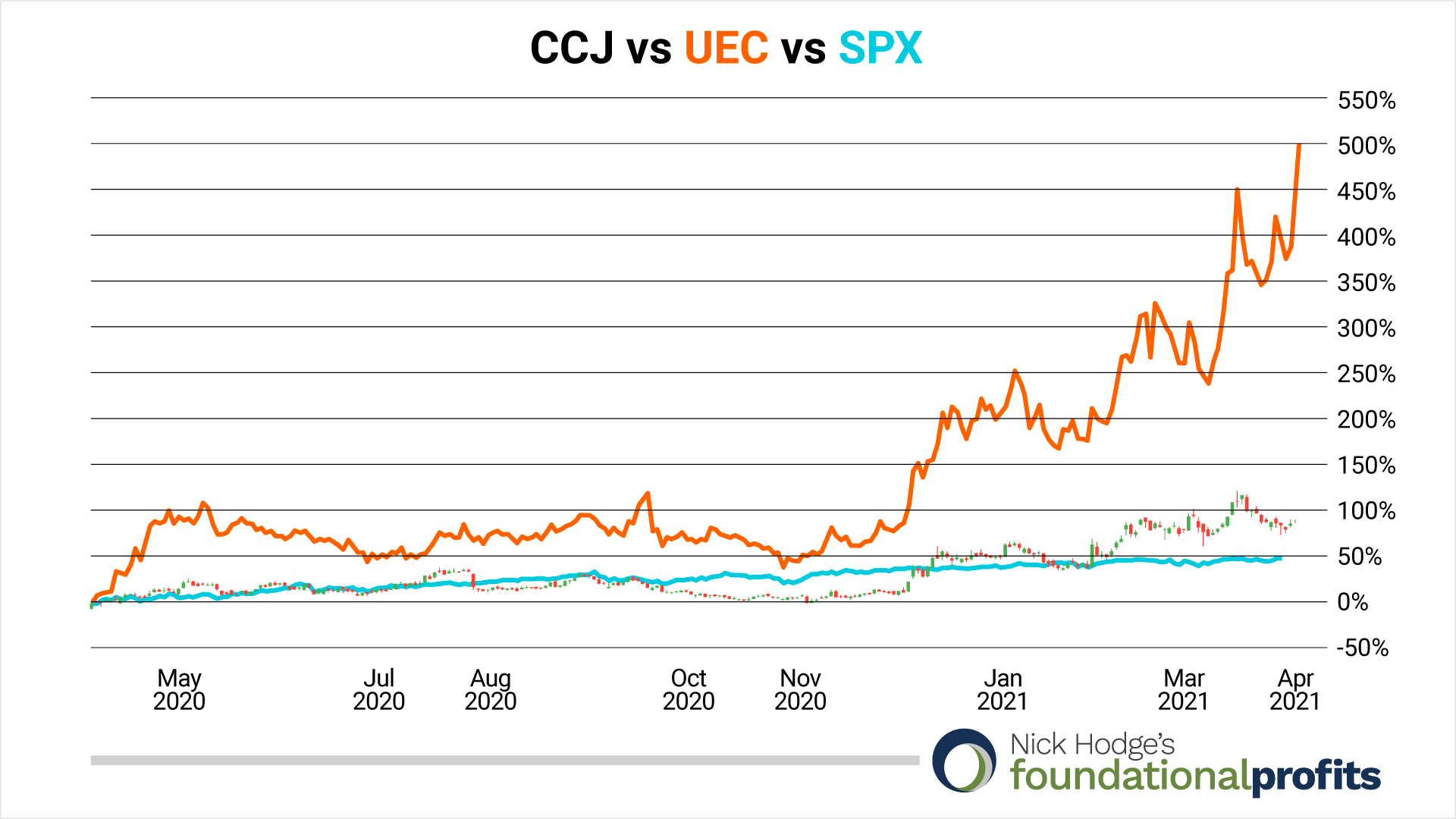

We’ve now doubled our money on both Cameco (NYSE: CCJ)(TSX: CCO) and Uranium Energy Corp. (NYSE: UEC). The sector is getting lots of social media love. Related equities have been inflating along with other energy-related metal stocks like copper, rare earths, and lithium.

The two uranium stocks we own are up 4X to 10X more than the stock market over the past three months. And the stock market is setting records.

However, unlike silver, the trend is still our friend with uranium from both an inflation and policy perspective. We’re staying long and strong for now.

I told you in the February issue to “hang on tight. Uranium rides can be steep.”

Hope you’re enjoying this one.

Call it like you see it,

Nick Hodge

Nick Hodge

Editor, Foundational Profits

Here is the current portfolio:

Open Positions

| Large Cap Sector Selections and Funds |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| AdvisorShares Pure US Cannabis ETF |

MSOS |

NYSE |

$44.00 |

| Altria Group Inc. |

MO |

NYSE |

$40.00 |

| Sunrun |

RUN |

NASDAQ |

$58.00 |

| Metals & Minerals |

|

|

|

| Company |

Symbol |

Exchange |

Buy Limit |

| Alamos Gold |

AGI |

NYSE |

$10.00 |

| Artemis Gold |

ARTG |

TSXV |

C$5.50 |

| Cameco Corporation |

CCJ |

NYSE |

$11.00 |

| Franco-Nevada Corp. |

FNV |

NYSE |

$130.00 |

| GoldMining Inc. |

GOLD |

TSX |

C$2.50 |

| Hecla Mining |

HL |

NYSE |

$6.00 |

| Ivanhoe Mines |

IVN |

TSX |

C$3.75 |

| MAG Silver Corp. |

MAG |

NYSE |

$11.00 |

| Perpetua Resources |

PPTA |

TSX |

C$10.00 |

| MP Materials |

MP |

NYSE |

$13.00 |

| Rio Tinto |

RIO |

NYSE |

$52.00 |

| Sibanye Stillwater |

SBSW |

NYSE |

$8.50 |

| Uranium Energy Corp. |

UEC |

NYSE |

$1.63 |

Make sure you never miss an update or issue from Nick Hodge's Foundational Profits by adding customerservice@digestpub.com to your address book or whitelisting it within your email service provider’s spam settings. For any customer service issues, please contact us. View our Terms & Conditions and Privacy Policy by clicking here. Nick Hodge's Foundational Profits, Copyright © 2021, Digest Publishing. 2051 Gattis School Rd Ste. 540 PMB 176, Round Rock TX 78664. For Customer Service, please email us at customerservice@digestpub.com. All rights reserved. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Digest Publishing, Resource Stock Digest, and Nick Hodge's Foundational Profits does not provide individual investment counseling, act as an investment advisor, or individually advocate the purchase or sale of any security or investment. Subscribers should not view this publication as offering personalized legal or investment counseling. Investments recommended in this publication should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company in question. This letter is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be – either implied or otherwise – investment advice. Neither the publisher nor the editors are registered investment advisors. This letter reflects the personal views and opinions of the editor and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. Neither Digest Publishing, its related companies, employees, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter. The information contained herein is subject to change without notice, may become outdated and may not be updated. Digest Publishing, entities it controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Digest Publishing. Unauthorized reproduction of this newsletter or its contents by Xerography, facsimile, or any other means is illegal and punishable by law.